By John Revill

ZURICH (Reuters) -The Swiss National Bank's supervisory board is in the final stages of deciding its candidate to replace outgoing Chairman Thomas Jordan, people familiar with the matter have told Reuters.

The Bank Council is expected soon to nominate the successor to Jordan, who steps down in September after 12 years leading the central bank through major challenges including the fall of bank Credit Suisse and a sharp appreciation in the Swiss franc.

Two sources who asked not to be named said the process to fill one of the best-paid jobs in central banking - with a 1.3 million Swiss francs ($1.5 million) compensation package last year - was almost complete, with interviews already finished.

The Bank Council, which must present its candidate to the Swiss cabinet for approval, said it did not comment on the search process or on rumours.

SNB Vice Chairman Martin Schlegel is seen as the most likely successor, with 16 out of 18 economists polled by Reuters expecting the 47-year-old to get the job.

"Schlegel is seen as the leading candidate. Having deep knowledge of the SNB and Swiss financial markets is clearly an advantage," said Stefan Gerlach, chief economist at EFG Bank and a former deputy governor of the Central Bank of Ireland.

Schlegel started his SNB career in 2003 and worked in the research department, which was then headed by Jordan, who under the rules has no role in choosing his successor.

"I was Thomas Jordan's intern," Schlegel told the Neue Zuercher Zeitung newspaper in 2019. "And somehow I still am."

Schlegel has consistently declined to comment on speculation linking him to the job.

Analysts expect no change to the SNB's monetary policy, which targets inflation at 0-2%, and preventing large fluctuations in the franc's value.

But the newcomer will not have an easy time, having to reduce the big payments the SNB is making to commercial banks - 7.4 billion francs last year - after interest rates turned positive.

They will also have to decide what to do with the SNB's huge balance sheet, which caused a 133 billion franc loss in 2022.

"A central bank cannot go bankrupt but big losses could have a negative effect on the SNB's credibility, which is the most important asset for a central bank," said Sarah Lein, an economist at the University of Basel.

"It is going to be a challenging legacy for whoever takes over."

The debate between government and regulators over new banking regulations, following questions whether the SNB could have done more in the run-up to the Credit Suisse crash, will also have to be negotiated by the new chairman.

If Schlegel is promoted, it would leave a vacancy on the SNB's three-member rate-setting governing council, alongside former Federal Reserve Bank of New York executive Antoine Martin, who joined in January.

The SNB is under pressure to pick a woman, especially after Andrea Maechler, the only previous female member, left in 2023.

Celine Widmer, a federal lawmaker for the left-leaning Social Democrats, said it was time for a female leader of the SNB, with Beatrice Weder di Mauro - a former economic adviser to the German government’s panel of economic advisers – seen as a suitable candidate.

Weder di Mauro declined to comment to Reuters.

"Our national bank is one of the most powerful institutions in Switzerland. From a gender equality perspective, it's absolutely crucial that women are represented," said Widmer.

According to the SNB, candidates must have an "impeccable reputation", expertise in "monetary, banking and financial issues," Swiss citizenship and live in the country.

"I don't have great hope that a woman will be elected as chairwoman," said Widmer. "However, it would be completely unacceptable if there were no women on the governing board."

($1 = 0.8953 Swiss francs)

(Reporting by John Revill; Editing by Hugh Lawson)

China probes personal disputes after mass killings. Many fear further infringement on freedoms

China probes personal disputes after mass killings. Many fear further infringement on freedoms

Yen hovers near 5-month low as BOJ's cautious stance weighs

Yen hovers near 5-month low as BOJ's cautious stance weighs

Big Oil backtracks on renewables push as climate agenda falters

Big Oil backtracks on renewables push as climate agenda falters

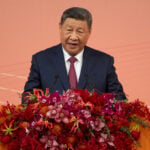

China's Xi Jinping will visit Russia in 2025, Russian ambassador says

China's Xi Jinping will visit Russia in 2025, Russian ambassador says

Brazil court suspends law cutting tax breaks for firms with deforestation soy commitment

Brazil court suspends law cutting tax breaks for firms with deforestation soy commitment

Sirianni and Ertz cleared the air after exchanging words following Washington's win over the Eagles

Sirianni and Ertz cleared the air after exchanging words following Washington's win over the Eagles

Tucker Gleason runs and passes for 5 OT scores as Toledo beats Pitt 48-46 in bowl-record 6 overtimes

Tucker Gleason runs and passes for 5 OT scores as Toledo beats Pitt 48-46 in bowl-record 6 overtimes

Why Nefertiti still inspires, 3,300 years after she reigned

Why Nefertiti still inspires, 3,300 years after she reigned