By Davide Barbuscia

NEW YORK (Reuters) - The longest and deepest U.S. Treasury yield curve inversion in history, a key bond market signal of an upcoming recession, could be nearing its end.

While an inverted curve has typically preceded a recession, this time there is debate about the predictive power of the curve, with optimism that the U.S. could escape prolonged economic pain. Some indicators in recent weeks have pointed to a slowdown, but growth remains strong thanks to a resilient labor market.

"I'm not looking at it as recessionary as of now, I think it's a very different time," said Phil Blancato, chief market strategist at Osaic.

Investors observe the shape of the Treasury yield curve - which plots the yields of all Treasury securities - because it reveals market expectations on monetary policy and the economy. An inverted yield curve, which occurs when short-term debt yields more than long-term paper, has been a harbinger of a recession in nine out of 10 instances over the last 70 years, according to Deutsche Bank data.

Several Wall Street firms expected a recession to occur last year because of higher borrowing costs, but continued economic resilience defied those projections. Economists polled by Reuters this month expect the U.S. economy will keep expanding over the next two years. A majority of bond strategists polled by Reuters earlier this year said the curve was no longer a reliable recession signal.

"It is one of those indicators that may be not as perfect as the data suggests," said Lawrence Gillum, chief fixed income strategist for LPL Financial. "Right now, as the yield curve disinverts it's not because of recession, it's just getting back to a normal upward-sloping yield curve."

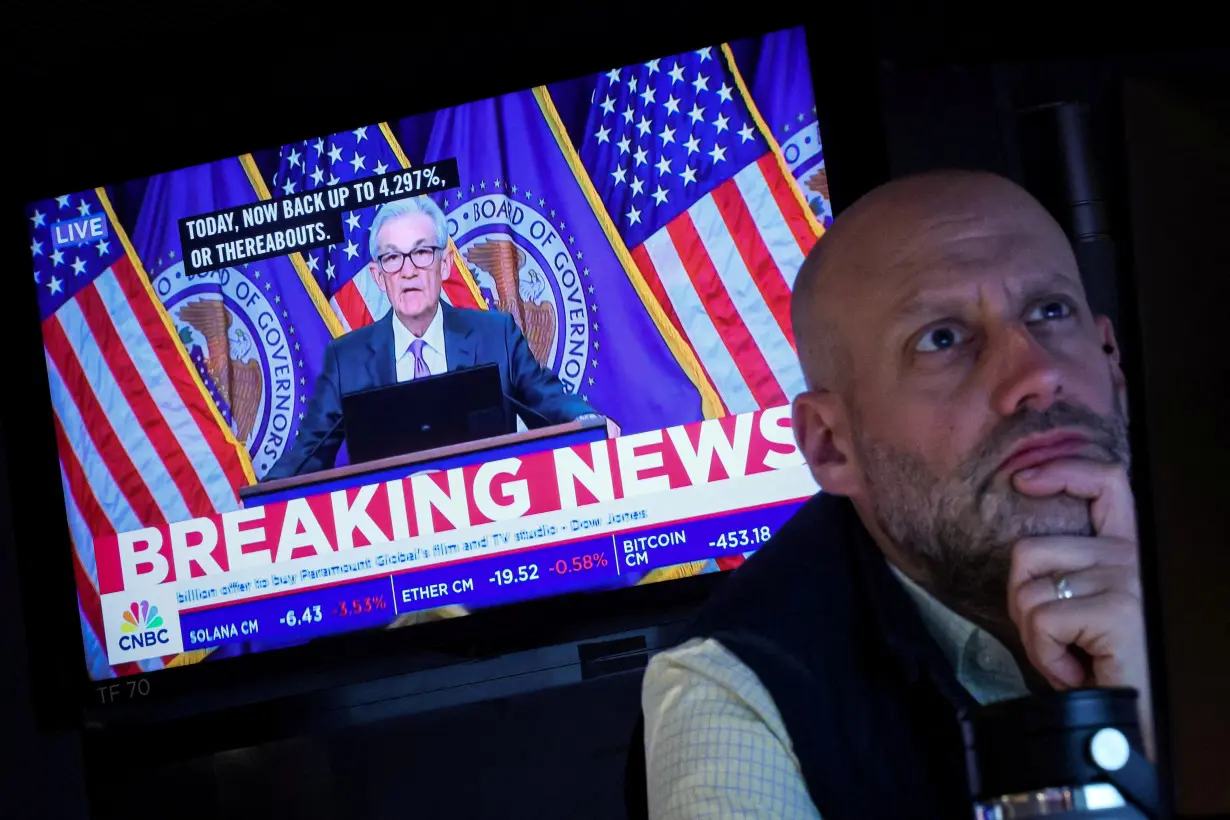

A key part of the Treasury yield curve that plots two-year and 10-year yields has been continuously inverted since early July 2022, exceeding a previous inversion record from 1978. The inversion followed a cycle of interest-rate increases by the Federal Reserve that started in March 2022 to tame inflation.

In recent weeks, that curve has steepened - meaning that the spread of two-year yields over 10-year (2/10 curve) has narrowed - amid signs of a cooling economy. On Wednesday, the curve hit minus-14.5 basis points, the least inverted it has been since July 2022, Tradeweb data showed. On Friday it was at minus-18.5.

The curve typically turns positive because a slowing economy leads to markets anticipating the Fed will cut rates, causing a rally in short-term debt more than in longer-dated bonds. Yields decline when bond prices increase.

But while a disinversion could happen amid signs of the economy only moderately slowing, as it appears to be doing now, some analysts warn recent yield curve history suggests an economic contraction could still be in the cards.

"In recent cycles, a re-steepening back out of inversion has occurred shortly before a recession, so that’s one to keep an eye on, given how it’s moved ahead of the past few downturns," Deutsche Bank strategist Jim Reid said in a note on Thursday.

In every case Deutsche Bank examined, the curve had re-steepened before the recession started.

In the past four recessions - 2020, 2007-2009, 2001 and 1990-1991 - the 2/10 curve had turned positive by the time a recession occurred, according to a Deutsche Bank analysis published last year. The interval between a disinversion and the beginning of recession varied, ranging roughly between two and six months in those four instances.

“We are at an important point today, because now the yield curve ... is getting steeper, and that's usually when we run into some trouble,” said George Cipolloni, portfolio manager at Penn Mutual Asset Management.

Another closely watched part of the curve comparing three-month yields with 10-year yields also disinverted before the last four U.S. recessions started, said Campbell Harvey, a finance professor at Duke University, who pioneered the idea that the yield curve is an indicator of future economic performance.

That curve inverted in November 2022 and was still deeply inverted at minus-109 basis points on Friday. The longest interval between an inversion of the three month/10-year yield curve and a recession is 22 months, he has observed.

"It's too early to rule the signal out like a false signal," he said.

(Reporting by Davide Barbuscia, additional reporting by Saeed Azhar; editing by Megan Davies and Rod Nickel)

Joe Biden’s record on science and tech: Investments and regulation for vaccines, broadband, microchips and AI

Joe Biden’s record on science and tech: Investments and regulation for vaccines, broadband, microchips and AI

Meta shift from fact-checking to crowdsourcing spotlights competing approaches in fight against misinformation and hate speech

Meta shift from fact-checking to crowdsourcing spotlights competing approaches in fight against misinformation and hate speech

Fire tornadoes are a risk under California's extreme wildfire conditions

Fire tornadoes are a risk under California's extreme wildfire conditions

In eyeing Greenland, Trump is echoing long-held American designs on the Arctic expanse

In eyeing Greenland, Trump is echoing long-held American designs on the Arctic expanse

78 dead at abandoned South Africa gold mine that was scene of a standoff. Toll is expected to rise

78 dead at abandoned South Africa gold mine that was scene of a standoff. Toll is expected to rise

Poland's leader accuses Russia of planning acts of sabotage against 'airlines around the world'

Poland's leader accuses Russia of planning acts of sabotage against 'airlines around the world'

Jayden Daniels accomplishes a feat last done by Slinging Sammy Baugh in 1937

Jayden Daniels accomplishes a feat last done by Slinging Sammy Baugh in 1937

Wildfires latest: A final round of dangerous fire weather and dry conditions is in the forecast

Wildfires latest: A final round of dangerous fire weather and dry conditions is in the forecast

Kamala Harris memes questioning her cultural background highlight Americans’ contradictions with race

Kamala Harris memes questioning her cultural background highlight Americans’ contradictions with race