By Bansari Mayur Kamdar

(Reuters) - An exchange-traded fund (ETF) that started trading on Thursday allows investors to leverage the higher volatility in emerging market equities by selling options.

The recently launched Global X MSCI Emerging Markets Covered Call ETF buys the iShares Core MSCI Emerging Markets ETF and sells call options on the same ETF.

The fund seeks to generate income while also offering investors exposure to volatility.

The higher volatility of emerging markets as compared to other major large cap equity indexes allows the fund to generate higher options premiums, or the price buyers have to pay for a contract, said Rohan Reddy, director of research at Global X ETFs.

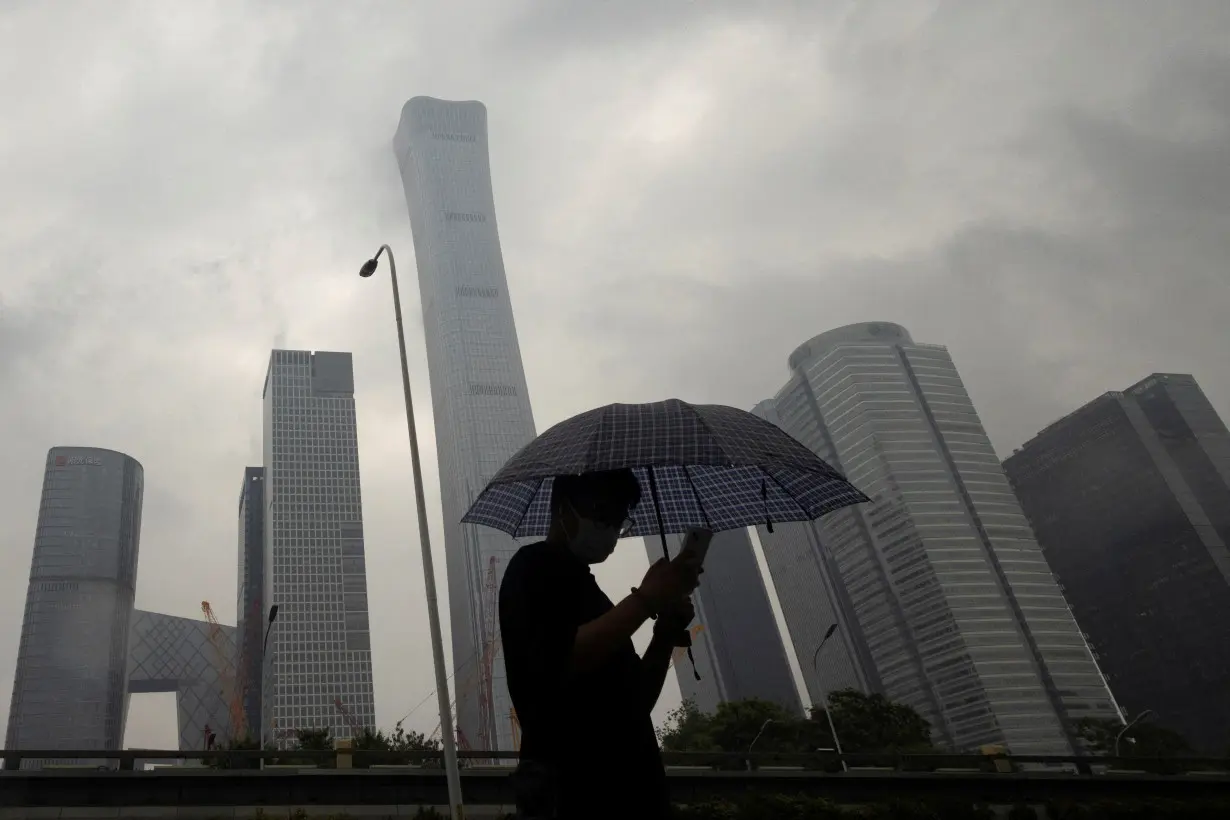

Overall, the MSCI's index tracking emerging market stocks has lagged peers on Wall Street amid concerns about higher interest rates and economic growth in China, with the index nearly flat so far this year compared to the 14% gains on the S&P 500.

Foreigners pulled money out of emerging market portfolios for a third consecutive month in October, with $17.2 billion in outflows from stocks, according to data from the International Institute of Finance. Investors have flocked to ETFs that look to generate income and reduce portfolio volatility by selling options against stocks. Assets under management of U.S. listed, derivative strategy ETFs rose to $96.4 billion at the end of September, representing a 1-year growth rate of 85%, according to Global X.

"There is definitely much more of an awareness and familiarity of options trading in general compared to just five years ago," said Reddy.

However, the income generated by selling options may not be enough to protect investors if markets get especially turbulent, analysts warned.

"Investors remain exposed to extreme declines," said Bryan Armour, director of passive strategies research for North America at Morningstar.

"Whatever premium an investor collects from selling call options would be dwarfed by a significant drawdown like the global financial crisis in 2008."

(Reporting by Bansari Mayur Kamdar in Bengaluru; Editing by Chris Reese)

Argentina logs largest energy trade surplus in 18 years in win for Milei

Argentina logs largest energy trade surplus in 18 years in win for Milei

Warren Buffett's Pilot Co shuts oil trading business, sources say

Warren Buffett's Pilot Co shuts oil trading business, sources say

OpenAI, SoftBank, Oracle to invest $500 billion in AI, Trump says

OpenAI, SoftBank, Oracle to invest $500 billion in AI, Trump says

Colombians flee to Venezuela as clashes between rebel groups escalate in coca-rich border region

Colombians flee to Venezuela as clashes between rebel groups escalate in coca-rich border region

Trump vows to hit EU with tariffs, eyes 10% tariff on China on Feb. 1

Trump vows to hit EU with tariffs, eyes 10% tariff on China on Feb. 1

US fiscal path unsustainable despite improved budget forecasts, says DoubleLine

US fiscal path unsustainable despite improved budget forecasts, says DoubleLine

With Ben Johnson on the move to Chicago, 5 head coaching vacancies remain

With Ben Johnson on the move to Chicago, 5 head coaching vacancies remain

Vikings and coach Kevin O'Connell agree to a multiyear contract extension after a 14-win season

Vikings and coach Kevin O'Connell agree to a multiyear contract extension after a 14-win season

Young collector nabs rare Paul Skenes card that could offer him a hefty haul in trade with Pirates

Young collector nabs rare Paul Skenes card that could offer him a hefty haul in trade with Pirates