The holiday shopping season in the United States has steadily shifted earlier each year, with consumers now seeing Christmas decorations, holiday discounts, and seasonal marketing campaigns as early as September or October. This trend, often referred to as Christmas creep, has altered the retail landscape significantly, influencing consumer behavior and shaping retail strategies for major supermarket chains. A range of studies have explored these trends, providing valuable insights into the reasons behind the early start of the holiday shopping season.

According to Deloitte's annual holiday survey, nearly 40% of American shoppers begin their Christmas shopping before November. The study highlights a growing trend of early holiday purchases driven by two main factors: the desire to spread out expenses over several months and the fear of missing out on early deals. This early shopping approach also aims to alleviate the stress of last-minute holiday spending.

Deloitte's report emphasizes how consumers are seeking more control over their budgets, given the challenges of economic uncertainty. With inflationary pressures impacting household budgets, shoppers are increasingly likely to start early to take advantage of promotions and to avoid potential price increases later in the season.

PwC 2024 Holiday Outlook indicates 58% of holiday shoppers are taking advantage of pre-Black Friday deals, a significant increase from previous years. This shift reflects consumers' desire to hunt for bargains earlier, driven by a need to secure gifts while avoiding stock shortages that plagued previous holiday seasons.

The PwC study also suggests that early shoppers are more likely to be budget-conscious, with 73% of respondents saying they planned to spend the same or less on holiday shopping in 2024 compared to the previous year. As a result, early shopping helps spread out costs and aligns with concerns about economic conditions.

Supermarket chains and major retailers have adapted their strategies to capitalize on the early shopping trend. Here's how some of the largest supermarket brands are responding:

Walmart, one of the largest retail giants in the U.S., has embraced the early shopping season with its Deals for Days event, which starts in October. Walmart's strategy focuses on attracting early shoppers with significant discounts on electronics, toys, and home goods—key categories for holiday gifting. By launching early, Walmart aims to spread out shopping traffic and reduce the impact of supply chain disruptions, which were a challenge in previous years.

Target has also adjusted its approach, with seasonal promotions beginning as early as mid-October. Target’s Target Circle Week offers exclusive deals for loyalty members, drawing in early shoppers who are eager to take advantage of pre-holiday discounts. This year, Target's promotions have emphasized value-oriented pricing, highlighting budget-friendly options and buy-one-get-one offers, appealing to shoppers looking to save during the early holiday rush.

Costco has responded to the early holiday shopping trend by stocking Christmas decorations and holiday-related items as early as September. Costco's bulk-buying model encourages early purchases, with consumers shopping for holiday essentials like decorations, gifts, and food items long before the traditional holiday season begins. Early inventory stocking helps manage customer demand and maintain consistent traffic throughout the fall.

Amazon, the leading e-commerce player, has been a significant driver of the "Christmas creep" phenomenon. With events like Prime Big Deal Days in October, Amazon encourages early holiday spending by offering deep discounts across a wide range of categories. The company leverages its data-driven insights to tailor offers that appeal to early bird shoppers, focusing on popular holiday categories such as electronics, toys, and fashion.

The early start to Christmas shopping is not just about retailers pushing sales; it’s also a reflection of evolving consumer behaviors. The key trends among them include:

According to Deloitte's survey, 66% of shoppers are concerned about economic conditions impacting their holiday budgets. As a result, early shopping allows them to manage spending more effectively, spreading out costs over several months rather than concentrating purchases in November and December.

PwC’s report indicates that 45% of holiday shoppers are worried about product availability. Previous holiday seasons were marked by supply chain disruptions, leading to increased anxiety about potential shortages. This concern has driven consumers to shop earlier, ensuring they secure key items before stock runs out.

Early shopping is also about reducing the stress associated with last-minute holiday preparations. Deloitte's survey found that 60% of early shoppers aim to avoid the rush of crowded stores and last-minute online shopping. The convenience of shopping in a more relaxed timeframe appeals to those looking for a more enjoyable and less stressful holiday experience.

As these trends solidify, the "Christmas creep" is likely to become a permanent feature of the U.S. retail calendar, reflecting a new norm in how Americans celebrate and prepare for the holiday season. For consumers, the appeal lies in finding better deals, reducing stress, and managing budgets more effectively, while for retailers, it means extended opportunities to capture the holiday spirit—and spending—of millions of shoppers nationwide.

Trump appears with Italian Prime Minister Meloni at his Florida club

Trump appears with Italian Prime Minister Meloni at his Florida club

Biden's decision to block Nippon Steel takeover creates uncertainty for U.S. Steel workers

Biden's decision to block Nippon Steel takeover creates uncertainty for U.S. Steel workers

Drawn to New Orleans' iconic street of celebration, a night of partying becomes a nightmare

Drawn to New Orleans' iconic street of celebration, a night of partying becomes a nightmare

'Our county ignored Africa,' Jimmy Carter said. He didn't

'Our county ignored Africa,' Jimmy Carter said. He didn't

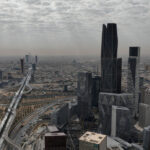

Saudi Arabia's non-oil private sector keeps growing solidly in December, PMI shows

Saudi Arabia's non-oil private sector keeps growing solidly in December, PMI shows

Why Scott Jennings thinks Republicans can pull off 'historic' piece of legislation

Why Scott Jennings thinks Republicans can pull off 'historic' piece of legislation

The Golden Globes are Sunday night. Here's five things to look for and how to watch them

The Golden Globes are Sunday night. Here's five things to look for and how to watch them

Joe Burrow and the Cincinnati Bengals kept their playoff hopes alive by edging the Steelers 19-17

Joe Burrow and the Cincinnati Bengals kept their playoff hopes alive by edging the Steelers 19-17

Getty Images

Getty Images