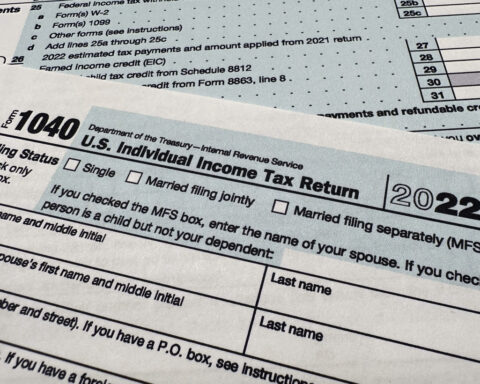

How to file for an extension, and other Tax Day advice

If you’ve waited till the last minute to file your taxes, don’t panic

If you’ve waited till the last minute to file your taxes, don’t panic

If your life has been upended by a wildfire, hurricane, flood, tornado, or another disaster this past year, the IRS recognizes you may need more time to file your taxes and grants you an automatic extension

The House has voted to overturn a rule that would have limited bank overdraft fees to $5, following the Senate in moving to dismantle the Biden-era regulation that the Consumer Financial Protection Bureau had estimated would save consumers billions of dollars

Bulls, bears and dead cats are lurking in the background of President Donald Trump’s trade war

The huge swings rocking Wall Street and the global economy may feel far from normal

Steeper tariffs mean you’ll likely see higher prices from the grocery aisle to your next car repair

If you know or suspect you can’t pay the taxes you owe this tax season, you should still file a return with that information, or file for an extension

Your subscription includes

Unlimited Access to All Content from

The Los Angeles Post

Your subscription has been successfully upgraded!