By Jayshree P Upadhyay and Ira Dugal

MUMBAI (Reuters) - India's markets regulator will tighten derivative rules to increase entry barriers and make it more expensive to trade as it tries to limit retail investors speculating on risky contracts, said four sources with direct knowledge of the matter.

Securities and Exchange Board of India (SEBI) will limit the number of options contract expiries to one per exchange a week and nearly triple the minimum trading amount, the sources said, in rules similar to those proposed in July, despite pushback from traders and brokers.

But SEBI will review some of its earlier proposals to increase margin requirements and to monitor intraday trading positions, according to the sources.

Authorities have been flagging risks from speculative trading by retail investors, who have been funnelling savings into India's booming options market.

The monthly notional value of derivatives traded was 10,923 trillion Indian rupees ($130.13 trillion) in August - the highest globally, data from the regulator showed. The largest share of trading is in options contracts linked to stock indices like BSE Sensex and NSE Nifty 50.

The share of individual investors in index options has risen to 41% in the financial year ended March 2024 from 2% six years earlier, regulatory data showed.

"A key objective was to put an end to the large and rising speculative volumes in index options contracts close to expiry," said the first of the sources, who all declined to be identified as the decisions are not yet public.

"The regulator believes that this warrants additional measures both for small investor protection and for ensuring continued systemic stability," the source added.

The final rules will be released this month through a circular, the sources said.

The details have not been reported previously. SEBI did not respond immediately to a request for comment.

The steps follow an increase in tax on derivative transactions in July intended to reduce the participation of retail investors in the options market.

India's finance minister flagged concerns in May that any unchecked explosion of retail investor trading in derivatives could create future challenges for the markets, investor sentiment and household finances.

SOCIAL MEDIA CAMPAIGN

The regulator received nearly 10,000 comments on its July proposals from traders and other market participants after a social media campaign, the first source said, adding a large majority of them were from traders and brokers who argued the regulator's new rules would hit trading profits and liquidity.

"There was a social media campaign to overwhelm the regulator with the responses," the source added.

The final rules will ask exchanges to reduce the number of contract expiries to one a week per exchange from multiple expiries currently that give traders the opportunity to speculate more, said the four sources.

SEBI will also raise the minimum trading amount to nearly 1.5 million rupees to 2 million rupees ($18,000-$24,000) as proposed in the July consultation paper from 500,000 rupees, the second of the sources said.

In its proposals, the regulator had suggested higher margins for contracts expiring on the same day, but feedback from the country's stock exchanges and market participants said this would be difficult to implement.

This was a genuine concern and the regulator would tweak the proposed hike in margins, the sources said.

Exchanges and depositories also raised concerns over intraday monitoring of positions in index derivatives due to a lack of technical capability and the regulator might not insist on it for now, the third of the sources said.

($1 = 83.9370 Indian rupees)

(Reporting by Jayshree P Upadhyay and Ira Dugal in Mumbai; Editing by Jamie Freed)

China blacklists four U.S. companies for involvement in arms sales to Taiwan

China blacklists four U.S. companies for involvement in arms sales to Taiwan

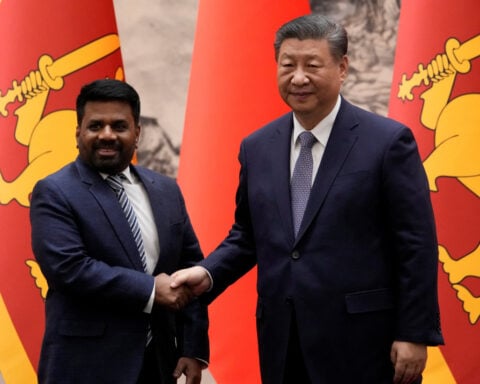

China, Sri Lanka agree more investment and economic cooperation

China, Sri Lanka agree more investment and economic cooperation

Brazil's Gol releases new five-year plan ahead of Chapter 11 exit

Brazil's Gol releases new five-year plan ahead of Chapter 11 exit

Poland's leader accuses Russia of planning acts of terror against 'airlines over the world'

Poland's leader accuses Russia of planning acts of terror against 'airlines over the world'

Portugal's growth likely accelerating, finance minister says

Portugal's growth likely accelerating, finance minister says

Italy's Salvini faces calls to quit over late-running trains

Italy's Salvini faces calls to quit over late-running trains

Look of the Week: Timothée Chalamet adopts London’s most stylish accessory

Look of the Week: Timothée Chalamet adopts London’s most stylish accessory

Texas online porn age-verification law goes to US Supreme Court

Texas online porn age-verification law goes to US Supreme Court