By Lisa Baertlein and Ananta Agarwal

(Reuters) - FedEx on Tuesday forecast fiscal 2025 profit above analysts' estimates, and shares in the delivery giant soared as executives said slashing expenses and consolidating operations would bolster returns even as demand remained weak for package deliveries.

Shares of FedEx jumped 14% in extended trading as the Memphis-based company targeted fiscal 2025 earnings of $20 to $22 per share - the midpoint of which was slightly above analysts' estimate of $20.92. The company is also weighing whether to will keep or sell its freight trucking business that generated revenue of $2.3 billion in the latest quarter.

The news helped investors shake off worries that the trends that drove a 10% gain in FedEx shares over the last year were diminishing.

FedEx earnings excluding items grew 7.2% to $1.34 billion, or $5.41 per share, for the fourth quarter that ended on May 31. Operating margin also improved to 8.5% from 8.1% in the year-ago quarter.

"These results are unprecedented in this current environment," FedEx CEO Raj Subramaniam said. "We expect this momentum to continue in fiscal 2025."

The company's largest unit, Express overnight delivery, has struggled with falling volumes as the U.S. Postal Service shifts packages from higher-margin air services to more economical ground services. FedEx's unprofitable U.S. Postal Service contract, which accounted for about $1.75 billion in revenue to FedEx during the postal service's latest fiscal year, will end on Sept. 29.

Express operating margin, excluding items, fell to 4.1% during the quarter, from 5.0% a year earlier.

FedEx previously said that eliminating the costs related to supporting postal service volume will help profitability improve in fiscal 2025 and beyond.

FedEx's "guidance was impressive, in light that it did not renew its contract with the U.S. Postal Service," said Louis Navellier, founder and chief investment officer of asset manager Navellier & Associates, which holds FedEx shares in a fund.

CEO Subramaniam, who succeeded founder Fred Smith two years ago, has been squeezing out costs and merging its separate airplane- and truck-based delivery units amid pressure from activist investors.

But the revenue side of its business remains challenging. Industrial production and parcel shipping demand - two key business drivers - are lackluster as inflation and higher interest rates take a toll.

FedEx revenue hit $22.1 billion in the fourth quarter, up 1% from the year earlier, and slightly above analysts' estimate of $22.06 billion.

Shares in FedEx rose 14.2% to $292.83 in after-hours trading, when stock in rival United Postal Service also rose 2.4% to $137.56. (This story has been refiled to add the dropped 'percent' symbol in paragraph 2)

(Reporting by Ananta Agarwal in Bengaluru and Lisa Baertlein in Los Angeles; Editing by David Gregorio; Editing by Pooja Desai and Matthew Lewis)

Marco Rubio became secretary of state without a hitch. Keeping Trump's favor may be harder

Marco Rubio became secretary of state without a hitch. Keeping Trump's favor may be harder

Trump to announce newly formed partnership investing $500B in AI

Trump to announce newly formed partnership investing $500B in AI

Porsche confirms 2024 earnings outlook in investor call, analyst's note says

Porsche confirms 2024 earnings outlook in investor call, analyst's note says

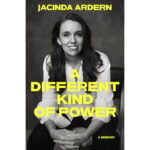

Former New Zealand Prime Minister Jacinda Ardern has memoir coming out in June

Former New Zealand Prime Minister Jacinda Ardern has memoir coming out in June

Gaza ceasefire to help Israel's credit rating, implementation is key, agencies say

Gaza ceasefire to help Israel's credit rating, implementation is key, agencies say

At inaugural prayer service, bishop pleads for Trump to ‘have mercy’ on LGBTQ+ people and migrants

At inaugural prayer service, bishop pleads for Trump to ‘have mercy’ on LGBTQ+ people and migrants

'Wicked' star Cynthia Erivo named Harvard's Hasty Pudding Woman of the Year

'Wicked' star Cynthia Erivo named Harvard's Hasty Pudding Woman of the Year