JEFFERSON CITY, Mo. (AP) — Missouri lawmakers gave final approval Thursday to significantly expand a low-interest loan program for farmers and small businesses, in a move that reflects strong consumer demand for such government aid amid persistently high borrowing costs.

The legislation comes as states have seen surging public interest in programs that use taxpayer funds to spur private investment with bargain-priced loans. Those programs gained steam as the Federal Reserve fought inflation by repeatedly raising its benchmark interest rate, which now stands at a 23-year high of 5.3%.

Higher interest rates have made virtually all loans more expensive, whether for farmers purchasing seed or businesses wanting to expand.

Under so-called linked-deposit programs, states deposit money in banks at below-market interest rates. Banks then leverage those funds to provide short-term, low-interest loans to particular borrowers, often in agriculture or small business. The programs can save borrowers thousands of dollars by reducing their interest rates by an average of 2-3 percentage points.

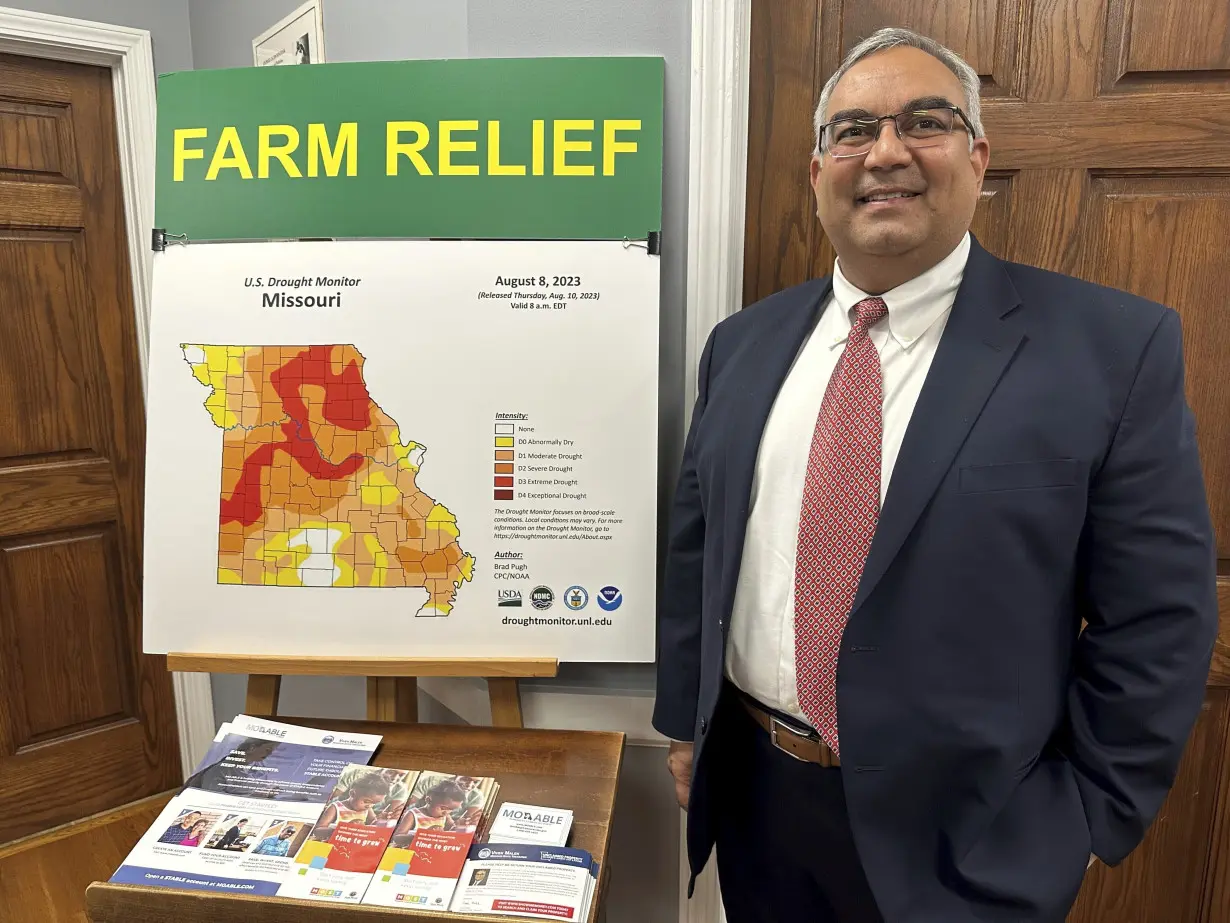

When Missouri Treasurer Vivek Malek opened up an application window for the program in January, he received so many requests that he had to close the window the same day.

Malek then backed legislation that would raise the program’s cap from $800 million to $1.2 billion. That bill now goes to Gov. Mike Parson.

“The MOBUCK$ program has skyrocketed in demand with farmers, ranchers and small businesses, especially during these times of high interest rates," Malek said in an emailed statement Thursday praising the bill's passage.

The expansion could cost the state $12 million of potential earnings, though that could be partly offset by the economic activity generated from those loans, according to a legislative fiscal analysis.

Not all states have similar loan programs. But neighboring Illinois is among those with a robust program. In 2015, Illinois' agricultural investment program had just two low-interest loans. Last year, Illinois made $667 million of low-rate deposits for agricultural loans. Illinois Treasurer Michael Frerichs recently raised the program's overall cap for farmers, businesses and individuals from $1 billion to $1.5 billion.

In eyeing Greenland, Trump is echoing long-held American designs on the Arctic expanse

In eyeing Greenland, Trump is echoing long-held American designs on the Arctic expanse

Kamala Harris memes questioning her cultural background highlight Americans’ contradictions with race

Kamala Harris memes questioning her cultural background highlight Americans’ contradictions with race

Vulnerable Americans live in the shadow of COVID-19 as most move on

Vulnerable Americans live in the shadow of COVID-19 as most move on

78 dead at abandoned South Africa gold mine that was scene of a standoff. Toll is expected to rise

78 dead at abandoned South Africa gold mine that was scene of a standoff. Toll is expected to rise

Poland's leader accuses Russia of planning acts of terror against 'airlines over the world'

Poland's leader accuses Russia of planning acts of terror against 'airlines over the world'

Universities are mapping where local news outlets are still thriving − and where gaps persist

Universities are mapping where local news outlets are still thriving − and where gaps persist

China blacklists four U.S. companies for involvement in arms sales to Taiwan

China blacklists four U.S. companies for involvement in arms sales to Taiwan

Wildfires latest: A final round of dangerous fire weather and dry conditions is in the forecast

Wildfires latest: A final round of dangerous fire weather and dry conditions is in the forecast

Music streams hit nearly 5 trillion in 2024. Women pop performers lead the charge in the US

Music streams hit nearly 5 trillion in 2024. Women pop performers lead the charge in the US