(Reuters) - Super Hi International jumped 38% in its debut on Nasdaq, giving the operator of Chinese hotpot restaurant chain Haidilao a valuation of about $1.74 billion.

Shares opened at $27 per share compared with the initial public offering (IPO) price of $19.56 per share.

The Chinese restaurant brand on Thursday raised $52.7 million by selling nearly 2.7 million American Depositary Shares.

After two dismal years, the U.S. IPO market is staging a strong comeback as not only new private companies are listing their stocks, but foreign companies are also choosing U.S. exchanges to debut in the market.

Market participants are expecting a strong pipeline of new entrants as the current year progresses on rising hopes of a rate cut in the second half of the year, which is expected to boost sentiment around IPOs.

Haidilao, which started in a small town in Sichuan in 1994, has become one of the most popular Chinese cuisine brands in the world.

Super Hi, which commenced operations outside Greater China in 2012 through its then-parent company Haidilao International, was spun off and listed as a public company in Hong Kong at the end of 2022.

Since opening its first restaurant in Singapore in 2012, the Chinese cuisine restaurant brand has expanded to 115 self-operated restaurants in 12 countries across four continents at the end of 2023.

(Reporting by Jaiveer Singh Shekhawat in Bengaluru; Editing by Vijay Kishore and Shilpi Majumdar)

Santa Cruz County ballot errors impact more than 1,100 voters

Santa Cruz County ballot errors impact more than 1,100 voters

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Google defeats lawsuit over gift card fraud

Google defeats lawsuit over gift card fraud

Delay in Chile mining permits a serious problem, says local head of Freeport

Delay in Chile mining permits a serious problem, says local head of Freeport

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

Malaysia central bank set to manage market volatility, monitoring US election

Malaysia central bank set to manage market volatility, monitoring US election

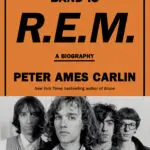

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury