By Manya Saini and Niket Nishant

(Reuters) - U.S. mid-sized banks will likely need to shell out more to retain deposits in the next few months, a move that could crimp margins and add pressure to an industry already grappling with a potential slowdown in loan demand.

Net interest margins have broadly contracted across mid-sized lenders who have so far reported earnings for the quarter.

"We expect all banks to see slower net interest income growth in 4Q23 sequentially due to deposit mix changes and pricing pressures," analysts at brokerage RBC Capital Markets wrote in a note.

The U.S. Federal Reserve's interest rate hikes have spurred customers into chasing high-yielding alternatives to bank deposits, like money market funds.

To stem the migration, banks are offering higher rates of interest on deposits. This has increased costs for an industry that has already warned of a slowdown in loan demand as borrowing becomes costlier.

Banks are also looking to contain the fallout from the sector-wide crisis in March that wiped billions of value from bank stocks and saw customers frenetically withdraw deposits seeking the safety of large "too-big-to-fail" institutions.

The industry has regained some poise since then, but deposit levels continue to be a closely watched metric. A bond market rout has also raised fears of unrealized losses lurking on banks' balance sheets.

The harsh operating environment has weighed on stock prices and hurt valuations. The S&P 500 Banks index, which tracks a basket of large-cap bank stocks, has fallen nearly 12% this year, underperforming the benchmark S&P 500 index.

Truist Financial reported a near 31% drop in third-quarter profit on Thursday as the lender's interest income from mortgages and credit-card debt declined, while it allocated more funds towards rainy-day reserves to cover potential sour loans.

KeyCorp said it expects interest income to be stable in the current quarter after reporting a lower-than-expected drop in its third-quarter profit, sending shares up marginally.

Fifth Third Bancorp's earnings also came ahead of Wall Street's profit expectations, sending shares 2.2% higher, but the lender said it expects net interest income to decline again in the current quarter between 1% and 2%.

Meanwhile, several U.S. regional banks beat third-quarter profit estimates on Wednesday as higher interest rates allowed them to charge more for loans, although rising loan loss provisions and deposit retention costs crimped margins.

Citizens Financial's Chief Financial Officer John Woods said the bank expects a further contraction in its net interest margin to around 3% in the current quarter. It reported net interest margin of 3.03% in the third quarter compared with 3.25% a year earlier.

Zions Bancorp on Wednesday missed analysts' estimates for third-quarter profit, as higher interest payment on deposits squeezed the lender's interest income.

Discover Financial Services also fell short of estimates for quarterly profit on Wednesday.

Zions and Discover Financial shares fell 6.2% and 8.3%, respectively, on Thursday.

(Reporting by Manya Saini and Niket Nishant in Bengaluru; Additioanl reporting by Jaiveer Shekhawat, Sri Hari N S and Pritam Biswas; Editing by Krishna Chandra Eluri and Shounak Dasgupta)

Fire tornadoes are a risk under California's extreme wildfire conditions

Fire tornadoes are a risk under California's extreme wildfire conditions

Bondi faces a skeptical reception from Democrats at confirmation hearing over her loyalty to Trump

Bondi faces a skeptical reception from Democrats at confirmation hearing over her loyalty to Trump

In eyeing Greenland, Trump is echoing long-held American designs on the Arctic expanse

In eyeing Greenland, Trump is echoing long-held American designs on the Arctic expanse

78 dead at abandoned South Africa gold mine that was scene of a standoff. Toll is expected to rise

78 dead at abandoned South Africa gold mine that was scene of a standoff. Toll is expected to rise

Poland's leader accuses Russia of planning acts of sabotage against 'airlines around the world'

Poland's leader accuses Russia of planning acts of sabotage against 'airlines around the world'

Vulnerable Americans live in the shadow of COVID-19 as most move on

Vulnerable Americans live in the shadow of COVID-19 as most move on

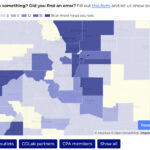

Universities are mapping where local news outlets are still thriving − and where gaps persist

Universities are mapping where local news outlets are still thriving − and where gaps persist

Wildfires latest: A final round of dangerous fire weather and dry conditions is in the forecast

Wildfires latest: A final round of dangerous fire weather and dry conditions is in the forecast

Kamala Harris memes questioning her cultural background highlight Americans’ contradictions with race

Kamala Harris memes questioning her cultural background highlight Americans’ contradictions with race

Music streams hit nearly 5 trillion in 2024. Women pop performers lead the charge in the US

Music streams hit nearly 5 trillion in 2024. Women pop performers lead the charge in the US