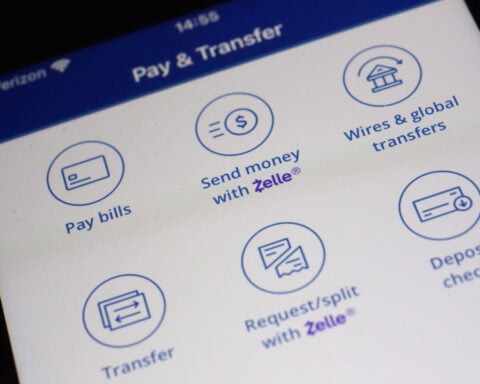

WASHINGTON (AP) — Users of Venmo, Cash App and other payment apps will get a tax reprieve this year. The IRS announced Tuesday it will delay implementing new reporting requirements that were to take effect for the coming tax filing season.

Originally, app users who made $600 or more selling goods and services would have been required to report those transactions to the IRS, a new threshold required by the American Rescue Plan passed in March 2021.

Instead, payment apps and online marketplaces will send out separate tax forms — called 1099-K documents — for taxpayers who receive over $20,000 and make over 200 transactions selling goods or services.

For 2024, the basic reporting threshold will be increased from $600 to $5,000, the IRS said.

IRS officials say one reason for the delay is taxpayer confusion over what sorts of transaction are reportable.

For instance, peer-to-peer transactions, like selling a couch or car, sending rent to a roommate, and buying concert tickets would not be reportable, whereas other purchases would apply.

“Taking this phased-in approach is the right thing to do for the purposes of tax administration, and it prevents unnecessary confusion,” IRS Commissioner Danny Werfel said. “It’s clear that an additional delay for tax year 2023 will avoid problems for taxpayers, tax professionals and others in this area.”

This new requirement was delayed last year as well.

“We spent many months gathering feedback from third-party groups and others, and it became increasingly clear we need additional time to effectively implement the new reporting requirements,” said Werfel.

A provision in the American Rescue Plan requires users to report transactions through payment apps including Venmo, Cash App and others for goods and services meeting or exceeding $600 in a calendar year. Before that provision — and now for this year — the reporting requirement applied only to the sale of goods and services to taxpayers who receive over $20,000 and have over 200 transactions.

Lawmakers across the aisle celebrated the delay.

Democratic Sen. Jon Tester of Montana, who last week sent a letter to the IRS calling for a delay of the reporting requirement, said “I’m glad to see the IRS heard my concerns and I’ll continue to fight back against burdensome bureaucratic policies."

Republican Rep. Jason Smith of Missouri said the delay showcases a flaw in the provision in the American Rescue Plan, which passed on near party lines. “Given that even Democrats now admit that this law is unworkable and are trying to rewrite a key provision, it’s time to scrap it and start over,” Smith said.

German Christmas market ramming is the latest attack to use vehicles as deadly weapons

German Christmas market ramming is the latest attack to use vehicles as deadly weapons

What we know about the suspect behind the German Christmas market attack

What we know about the suspect behind the German Christmas market attack

How to save a fentanyl victim: Key facts about naloxone

How to save a fentanyl victim: Key facts about naloxone

In a calendar rarity, Hanukkah starts this year on Christmas Day

In a calendar rarity, Hanukkah starts this year on Christmas Day

What to know about Hanukkah and how it's celebrated around the world

What to know about Hanukkah and how it's celebrated around the world

Russia's UK embassy denounces G7 loans to Ukraine as 'fraudulent scheme'

Russia's UK embassy denounces G7 loans to Ukraine as 'fraudulent scheme'

Drones continue to buzz over US bases. The military isn’t sure why or how to stop them

Drones continue to buzz over US bases. The military isn’t sure why or how to stop them

Tiger Woods says his son Charlie beat him in a round of golf for the first time, but only on a nine hole course

Tiger Woods says his son Charlie beat him in a round of golf for the first time, but only on a nine hole course

Philadelphia 76ers star Joel Embiid working through injuries and mental health struggles

Philadelphia 76ers star Joel Embiid working through injuries and mental health struggles

Weightlifting Taiwan granny, 90, garners cheers, health benefits at gym

Weightlifting Taiwan granny, 90, garners cheers, health benefits at gym