By Sarah Wu

TAICHUNG, Taiwan (Reuters) - For years, Hota Industrial Mfg. Co has made gears, shafts and other auto parts in Taiwan and shipped them to large foreign carmakers such as Tesla, Ford Motor and General Motors.

But soaring shipping costs during the pandemic and escalating cross-strait tensions have forced some of Hota's customers to re-evaluate their reliance on Taiwan, a democratically governed island that China claims as its own and has not ruled out taking by force.

To address client concerns about supply chain security and to move closer to North America, which accounts for 70% of its sales, Hota in September announced a $99 million investment in a plant in New Mexico, its first outside Asia.

"Our choice of the United States is actually a very natural decision," Hota CEO Holly Sheng told Reuters in an interview earlier this month. "But, in terms of cost, it is not very natural. That is why for so many years we chose not to leave Taiwan."

Facing shortages of cargo containers and workers at ports throughout the pandemic, Hota, which was founded in 1966, resorted to expensive air freight to send heavy auto parts to North America.

"During COVID, even if your products were cheaper, they couldn't be shipped," Sheng said. "Now, everyone can accept that 'If you're located closer to me, I'm willing to pay a bit more'."

'THE NEXT DETROIT'

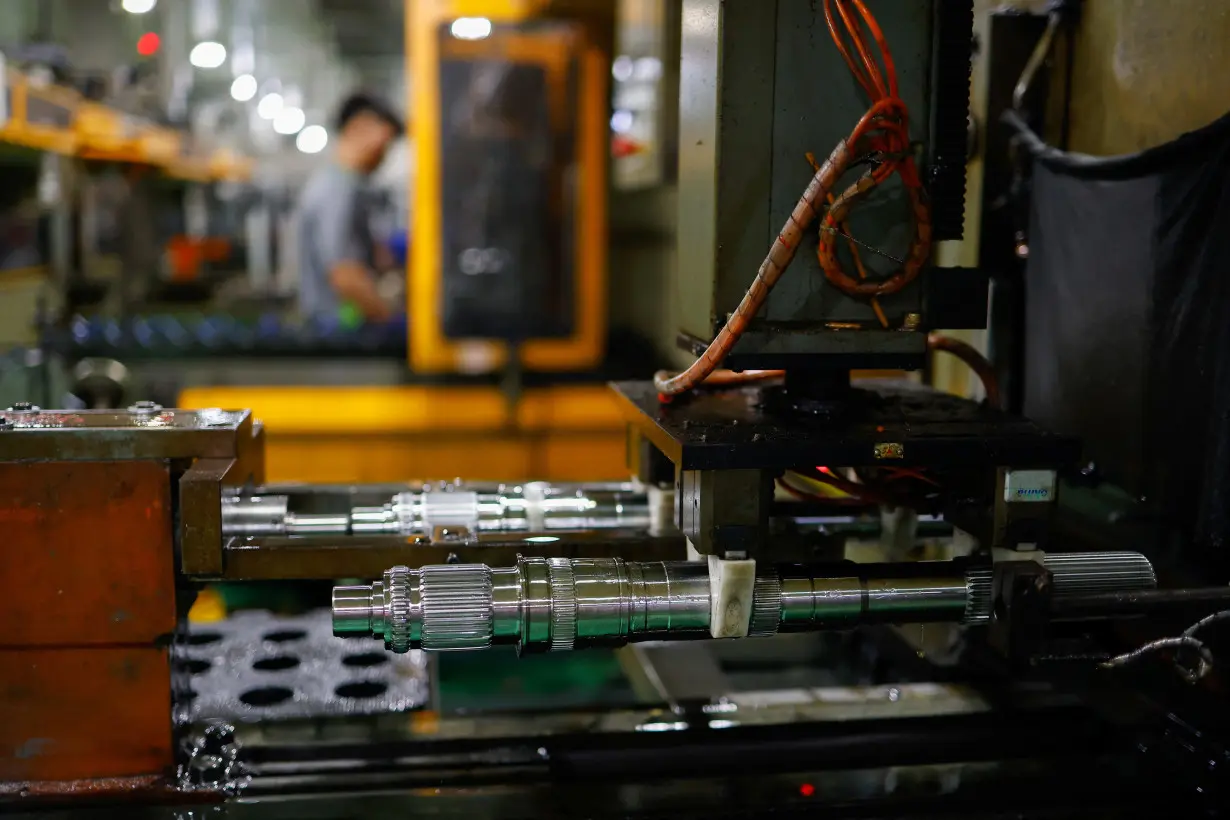

At one of Hota's plants in Taiwan, robotic arms move metal cylinders through a series of machines, each a step in shaping them into precise shafts that will combine with other powertrain components to make cars move.

The crates of shafts and gears at the factory contain some of the more than 20 million parts Hota produces each year.

Soon, Hota's machines will be humming in Santa Teresa, New Mexico, with factory construction to begin early next year and mass production in 2025. Hota chose New Mexico because of lower costs compared with other states and proximity to customers in the United States and Mexico, as both countries accelerate a push to build electric vehicle (EV) supply chains.

"It will become the next Detroit," Sheng said of the Borderplex region along the U.S.-Mexico border. Hota's factory will be near Texas, home to Tesla's headquarters, and Mexico, where Tesla plans to build a gigafactory.

U.S. production will account for 5-8% of Hota's total production in the plant's first few years, Sheng said. New Mexico will provide $3 million in funding, plus potential tax credits.

Hota's biggest U.S. competitors will be its own customers, who could make components themselves but outsource if suppliers can offer cheaper prices.

Most Taiwanese manufacturers seeking a North American foothold choose Mexico over the United States due to costs, Sheng said.

While Hota's U.S. costs will be higher, Sheng pointed to its advantages in scale, vertical integration and expertise.

The U.S. Inflation Reduction Act will also help ease cost pressures as Washington incentivises EV makers to source components domestically, Sheng said.

Given its highly automated production lines, Hota is less worried about higher wages and labour shortages. The latter delayed the production timeline for Taiwanese chip giant TSMC's $40 billion plant in Arizona.

Overhanging the U.S. plan, however, are concerns about a China-Taiwan war.

"There's no way to convince a customer that war will not happen," Sheng said.

Similarly, Hota would never be able to completely replace its established Taiwan production base.

"But if you distribute the risk, however much, customers will feel more comfortable," Sheng said.

(Reporting by Sarah Wu; Editing by Anne Marie Roantree and Sam Holmes)

AAPI adults prioritize immigration, but split on mass deportations: AP-NORC/AAPI Data poll

AAPI adults prioritize immigration, but split on mass deportations: AP-NORC/AAPI Data poll

Nippon Steel wants to work with Trump administration on US Steel deal, Mori tells WSJ

Nippon Steel wants to work with Trump administration on US Steel deal, Mori tells WSJ

BOJ will raise rates if economy, price conditions continue to improve, Ueda says

BOJ will raise rates if economy, price conditions continue to improve, Ueda says

After cable damage, Taiwan to step up surveillance of flag of convenience ships

After cable damage, Taiwan to step up surveillance of flag of convenience ships

As fires ravage Los Angeles, Tiger Woods isn't sure what will happen with Riviera tournament

As fires ravage Los Angeles, Tiger Woods isn't sure what will happen with Riviera tournament

Antetokounmpo gets 50th career triple-double as Bucks win 130-115 to end Kings' 7-game win streak

Antetokounmpo gets 50th career triple-double as Bucks win 130-115 to end Kings' 7-game win streak

Zheng loses to No 97 Siegemund, Osaka rallies to advance at the Australian Open

Zheng loses to No 97 Siegemund, Osaka rallies to advance at the Australian Open