(CNN) — Buy now, Pay Later services had their best day yet on Cyber Monday, with consumers spending a record-breaking $991.2 million, according to Adobe Analytics.

With holiday shopping now in full swing, US consumers are making more purchases using these services, which are known in the industry as BNPL.

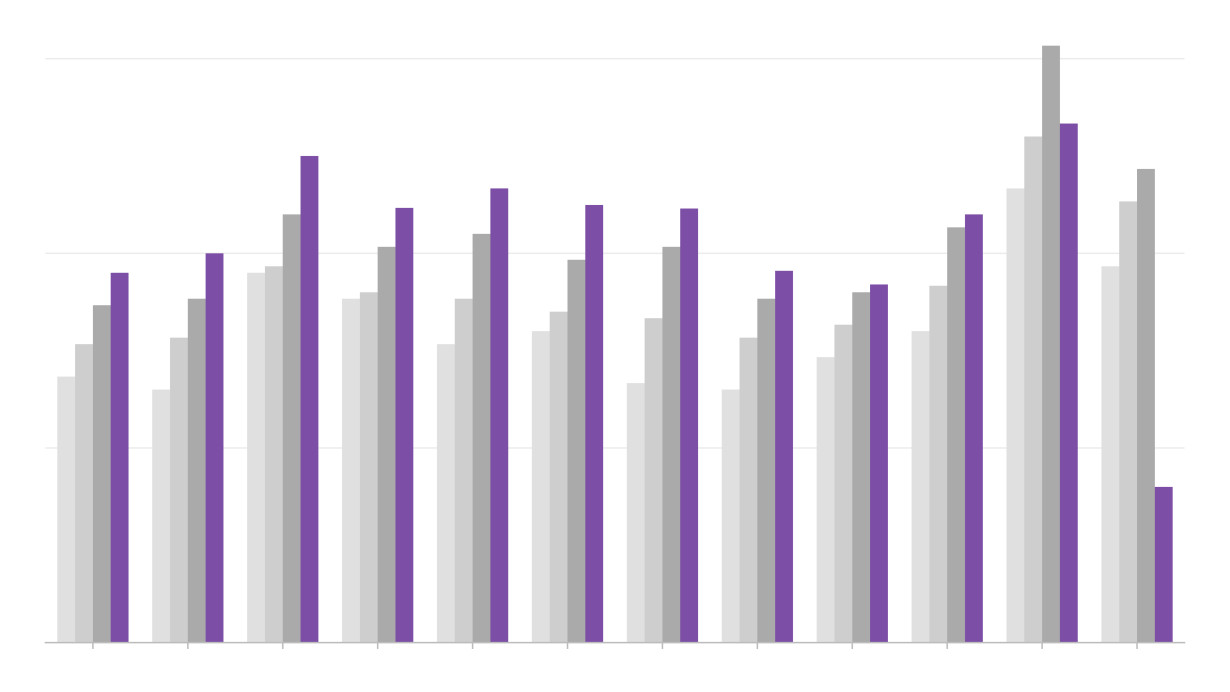

So far in 2024, BNPL spending in the United States has outpaced prior years. Consumers spent a total of $75.1 billion dollars with BNPL in 2023, up from $65.6 billion dollars in 2022, a 14% increase.

Experts caution that while these services can offer flexibility, they also carry financial risks — especially for young and financially constrained consumers who tend to rely most on BNPL services.

Retailers across markets have increasingly adopted BNPL options because they convert window shoppers into purchasers and push those customers to check out with fuller carts, according to a recent study.

BNPL payment plans especially influence shoppers who usually spend less and are more reliant on credit cards, said Dionysius Ang, a consumer researcher and associate professor at the University of Leeds in England.

“The seemingly financially constrained, the credit card users and the small-basket shoppers tend to have the largest increase in spending, post adopting Buy Now, Pay Later,” Ang told CNN.

Users of BNPL services are more likely to face financial hardships, according to a survey from the Federal Reserve Bank of Philadelphia. BNPL shoppers are more likely to be unable to pay some or any bills and to be concerned about making ends meet in the next year. More than twice the percentage of BNPL users had lost government benefits, relocated because of housing costs, experienced a natural disaster/weather event or were evicted in the past year, compared with nonusers.

BNPL users also tend to be younger, according to Bankrate. More than half of Gen Z and Millennials reported having used a BNPL service, compared with a quarter of Baby Boomers.

BNPL appeals to young people who are hesitant to incur credit card debt or who may struggle to get approved for a credit card, Ted Rossman, senior industry analyst at Bankrate, told CNN.

While consumers perceive BNPL services to be a safer alternative to credit cards, experts warn that they carry risks.

“I worry that consumers will become quickly overextended financially and not be able to make payments, have trouble with debt collectors and destroy their credit,” Consumer Reports investigator Lisa L. Gill told CNN.

BNPL services had been loosely regulated before the Consumer Financial Protection Bureau issued a rule in May that classifies BNPL lenders as credit card providers, which provides consumers with additional rights and legal protections, such as the right to dispute charges and demand a refund after making a return.

Young people are not only more likely to use BNPL services but are more likely to encounter issues when they do. Only 24% of Gen Z and 35% of Millennial BNPL users reported never experiencing an issue with BNPL services, compared with 68% of Baby Boomer users, according to a Bankrate survey.

While most traditional BNPL services require interest-free payments, some include interest or late fees that consumers may not be aware of. Of Gen Z and Millennial users, 24% and 21%, respectively, reported missing a payment.

The most common issue that Gen Z and Millennial users reported was overspending.

Rossman said that like credit cards, BNPL can be a useful tool for financial planning, but only when used with caution.

The-CNN-Wire

™ & © 2024 Cable News Network, Inc., a Warner Bros. Discovery Company. All rights reserved.

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness