(Reuters) -The Federal Reserve and two other U.S. regulators are moving toward a new plan that would significantly reduce a nearly 20% mandated increase in capital for the country's biggest banks following lobbying efforts by industry CEOs like JPMorgan Chase's Jamie Dimon, the Wall Street Journal reported on Sunday.

Required increases in capital for banks like JPMorgan and Goldman Sachs meant to ensure they have sufficient buffers to absorb potential losses — would on average be about half as much as originally floated, the Journal added.

Top officials from all three agencies involved in the pending capital rules — the Federal Reserve, the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency — are still discussing substantive and technical revisions and there is no guarantee that an agreement will be reached, the WSJ reported.

The Fed, FDIC and OCC declined to comment on the report.

The three bank regulators, led by the Fed, in July last year unveiled a proposal to overhaul how banks with more than $100 billion in assets calculate the cash they must set aside to absorb potential losses.

The Basel proposal aims to make banks more resilient to potential losses, lowering the risk of failures or bailouts. Banks say that they are already highly capitalized and the changes are unnecessary.

Big U.S. banks have lobbied against the Basel proposal, which they say will force them to overhaul or shut down a range of products and businesses.

Goldman Sachs recruited dozens of small business owners to travel to Washington and urge lawmakers to reconsider the proposal, a Reuters review of private Goldman documents, interviews with program participants and public disclosures show.

(Reporting by Surbhi Misra and Disha Mishra in Bengaluru; Editing by Leslie Adler, Lisa Shumaker and Sandra Maler)

Santa Cruz County ballot errors impact more than 1,100 voters

Santa Cruz County ballot errors impact more than 1,100 voters

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Strike at Boeing was part of a new era of labor activism long in decline at US work places

Google defeats lawsuit over gift card fraud

Google defeats lawsuit over gift card fraud

Delay in Chile mining permits a serious problem, says local head of Freeport

Delay in Chile mining permits a serious problem, says local head of Freeport

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

Equatorial Guinea orders crackdown on sex in government offices after videos leaked

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

US needs to crack down on Chinese chipmaker SMIC, Republican lawmaker says

Malaysia central bank set to manage market volatility, monitoring US election

Malaysia central bank set to manage market volatility, monitoring US election

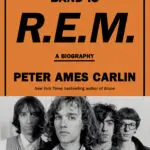

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Book Review: 'The Name of This Band is R.E.M.' is a vivid journey through the rock band's history

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Rare letter signed by Founding Fathers expected to fetch $1 million at auction

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury

Jerry Jones says Dak Prescott likely out at least 4 games with IR move because of hamstring injury