The latest online swindle captivating TikTok carries an enticing yet unbelievable promise: earn up to $6,400 in no-hassle government assistance, endorsed by none other than President Joe Biden and rap icon Snoop Dogg themselves. But financial experts warn such outlandish free money claims reveal only an elaborate digital fraud in the making, one deploying deep fake celebs to bait seniors already conditioned to pandemic stimulus windfalls.

Several misleading videos currently circulate on TikTok and Facebook touting supposed Social Security bonus subsidies accessible through special links. Some feature spliced footage showing Biden alongside Snoop claiming “The U.S. is sending everyone a free $6,400 right now” before directing clicks to a sketchy third-party website.

In other cases, con artists invoke recycled yet still convincing 2019 interview clips capturing Snoop endorsing “a program to get you thousands of your dollars back” through a “15-minute phone call.” The presentations aim to convince struggling seniors of guaranteed payouts requiring only minimal effort.

Yet experts universally condemn such offers as fraudulent despite seemingly credible packaging. No government partnership exists between the President and California pot proponent-turned-entrepreneur Snoop. Nor do any unclaimed federal grants currently sit available to Social Security recipients absent elaborate application rituals already long completed.

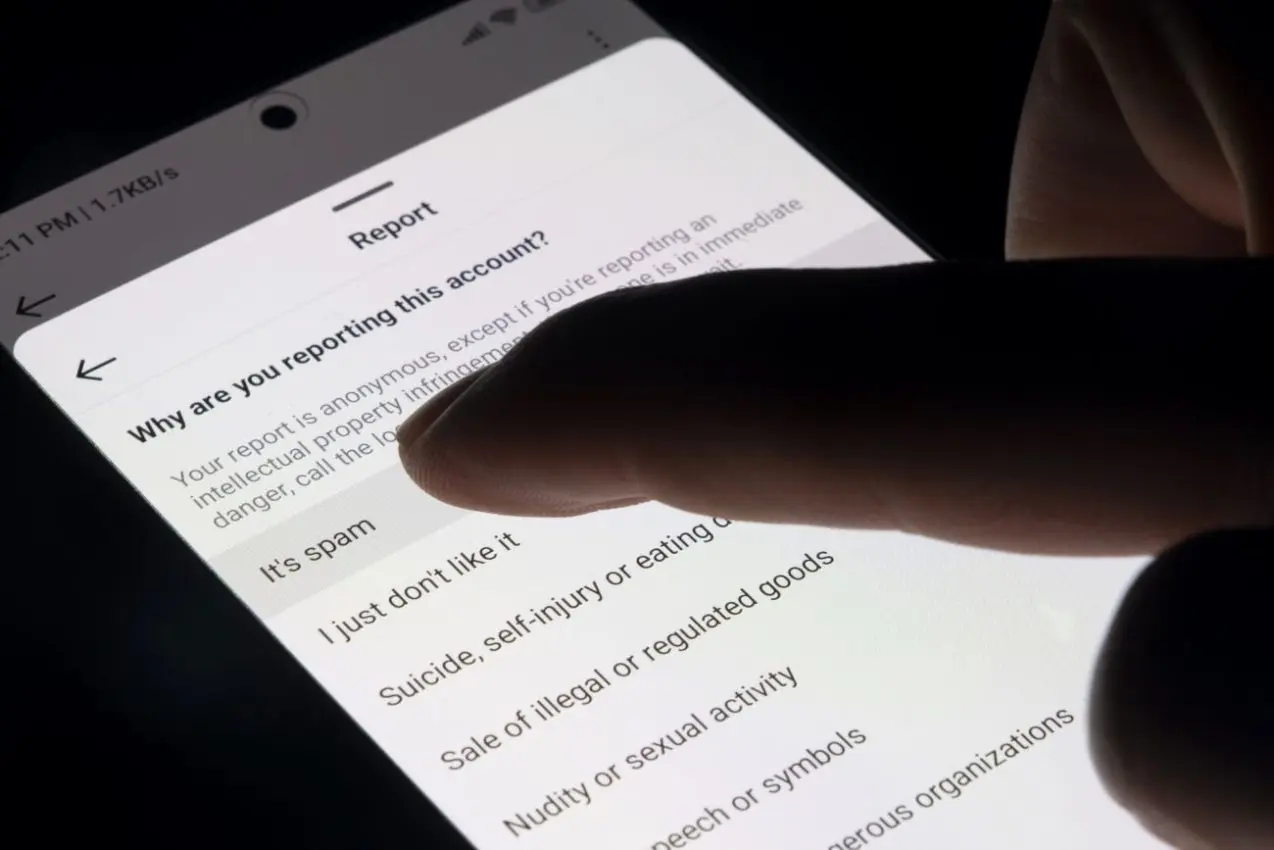

In truth, the sophisticated fakes represent “phishing” ploys seeking targets’ sensitive information for identity theft or financial fraud. Those fooled into visiting linked spoof sites under lures of “free” sums instead deliver account details and more to unscrupulous strangers sporting professional polish belying cruel intent.

And the scammers specifically exploit heightened conditions that enable believability. Purdue University accounting professor Troy Janes points to sprawling stimulus measures rolling out cash to every household in 2020. “That may make people less suspicious when seeing this offer,” Janes told Newsweek, given associated openness to government giveaways.

Likewise, David Derigiotis of cyber insurance firm Embroker stresses seniors present prime marks for such “social engineering” stings. With accumulated savings and admittedly limited technological literacy, many fall back on remembered financial security training urging contacting agencies directly. Yet digital spaces teeming with deep fake doppelgangers cloud even healthy skepticism.

Still, specific precautions apply universally in combating cascading online deceit. As always, independently verify uncanny offers through official channels no matter how authentic accompanying evidence appears. Refuse sharing personal details anywhere absent confirming a trusted entity behind requests. And leverage site integrity tools sniffing out fraudulent links early before hooks set.

Because ultimately ample footage exists for convincing cut-and-paste video falsehoods. And economic unease spotlights financial hopes, not diligence. Together the landscape urges added wariness given proven prowess parting even savvy targets from their money. Heeding common-sense cybersecurity rules marks our first line of defense amidst ballooning high-tech hoodwinks until better protections emerge. With awareness and vigilance, we control our clicks and secure our futures.

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness