Two major U.S. airlines are experiencing financial challenges weeks before the holiday travel season, with both carriers announcing significant operational changes.

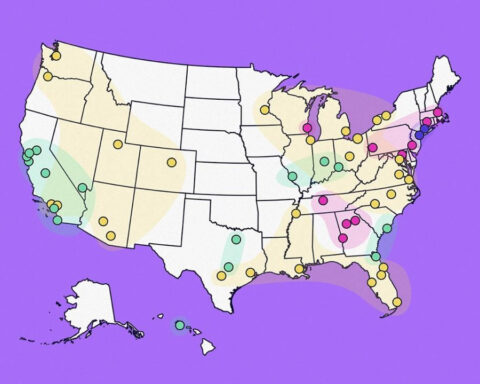

Southwest Airlines has introduced a voluntary employee buyout program across more than a dozen U.S. airports, including four in Southern California. The affected airports are Los Angeles International Airport, John Wayne International Airport, Long Beach Airport, and Hollywood-Burbank Airport. The airline states the program aims to "avert overstaffing in certain locations."

Employees accepting the buyout offers, which are expected to be distributed this week, will complete their employment by year's end. Airline blogger JonNYC first reported the news. The extent of potential impacts on Southwest's operations remains unclear.

Spirit Airlines faces its own financial hurdles following two unsuccessful merger attempts. A federal judge blocked the proposed merger with JetBlue Airways, while an earlier potential deal with Frontier Airlines fell through after JetBlue presented a higher bid. According to The Wall Street Journal, Spirit is now in "advanced" talks for a possible Chapter 11 bankruptcy filing.

In response to its financial situation, Spirit has announced plans to reduce its workforce and sell aircraft to cut costs. The company's stock value dropped significantly following news of the potential bankruptcy filing.

The airline industry developments come as the holiday travel season, traditionally the busiest time for air travel, approaches. Both airlines serve major airports like L.A. International Airport, where holiday travel has historically been challenging to navigate.

These financial challenges at Southwest and Spirit emerge just weeks before the holiday travel period begins. While Southwest's buyout program is confirmed to affect Southern California airports, the immediate impact on holiday operations has not been specified by either airline.

Trump's orders take aim at critical race theory and antisemitism on college campuses

Trump's orders take aim at critical race theory and antisemitism on college campuses

Despite chaos over Trump White House's funding pause, FAFSA forms and student loans still available

Despite chaos over Trump White House's funding pause, FAFSA forms and student loans still available

Proposed constitutional amendment could fully ban slavery in Kentucky

Proposed constitutional amendment could fully ban slavery in Kentucky

Mikaela Shiffrin prioritizes recovery over chasing World Cup win No. 100 in return from ski crash

Mikaela Shiffrin prioritizes recovery over chasing World Cup win No. 100 in return from ski crash

Leader of rebels who toppled Syrian President Bashar Assad is named country's interim president

Leader of rebels who toppled Syrian President Bashar Assad is named country's interim president

Elaborate burial site of ‘The Ivory Lady’ and her descendants contains more than 270,000 shell beads

Elaborate burial site of ‘The Ivory Lady’ and her descendants contains more than 270,000 shell beads

Strawberry farmers bounce back after historic snowstorm

Strawberry farmers bounce back after historic snowstorm

House Republicans fail to clinch deal on tax cuts, despite Trump's urging

House Republicans fail to clinch deal on tax cuts, despite Trump's urging

The US Open tennis tournament is adding a 15th day by moving to a Sunday start in 2025

The US Open tennis tournament is adding a 15th day by moving to a Sunday start in 2025

As the Chiefs chase a 3-peat, DeAndre Hopkins and other vets finally get their Super Bowl chance

As the Chiefs chase a 3-peat, DeAndre Hopkins and other vets finally get their Super Bowl chance

Getty Images

Getty Images