Hedge funds rally in Q1, powered by gains in equities

Hedge funds capped the first quarter with gains across different strategies, as a rally in stocks, some commodities and the dollar helped the industry weather a

Hedge funds capped the first quarter with gains across different strategies, as a rally in stocks, some commodities and the dollar helped the industry weather a

Hedge funds increased their bearish bets mainly on U.S. stocks last week when the major stock indexes plunged, Goldman Sachs showed in a report.

The U.S. securities regulator on Friday said it had fined 12 companies, including brokers, investment advisers and credit rating firms, for

Geopolitical tensions and a weakening economy are driving hedge funds to consider alternatives to investing in China.

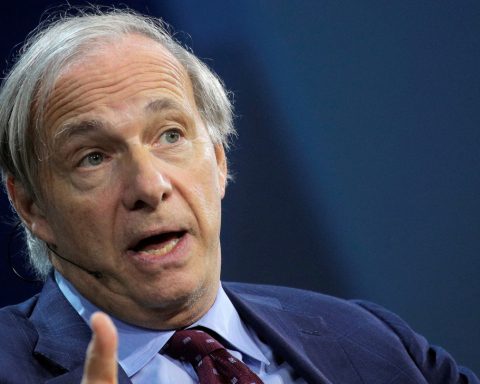

Ray Dalio, founder of hedge fund Bridgewater Associates, said on Tuesday that the relationship between China and the United States is "on the brink

Global hedge funds reduced their exposure to mega cap tech stocks in recent days, ahead of the companies' third-quarter earnings, two Wall Street banks said.

Some big investors showed increased appetite for weight-loss drug makers in the third quarter, piling in to shares of Eli Lilly and Novo Nordisk amid growing

As U.S. regulators ready rules that would push more trading in Treasuries to a central clearing venue, the industry's focus is turning on a

The recent rally that has lifted U.S. stocks and bonds is more of a year-end rebound than a turning point, according to

After making hay when a summer bond rout propelled the U.S. dollar to 10-month highs, hedge funds are now pondering what lies ahead for

Asset managers, insurers and pension funds are pushing to soften a proposed rule aimed at enhancing U.S.

Global hedge funds went on a stock-buying spree just ahead of a U.S. jobs report that drove the S&P 500 and Nasdaq to their highest closing levels since early

Global equities long/

Investors who bet against U.S. and Canadian stocks had paper losses of $194.9 billion last year following a sharp market rally, data provider S3 Partners

Wells Fargo on Friday posted higher fourth-quarter profit, beating analysts' expectation on cost cuts, but the lender warned that

Global hedge funds have reduced their exposure to the so-called Magnificent Seven stocks while increasing their

A handful of hedge funds made a winning bet on approval of a spot bitcoin exchange-traded fund (ETF) by investing in the Grayscale

New York Community Bancorp's exposure to commercial real estate has intensified investor scrutiny around regional banks,

Global hedge funds bought more stocks than they sold for the second consecutive week, mainly in the so-called cyclical sectors, such as energy, industrials and

Bridgewater Associates increased its stake in chipmaker Nvidia by 458% at the end of last year while also adding exposure to other members of the so-called

A number of well-known fund managers bought shares of New York Community Bancorp in the fourth quarter of 2023, securities filings showed, before the troubled

Capital One's chances of getting its $35.3 billion deal for Discover Financial past regulators hinge on the bank showing it can disrupt the close-knit

Billionaire Ray Dalio, founder of hedge fund Bridgewater Associates, said the Magnificent Seven stocks are a "bit frothy but not in a full-on bubble," with

The Bank of Japan, long the outlier as other major economies jacked up interest rates to curb inflation, is expected to end its

Hedge funds' use of leverage in equities trading is near record levels after debt-fueled strategies ballooned in recent years and an upturn in financial markets

Your subscription includes

Unlimited Access to All Content from

The Los Angeles Post

Your subscription has been successfully upgraded!