By Stefania Spezzati and Libby George

LONDON (Reuters) -The world's top investment banks are on track to post the highest revenue in five years from trading Israel's bonds and currency thanks to the volatility caused by the 14-month long war in the Middle East, data seen by Reuters show.

Banks are expected to post $475 million in fixed-income, currencies and commodities trading (FICC) revenue linked to Israel in 2024, a more than 10% increase from 2023, amid increased volatility primarily in the shekel, the Israeli currency, data from Vali Analytics Ltd show.

The revenue rise illustrates how global banks are making money on price gyrations in Israeli assets as the country's wars in Gaza and Lebanon grind on. The conflicts have boosted Israeli inflation, limited economic growth and increased borrowing costs.

JPMorgan Chase & Co., the largest U.S. bank, is expected to be the top gainer among 10 global lenders surveyed by the data firm, raking in about $70 million so far this year from such trades, according to a person with knowledge of the matter.

Though that is a tiny fraction of global trading income, the double-digit increase highlights how trading Israeli assets has been a bright spot in otherwise muted trading activity this year.

Vali Analytics expects the 10 global banks to post no growth in FICC income overall this year.

Goldman and Citigroup have the biggest share of the Israeli FICC market after JPMorgan, the person added, while European banks have a smaller portion.

Goldman, Citi and JPMorgan declined to comment.

Under pressure from activists and governments, some of Europe's biggest financial firms have cut back their links to Israeli companies or those with ties to the country, Reuters reported earlier this month.

Reuters could not establish how European banks fared in the trading rankings.

JPMorgan has been investing in Israel, where it opened its office in Tel Aviv in 2000. It currently has about 200 employees there.

BIGGER SWINGS

JPMorgan's global income from fixed-income markets trading declined by 2% to $14.7 billion in the nine months to September compared to the same period last year, according to a bank filing.

Volatility favours traders who bet on the future direction of an asset.

Early this month, the shekel's one-month implied volatility closed at its highest level since October 2023. It began to trade consistently above euro volatility in early 2023 - with the bigger peaks and troughs creating money-making opportunities for traders.

"Israeli currency volatility has increased as a result first of more divided politics and concerns over institutional stability with the controversial judicial reform and then, obviously, the war on multiple fronts," said Hasnain Malik, head of emerging and frontier markets equity strategy at Tellimer.

The Israeli government passed a series of laws in 2023 aimed at neutering the powers of Israel's Supreme Court in favour of Prime Minister Benjamin Netanyahu's executive branch, alarming investors.

The conflict in the region that followed further increased swings in markets. The shekel has strengthened by nearly 3% against the dollar this month due in part to hopes for a ceasefire deal between Israel and Iran-backed Hezbollah in Lebanon.

"That volatility suits banks whose spreads widen but hurts operating businesses exposed to imported inputs or exported finished products," Tellimer's Malik said.

(Reporting by Stefania Spezzati and Libby George in London. Editing by Elisa Martinuzzi and Mark Potter)

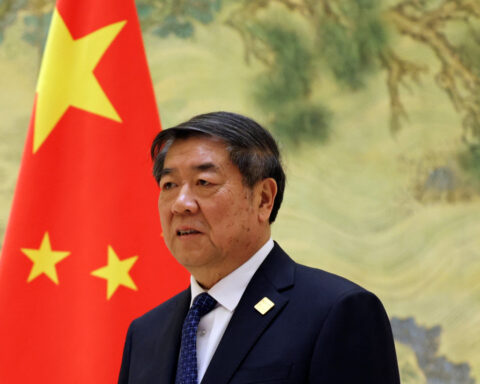

China's vice premier meets Blackstone chairman in Beijing

China's vice premier meets Blackstone chairman in Beijing

Relief rally starts to fizzle

Relief rally starts to fizzle

Downed municipal power lines may have caused LA's Palisades Fire, lawsuit claims

Downed municipal power lines may have caused LA's Palisades Fire, lawsuit claims

Citigroup appoints Akira Hoshino as head of markets for Japan

Citigroup appoints Akira Hoshino as head of markets for Japan

Josh Pastner agrees to become UNLV's coach, AP sources say

Josh Pastner agrees to become UNLV's coach, AP sources say

Baseball star Shohei Ohtani’s ex-interpreter has prison start postponed

Baseball star Shohei Ohtani’s ex-interpreter has prison start postponed

Greenlanders unite to fend off the US as Trump seeks control of the Arctic island

Greenlanders unite to fend off the US as Trump seeks control of the Arctic island