Markets see door wide open for more ECB rate cuts on tariff hit

Traders saw the all-clear on Thursday from the European Central Bank to bet on even steeper interest rate cuts ahead, confident the central bank

Traders saw the all-clear on Thursday from the European Central Bank to bet on even steeper interest rate cuts ahead, confident the central bank

The European Central Bank meets on

The pain, said Shuntaro Takeuchi, was 10 out of 10.

With markets crashing after U.S.

As the dust settles after a bruising week eased by U.S.

U.S.

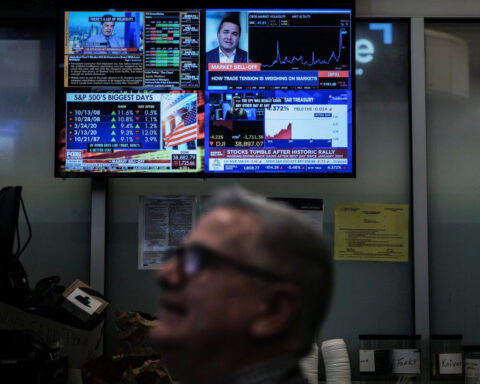

Major stock indexes fell on Tuesday as the trade war between the United States and China intensified, while oil prices and the U.S. dollar also eased.

In times of market panic investors tend to rush to the safety of the dollar, but when stocks swooned in response to U.S.

Global markets have been sucked into a downdraft after U.S.

The dollar, one of the world's safest places to park money in times of turmoil, has been shunned by investors as an option for now as

Your subscription includes

Unlimited Access to All Content from

The Los Angeles Post

Your subscription has been successfully upgraded!