By Bansari Mayur Kamdar and Amruta Khandekar

(Reuters) - Investors are exiting exchange traded funds (ETFs) that track medical technology and device firms due to growing concerns over the impact new weight-loss drugs will have on their businesses.

So far this month net outflows from the iShares U.S. Medical Devices ETF have been $32.5 million, LSEG Lipper data showed.

Many investors are increasingly wary that the popularity of weight-loss drugs could hurt corners of the health care sector focused on treating issues related to excess weight, from makers of bariatric surgery devices to companies whose products address the issues such as diabetes and sleep apnea.

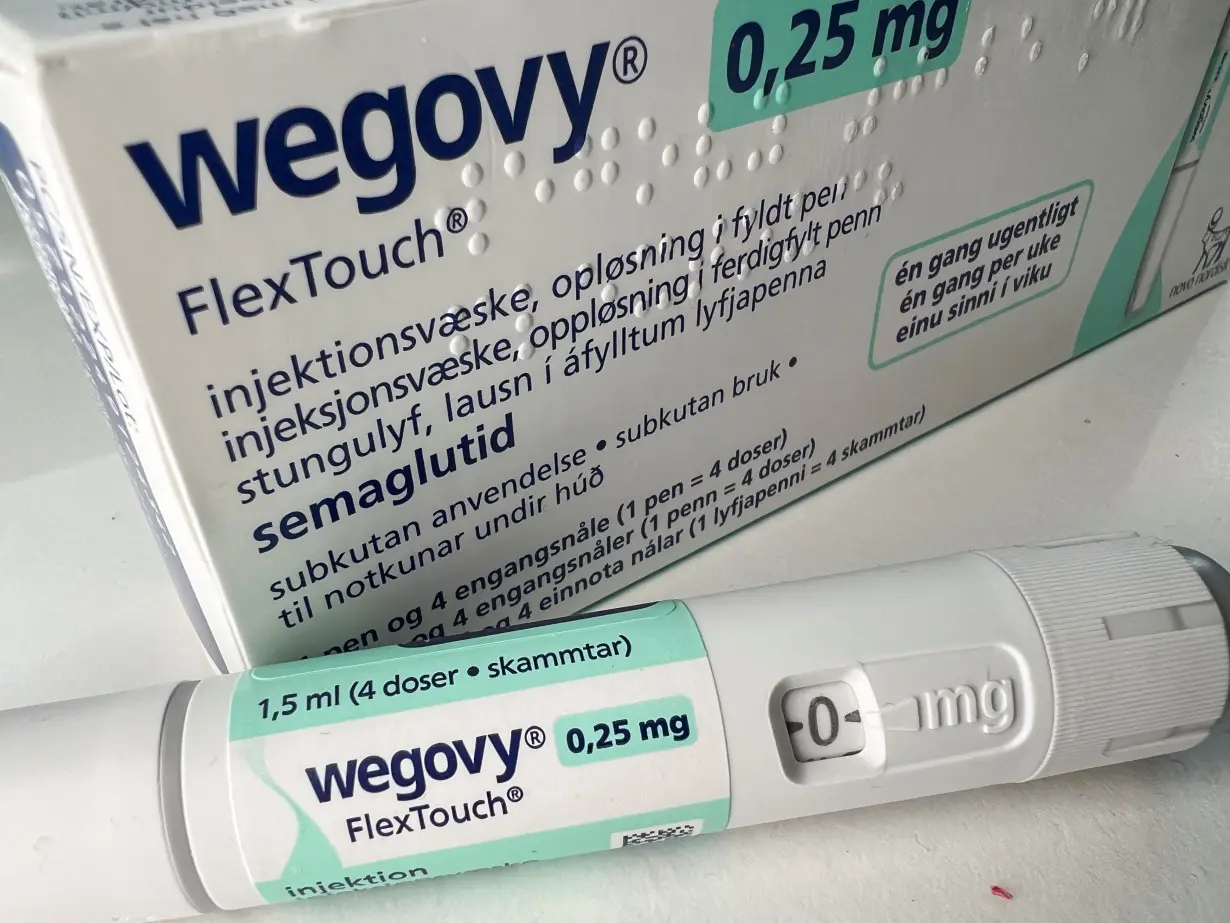

Stocks in the sector have tumbled since Aug. 8, when Novo Nordisk said its obesity drug Wegovy reduced the risk of major cardiovascular events by 20% in overweight or obese people with a history of heart disease.

The iShares fund, with assets of $4.6 billion, has seen outflows of nearly $371.4 million and fallen 16% since August.

The smaller SPDR S&P Health Care Equipment ETF, with net assets of $293 million, has seen outflows of $12 million so far this month. It has shed $183 million and dropped about 30% since August.

Some market participants say the selloff may be overdone.

"There could be a slight reduction in things like cardiovascular events over time, but it's not going to devastate the market," said Jeff Jonas, Portfolio Manager at Gabelli Funds.

"It's not worth a 10% hit to earnings or the stock price."

The iShares U.S. Medical Devices ETF was on track for its best daily showing since April on Monday, last up 2.5%, while the SPDR fund added 2.7% after data showed that Wegovy's heart protective benefits were more moderate than expected.

"We had some good cardiovascular data (for Wegovy) over the weekend, but we still don't know if patients are going to be taking these drugs for decades at a time and sustaining these benefits over many, many years," said Jonas.

(Reporting by Bansari Mayur Kamdar and Amruta Khandekar in Bengaluru; Editing by Ira Iosebashvili and Alexander Smith)

Italy, Albania, UAE sign deal for energy subsea interconnection

Italy, Albania, UAE sign deal for energy subsea interconnection

European shares advance as bond yields ease; soft inflation powers UK stocks

European shares advance as bond yields ease; soft inflation powers UK stocks

Bank Indonesia delivers surprise rate cut to support growth

Bank Indonesia delivers surprise rate cut to support growth

Novak Djokovic breaks a tie with Roger Federer for the most Grand Slam matches in tennis history

Novak Djokovic breaks a tie with Roger Federer for the most Grand Slam matches in tennis history

China's RedNote: what you need to know about the app TikTok users are flocking to

China's RedNote: what you need to know about the app TikTok users are flocking to

British author Neil Gaiman denies ever engaging in non-consensual sex as more accusers come forward

British author Neil Gaiman denies ever engaging in non-consensual sex as more accusers come forward