MEXICO CITY (Reuters) - Mexico's headline inflation likely ticked up in the first half of May for the third consecutive fortnight, a Reuters poll showed on Monday, fueling bets the Bank of Mexico will hold its key interest rate steady at its next monetary policy meeting.

The median forecast of 10 analysts projects annual headline inflation of 4.79% for the first half of May, slightly up from 4.67% in the second half of April.

"We believe that the price of some agricultural products may continue to put pressure," said Humberto Calzada, chief economist at the Rankia Latin America firm, citing adverse climate conditions.

Meanwhile, the closely watched core index, seen as a more useful measure of consumer price trends because it strips out some volatile energy and food prices, is seen at 4.31% in annual terms, its lowest level since May 2021.

Mexico's central bank held its benchmark interest rate steady at 11.0% earlier in May, in a unanimous decision, as inflation remained above its target range.

Bank of Mexico governor Victoria Rodriguez said last week the bank's five-member board will discuss the possibility of resuming interest rate cuts at the upcoming June 27 monetary policy meeting. Nonetheless, deputy governor Irene Espinosa said days later she did not expect a rate cut at the next meeting.

Compared with the previous two weeks, analysts estimated that monthly headline inflation fell 0.22%, while monthly core inflation rose 0.15%.

Mexico's national statistics agency will publish official inflation data for the first half of May on Thursday.

(Reporting by Noe Torres; Additional reporting by Gabriel Burin in Buenos Aires; Editing by Marguerita Choy)

Santa Cruz County ballot errors impact more than 1,100 voters

Santa Cruz County ballot errors impact more than 1,100 voters

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Google defeats lawsuit over gift card fraud

Google defeats lawsuit over gift card fraud

Delay in Chile mining permits a serious problem, says local head of Freeport

Delay in Chile mining permits a serious problem, says local head of Freeport

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

Malaysia central bank set to manage market volatility, monitoring US election

Malaysia central bank set to manage market volatility, monitoring US election

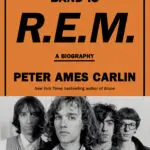

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury