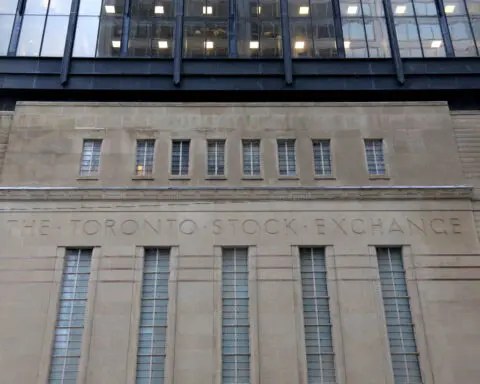

TSX extends recovery as resource shares lead broad-based gains

Canada's main stock index rallied for a second straight day on Monday as some investors took the view that the recent selloff in the market was a buying opportunity, with

Canada's main stock index rallied for a second straight day on Monday as some investors took the view that the recent selloff in the market was a buying opportunity, with

Canadian home sales dropped in February by the most in nearly three years as an uncertain outlook for the economy due to the onset of a trade war kept buyers on the

Canada's main stock index fell to a four-month low on Monday, including declines for technology and metal mining shares, as investors globally grew more worried that the

Greater Toronto Area home sales tumbled in February and home prices declined for a third straight month as an uncertain trade outlook weighed on the homebuyers'

The downturn in Canada's services economy deepened in February as firms avoided committing to new business in anticipation of a trade war, S&P Global's Canada

Canadian manufacturing activity contracted for the first time in six months in February as an uncertain trade outlook led to firms turning the most pessimistic

Canada's main stock index fell on Thursday to a near six-week low as escalating global trade tensions fueled risk-aversion and despite stronger-

Canada's main stock index rose on Wednesday as technology and metal mining shares notched gains, despite confusion around the timing of a deadline for U.S. tariffs on

Canada's main stock index is set to reach a new record high by the end of 2025, helped by lower borrowing costs, but an uncertain outlook for global trade could

As the threat of a trade war grows, Canadian investors are seeking protection in gold and in shares of companies producing goods with few substitutes, such as

Canada's services economy deteriorated for the second straight month in January as uncertainty generated by the threat of U.S. trade tariffs offset lower borrowing

Greater Toronto Area home sales rebounded in January as new listings climbed, while home prices were little changed after two straight months of increases, data

Canadian manufacturing activity increased at a slower pace in January as looming U.S. trade tariffs reduced confidence in the outlook, even as moves by clients to

The Canadian stock market stands to benefit from the expected election this year of a Conservative government that favors business-friendly economic policies and

– Canada’s second-quarter GDP report, due on Friday, is likely to show a sharp slowdown in economic growth, a Reuters poll of economists showed, which could lead the Bank of Canada to pause its interest rate hikes despite recent hotter inflation data. The GDP report will be the last major piece of domestic data before the Canadian central bank makes its next policy decision on Sept. 6. It is expected to show the economy growing at a 1.1% pace in the second quarter, down from 3.1% in the first three months of the year, and

Canada's plan to raise taxes on the savings of wealthy people and corporations is likely to hold back investment, potentially adding to the productivity malaise

Canadian manufacturing activity slowed in April, extending a lengthy period of contraction for the sector, as output and new orders fell at an accelerated pace and

Canada's services sector contracted at a slower pace in April as firms notched some unexpected sales and added workers, but increased wages led to inflation pressures

The Bank of Canada would be willing to cut interest rates three times ahead of the Federal Reserve's first move before a declining currency threatens to endanger

Canada's commodity-linked main stock index will take a breather for the rest of this year but is set to notch record highs as metal prices climb and expected lower

Canada, Mexico and Argentina on Monday started to settle securities trades faster, halving settlement time to one day, in a move designed to

Canadian manufacturing activity slowed in May, adding to a record-setting period of contraction for the sector, as output and new orders fell at a faster pace and

The Canadian dollar is set to strengthen less than previously expected over the coming year if the Bank of Canada begins cutting interest rates ahead of the Federal

Canadian stocks and bonds rallied on Wednesday, while the loonie touched a near two-week low against its U.S. counterpart, after the Bank of Canada became the first

Your subscription includes

Unlimited Access to All Content from

The Los Angeles Post

Your subscription has been successfully upgraded!