Wall Street ends down slightly; tariff uncertainty keeps investors on edge

U.S. stocks ended slightly lower on Tuesday as tariff uncertainty stayed high and shares of consumer and healthcare companies eased, while upbeat results

U.S. stocks ended slightly lower on Tuesday as tariff uncertainty stayed high and shares of consumer and healthcare companies eased, while upbeat results

U.S. stocks ended higher on Monday, with Apple giving the S&P 500 its biggest boost as the White House exempted smartphones and computers from new tariffs.

Benchmark 10-year U.S.

Major stock indexes and the U.S. dollar dropped on Thursday, with the S&P 500 ending down more than 3% as investors remained skittish, a day after U.S.

Stock indexes posted their biggest one-day gains in years, with the S&P 500 recording its largest rise since 2008, while the dollar gained and Treasuries

Major stock indexes fell on Tuesday as the trade war between the United States and China intensified, while oil prices and the U.S. dollar also eased.

Most major stock indexes ended a turbulent Monday lower as U.S. President Donald Trump showed no sign of easing up on his global trade war, while U.S.

Major U.S. stock indexes registered their biggest daily percentage drops since 2020 on Thursday and the dollar weakened as U.S.

Analysts are turning more cautious on U.S. corporate earnings for the first quarter of this year, with the Trump administration's policies threatening to

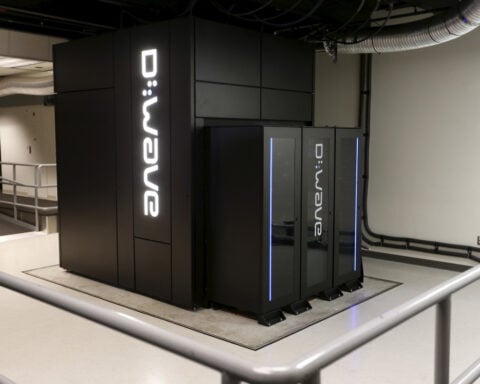

Shares of some quantum computing companies rallied on Thursday, adding to gains from the previous session and bucking the broader market's trend after D-

Stock indexes rose sharply on Wednesday after the White House said President Donald Trump will exempt automakers from his 25% tariffs on Canada and Mexico

Major stock indexes fell on Tuesday as the United States hit Canada, Mexico and China with steep tariffs, while the euro climbed to a three-month peak

The S&P 500 ended little changed on Wednesday ahead of quarterly results from Nvidia, whose positive outlook could set the tone for the artificial

The S&P 500 will finish 2025 up about 9% from now, but volatility will likely increase as a barrage of tariff announcements, job cuts and policy changes

S&P 500 earnings growth for the fourth quarter of 2024 is on track to be the highest since the end of 2021, according to LSEG, thanks to much stronger-

U.S. stocks ended lower on Friday, with indexes losing ground after the White House said U.S.

U.S. stocks ended a volatile session higher on Thursday as investors digested a stack of key earnings reports, with upbeat comments from Tesla helping to

U.S. stocks ended lower on Wednesday, but off their lows of the day, with the Federal Reserve holding interest rates steady as expected and Fed Chair

U.S. stocks ended higher on Tuesday, with Nvidia and other artificial intelligence-linked technology shares recovering from sharp losses the previous day

– U.S. stocks ended a volatile session higher on Friday as investors digested comments from Federal Reserve Chair Jerome Powell that the U.S. central bank may need to raise interest rates further to ensure inflation is contained. Powell also acknowledged that price pressures have eased in his much-anticipated morning speech at the Economic Policy Symposium at Jackson Hole, Wyoming. The major U.S. indexes, which started the day with solid gains, alternated between extending and paring those gains for much of the session. Powell “is demonstrating that he is pleased with how far monetary policy

U.S. companies are set for their biggest year-over-year gain in quarterly earnings since the second quarter of 2022 after a high percentage of S&P 500

An index of semiconductor stocks was up more than 2% on Thursday and chip stocks were helping the broader market after Taiwan Semiconductor Manufacturing

The S&P 500 posted a second straight record high close on Monday as tech stocks added to recent gains and investors awaited upcoming corporate reports for

Wall Street's run-up to record highs will be put to the test in the coming weeks as heavily weighted U.S. technology-related companies open their books on

The S&P 500 ended nearly flat on Monday with utilities falling sharply and investors weighing the likelihood the Federal Reserve will need to hold

Your subscription includes

Unlimited Access to All Content from

The Los Angeles Post

Your subscription has been successfully upgraded!