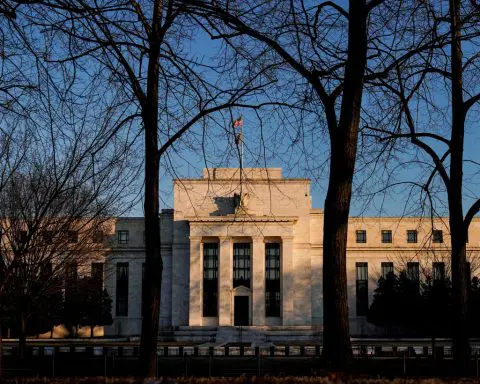

No real fix to the sharp rise in public debt loads, economists say

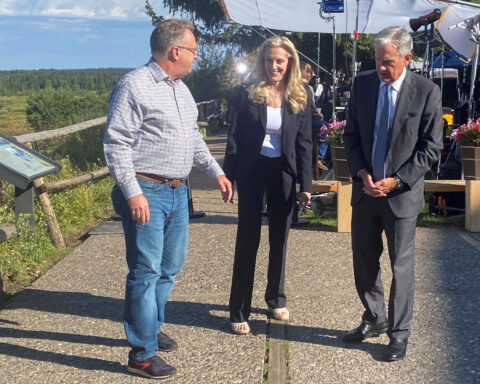

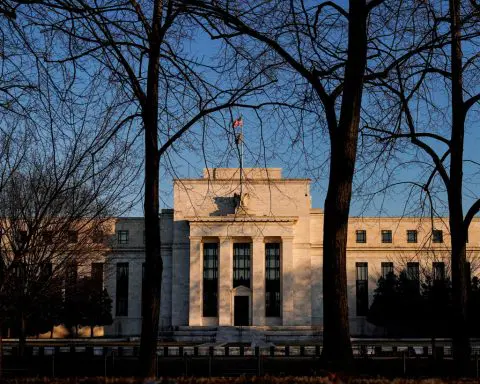

– The steep jump in public debt loads over the past decade and a half, as governments borrowed large amounts of money to battle the Global Financial Crisis and the fallout from the COVID-19 pandemic, is probably irreversible. That’s the unhappy conclusion of a research paper being presented on Saturday to some of the world’s most influential economic policymakers at the Kansas City Federal Reserve’s annual central banking symposium in Jackson Hole, Wyoming. Since 2007, worldwide public debt has ballooned from 40% to 60% of GDP, on average, with debt-to-GDP ratios even higher

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness