Top Articles

California bills aim to close loopholes in pet sales after puppy mill investigation

California forced to rethink clean air strategy after federal setback

US News

See all »Trump is quietly changing the Fed, even without firing Powell

Trump says number one priority now in Gaza is getting people fed

What's in Trump's trade deal with Europe?

This could be the most consequential week for the economy in years

World News

See all »Angry France slams US trade pact 'submission' as EU peers breathe sigh of relief

European leaders react to US-EU trade deal

Warner Bros to get studio business after split, Discovery to house news, sports brands

Shooter opens fire at Reno casino, killing 3 and injuring several others

Latest

Zelenskiy praises Trump for 'clear stance' in shortened deadline for Russia

Two Israeli rights groups say their country is committing genocide in Gaza

Two prominent Israeli rights groups say their country is committing genocide in Gaza

Baseball Commissioner Rob Manfred confronted by Bryce Harper during meeting, AP source says

Spirit Airlines to furlough 270 pilots, demote 140 more on downsized schedule

Spirit Airlines said on Monday it will furlough about 270 pilots while demoting another 140, as the cash-strapped budget carrier looks to scale down its workforce to match a downsized

Trump says he wants Netanyahu to 'make sure they get the food' in Gaza amid humanitarian crisis

President Donald Trump has expressed concern over the humanitarian crisis in Gaza, urging Israel to ensure food reaches the people there

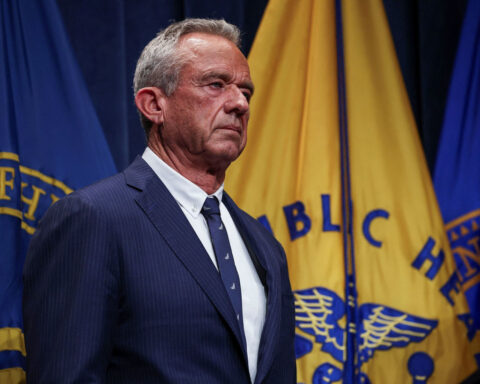

Kennedy announces plan to reform Vaccine Injury Compensation Program

Trump says he ended friendship with Epstein because he 'stole people that worked for me'

President Donald Trump says his friendship with Jeffrey Epstein ended after Epstein hired people who had worked for Trump

A frustrated Trump gives more details on his relationship with Epstein, as the scandal follows him abroad

A frustrated Trump gives more details on his relationship with Epstein, as the scandal follows him abroad

Project 2025 author Paul Dans will challenge Republican Sen. Lindsey Graham in South Carolina

A chief architect of Project 2025 is launching a Republican primary challenge to Sen. Lindsey Graham in South Carolina

California & Local

See all »Technology

See all »Trading Day: Fading trade deal relief?

Sarepta will resume gene therapy shipments after FDA review of recent patient death

Buffett's Berkshire to sell one-third of VeriSign stake

Lifestyle

See all »2 kids killed at Miami sailing camp after barge collides with their boat, authorities say

‘Meet the Parents 4’ will officially be titled ‘Focker In-Law’

What to know about the trial of a Colorado dentist accused of poisoning his wife

Children's hospital in desperate need of breast milk donors

Entertainment

See all »‘Meet the Parents 4’ will officially be titled ‘Focker In-Law’

Texas man pleads guilty to stalking WNBA star Caitlin Clark and gets 2 1/2 years in prison

What to know about the trial of a Colorado dentist accused of poisoning his wife

Girl with rare birthmark meets anime 'twin' at GalaxyCon after viral Tiktok

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness