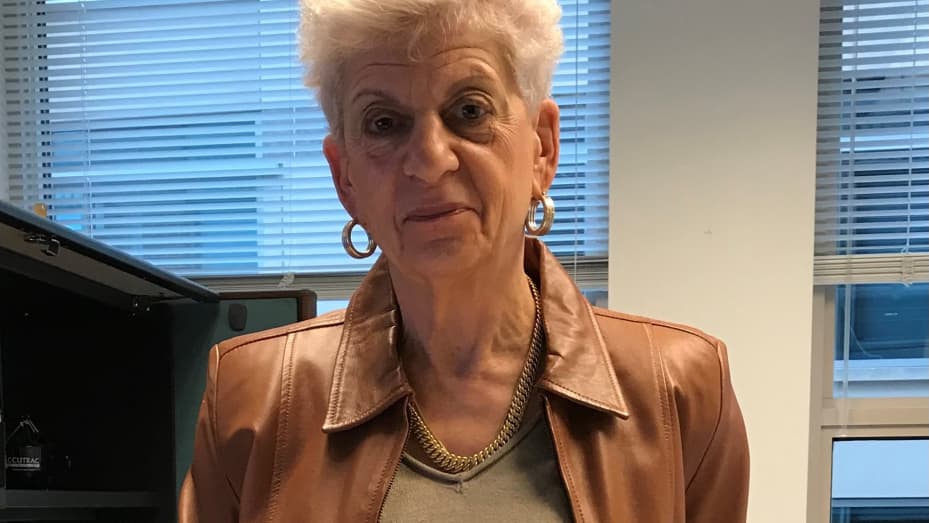

In the digital age, the danger of falling prey to scams is an ever-present reality.The rise of phony "tech support" firms is one such trend that should give us pause for concern. Scammers often prey on the trusting nature of their victims, the elderly, by pretending to be respectable businesses or organizations. A 77-year-old widow named Marjorie Bloom lost an astounding $661,000 to such a scam.

In the spring of 2021, retired woman Marjorie Bloom was in a difficult spot since she had been waiting for a phone call that never came. She had invested a sizable sum of money into bitcoin over the course of the previous month on the advice of a guy pretending to be a fraud investigator from her bank, PNC Bank. This man convinced Bloom to liquidate her savings, stocks, and annuity, amounting to a total of $661,000.

This man, who turned out to be a scammer, had convinced Bloom that criminals were about to steal her life savings using her stolen personal data. He persuaded her to act quickly and secretly to safeguard her money. Unfortunately, Bloom fell for the scam, not realizing that the man was, in fact, a fraudster, part of a "tech support" scam.

Tech support scams are increasingly common, particularly among older adults. In 2022, older adults lost $588 million to tech support scams, according to the Federal Bureau of Investigation. These criminals convince victims that they have a serious computer issue, such as a virus, and pose as technicians from well-known companies to steal their money.

Cryptocurrency scams have also been on the rise, particularly among people over 60. The chart below showcases the annual cost to people over 60 from cryptocurrency scams in 2022 by the type of fraud.(Source: FBI's Internet Crime Complaint Center)

On a fateful Friday morning in May 2021, Bloom awaited a call with instructions on how to access her life savings that she believed she had secured. But the call never came. She called the person who claimed to be the "investigator," but his phone was no longer in service. At that moment, it dawned on her and she realized that her whole life's savings had been stolen from her.

Instances like Bloom's highlight the disturbing reality of the times we live in. Technological advancements, coupled with little-understood investment options and a fragmented protection system in the U.S. financial sector, have exposed older Americans to financial fraud.

In 2022, Americans aged 60 and older lost $3.1 billion to cyber fraud, an 84% increase from 2021, according to the FBI. From $342 million in 2017, according to FBI data, the losses had increased ninefold in only five years. The reported incidence data shown here may grossly underrepresented the true scope of the problem.

The elderly stand to lose the most as they have worked their entire lives to accumulate savings. Home equity, Social Security payments, pension checks, and even life insurance payouts are just some of the many ways in which they bring in money and accumulate wealth. Because of these financial opportunities, they are easy prey for con artists.

Fraud can leave victims without funds for basic living expenses, or for the leisure and travel they had been saving for their post-retirement life. Moreover, fraud can have other repercussions: victims who deplete their tax-preferred retirement funds may owe the IRS a hefty sum. Taking out a second mortgage or maxing out credit cards can lead to regular debt payments.

Older adults are often unable to earn in the workforce like younger victims, making it difficult to recover lost money. "Most victims will say, 'I'm devastated financially, I'm ruined,'" said Kathy Stokes, director of fraud prevention programs at AARP. "But emotionally it's as bad, if not worse."

Tech support scams like the one Bloom fell for pose a significant threat to older adults. They are a type of "call center" fraud, which primarily targets older adults, according to the FBI. About half of the victims of illegal call center scams are 60 or older, and they bear 69% of the total financial losses compared to other age groups.

In 2022, nearly 18,000 Americans aged 60 and over reported being victims of tech support scams, the FBI said. That's more than any other type of elder fraud and almost double the number from 2020. These victims lost more to these scams than all other age groups combined, with an average loss of $33,000. In some cases, losses exceeded $1 million.

The elderly are often targeted because they tend to be home more often, use landline phones, and are generally less savvy about technology and safe online behavior. The Covid-19 pandemic, which forced people to stay indoors and rely heavily on online platforms, has exacerbated the situation.

The story of Marjorie Bloom also raises questions about the role of banks in preventing such scams. Bloom had been a long-time customer at PNC Bank, where she wired the money to the scammer's account. In her lawsuit against PNC Bank, she argued that the bank ignored "obvious red flags" and "textbook evidence" of financial exploitation. Her transactions were inconsistent with her usual banking habits, but the bank did not take steps to investigate or determine whether her money was at risk.

Despite her lawsuit, legal experts assert that such lawsuits are rarely successful due to a complex web of federal and state rules governing banking and elder financial fraud. Banks often have to balance issues such as consumer privacy when deciding to intervene. However, critics argue that banks should have stronger incentives to protect their customers from such frauds.

Cryptocurrency has also played a significant role in scams like the one that defrauded Bloom. Scammers had her wire funds to an account at Signature Bank in New York, which were then transferred to a Coinbase account created using Bloom's personal information. The funds were converted into cryptocurrency and moved to offshore accounts on the Binance crypto trading platform in the Cayman Islands.

Cryptocurrency allows fraudsters to circumvent traditional banking structures, executing rapid international transfers of substantial sums. This digital currency offers culprits a veil of anonymity, complicating the process of identifying them. Yet, due to the transparent nature of the blockchain, authorities can trace the flow of cryptocurrency transactions from source to endpoint. Despite Bloom's passion for travel and photography, the repercussions of the scam compelled her to significantly curtail her excursions. She also had to face the fact that her retirement savings and the inheritance she had planned to leave her children were now gone.

Her experience is a sobering illustration of why online safety and knowledge are important in the modern day. Be wary of any unexpected calls or messages that demand secrecy or immediate action. The elderly in particular need to be educated on how to spot and prevent scams.

The takeaway from Bloom's anecdote is that in this day and age, you need to be extra vigilant about falling for internet scammers. It highlights the need of financial literacy and awareness in navigating the increasingly complicated digital world and the necessity for more stringent safeguards to protect the vulnerable, especially the elderly.

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness