BEIJING (Reuters) - U.S. automaker Tesla sold 94,139 China-made electric vehicles (EVs) in December, a 68.7% increase from a year earlier, China Passenger Car Association (CPCA) data showed on Wednesday.

Deliveries of China-made Model 3 and Model Y vehicles were up 14.2% from November.

Chinese rival BYD, with its Dynasty and Ocean lineup of EVs and petrol-electric hybrid models, delivered 341,043 passenger vehicles in December, up 13% from November and a 45% jump year-on-year.

BYD had a record quarter with sales of 944,779 new energy vehicles in the fourth quarter, including 526,409 pure EVs.

Tesla's figures took its China-made sales, which include exports, to 947,742 for the full year, accounting for 52.4% of the U.S. EV pioneer's global deliveries.

Tesla's Shanghai plant, its biggest globally, is capable of producing 1.1 million units of Model 3 and Model Y cars a year and besides China also supplies countries such as New Zealand, Australia and Europe.

Worldwide, Tesla delivered a record 484,507 cars in the fourth quarter, beating market estimates, but was dethroned by BYD as the top EV maker.

Tesla faces mounting competition in China, the world's largest auto market, where a bruising price war and slowing EV demand has not inhibited Chinese latecomers from venturing into the arena.

In China, Tesla kicked off a price war at the start of last year that drew in more than 40 brands and dealt a blow to industry profitability.

While a BYD-led sales push continues with varied discounting policies, the U.S. EV giant put a hold on price adjustments in the Chinese market in December after making five upward price revisions in the prior month.

Toughening up the EV race, Chinese smartphone maker Xiaomi unveiled its first EV last week, aiming to become one of the world's top five automakers over the next 15 to 20 years.

Huawei, one of Xiaomi's closest Chinese phone rivals, has approached Mercedes Benz and Volkswagen's Audi about smart car investments, Reuters has reported.

Tesla has acquired land in Shanghai for a megapack battery manufacturing plant with production expected to start in the fourth quarter of 2024. That suggests slower-paced progress on the project than it had planned initially.

Tesla's ambitious plans to expand its EV capacity in Shanghai, its largest production hub globally, still hinges on China's regulatory approval.

(Reporting by Qiaoyi Li, Zhang Yan and Brenda Goh; Editing by Jamie Freed and Mark Potter)

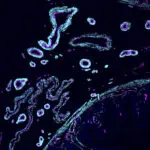

Scientists map out the human body one cell at a time

Scientists map out the human body one cell at a time

Russian doctors decry 'shameful' conviction of colleague over Ukraine war comments

Russian doctors decry 'shameful' conviction of colleague over Ukraine war comments

China-based biotech Laekna teams up with Lilly to develop muscle preserving obesity drug

China-based biotech Laekna teams up with Lilly to develop muscle preserving obesity drug

Trump chooses former acting Attorney General Matt Whitaker as NATO ambassador

Trump chooses former acting Attorney General Matt Whitaker as NATO ambassador

Family, former bandmates arrive for funeral of Liam Payne

Family, former bandmates arrive for funeral of Liam Payne

India's Q3 growth to pick up after festive boost, cenbank says in bulletin

India's Q3 growth to pick up after festive boost, cenbank says in bulletin

Capitals put Alex Ovechkin on injured reserve, ruling him out at least a week

Capitals put Alex Ovechkin on injured reserve, ruling him out at least a week

Rafael Nadal's legacy is a relentlessness that inspired Carlos Alcaraz and plenty of others

Rafael Nadal's legacy is a relentlessness that inspired Carlos Alcaraz and plenty of others