By Yadarisa Shabong and Joanna Plucinska

(Reuters) -European low-cost airline Wizz Air cut its annual net income forecast for the second time in six months on Thursday, as it grapples with rising costs related to the grounding of planes due to engine problems and economic uncertainties.

Wizz faces costs and disruptions due to groundings related to issues with Pratt & Whitney GTF engines, but is hopeful the year ahead will bring some relief, including a full return to service to Tel Aviv in the summer.

"Wizz Air has continued to navigate the complexity imposed on its operations from the ongoing grounding of some 20% of its fleet, due to the well-documented GTF engine issue. This is reflected in our unit cost performance," CEO Jozsef Varadi said in a statement.

Wizz shares were down 12.7% at 0840 GMT.

European airlines are hoping for a better 2025 after 2024 was mired by spiralling costs, geopolitical instability and capacity constraints that forced some carriers to spend more on leasing planes to ensure they could maintain key routes.

Wizz reported a third-quarter operating loss of 75.9 million euros ($79 million), compared with a loss of 180.4 million euros a year earlier.

Analysts had estimated an operating profit of about 10.6 million euros, according to data compiled by LSEG.

Varadi said this was largely caused by the GTF engine issue, which is set to impact Wizz for at least another two to three years.

"We understand that these issues are dragging longer than expected and they have bigger impacts than expected," Varadi told Reuters.

The London-listed carrier now expects net income in a range of 250 million euros to 300 million euros for the year ending March, compared with its previous forecast of between 350 million and 450 million euros.

WHAT'S NEXT?

Analysts were surprised by the higher costs faced by Wizz, tying them to higher depreciation and maintenance bills, but said they were expecting the profit downgrade.

"Looking further out the reduced fleet growth will have implications for forecasts although we suspect this may be seen as a small positive as Wizz Air will also have less debt to manage," said Goodbody analyst Dudley Shanley.

Varadi has long told investors that growth and stability would return after the airline's difficult few years.

"This should be the last profit warning - the issue we are struggling with is very specific," he told Reuters.

Wizz's share performance is among the worst of European airlines. It has spent heavily on so-called wet leases - which include crew - to maintain some key routes.

($1 = 0.9606 euros)

(Editing by Shri Navaratnam and Mark Potter)

GOP lawmaker explains why he supports dismantling the Department of Education

GOP lawmaker explains why he supports dismantling the Department of Education

Teen accused in deadly hit-and-run deemed a danger to others, as police arrest 3rd suspect

Teen accused in deadly hit-and-run deemed a danger to others, as police arrest 3rd suspect

What to know about Greenpeace after the Dakota Access protest case decision

What to know about Greenpeace after the Dakota Access protest case decision

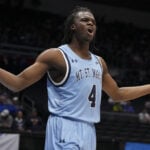

March Madness: Mount St. Mary's beats American 83-72 in First Four to earn date with No. 1 Duke

March Madness: Mount St. Mary's beats American 83-72 in First Four to earn date with No. 1 Duke

Anti-amyloid therapy may keep Alzheimer’s symptoms at bay in certain patients, study suggests

Anti-amyloid therapy may keep Alzheimer’s symptoms at bay in certain patients, study suggests

Researchers find a hint at how to delay Alzheimer's symptoms. Now they have to prove it

Researchers find a hint at how to delay Alzheimer's symptoms. Now they have to prove it

Exxon challenges Colonial Pipeline on proposed changes to fuel shipping terms

Exxon challenges Colonial Pipeline on proposed changes to fuel shipping terms

Investigators searching for "Super Bowl Scammer" accused of taking thousands from residents

Investigators searching for "Super Bowl Scammer" accused of taking thousands from residents

Injury in March Madness game ends storybook final season for Matt Rogers of American U.

Injury in March Madness game ends storybook final season for Matt Rogers of American U.