Column-Everlasting love? US savers seem wedded to stocks: Mike Dolan

Record peaks, pricey valuations, narrow markets, frenzied tech bandwagons and even punchy alternatives in bonds - all surely gnaw at U.S. household savers to lighten

Record peaks, pricey valuations, narrow markets, frenzied tech bandwagons and even punchy alternatives in bonds - all surely gnaw at U.S. household savers to lighten

If you believe the options market, the world's major currencies are going nowhere fast this year.

A Donald Trump redux come November may come with an inflation reboot too.

The Federal Reserve may finally have interest rate markets back in the palm of its hand - but it's surely casting a wary eye on effervescent stocks that seem oblivious

If the British government is trying to steer more domestic investors back into unloved UK stocks, it has a mammoth task on its hands given the scale of the desertion

Next week's Federal Reserve meeting has lost the heat it once had as a likely moment for the central bank's first interest rate cut - but it could shine a big light on

If the notorious 'term premium' is evaporating again, then last month's bond rout may just have been a nightmare.

Cut in June or not at all? The Bank of England is left parsing policy between a European Central Bank nailed on for cutting rates by mid-year and a U.S.

The slightly alarming sight of a French leader calling on the European Central Bank to nuance its focus on inflation may be less dramatic than it first seems - but it

If worries about sterling were a factor preventing the Bank of England cutting interest rates too far ahead of the U.S.

Worried about a hawkish Fed, over-valued stocks, teetering debt piles, volatile currencies, cliffhanger elections or rancorous geopolitics?

Big public debts typically stem from big economic and political junctures that require government to spend big - but reining them back risks 'creative' solutions

Becalmed by a likely interest rate cut as soon as next month, euro zone government bond markets seem serene - but the European Central Bank continues to fret about

Even as consensus builds inside and outside the Bank of England on UK interest rate cuts this summer, the thorny issue for banks and bond markets of when it stops its

In a year of elections worldwide, June turns up the heat several notches and will test global markets' seemingly nonchalance toward the process to date.

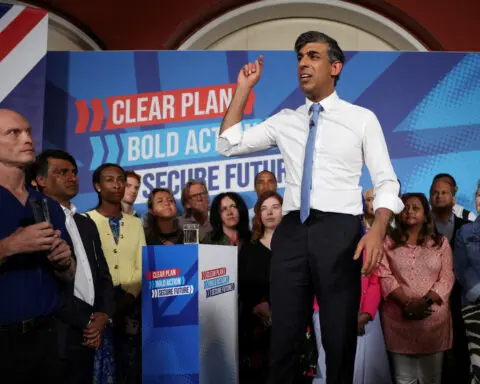

The optics of sterling hitting its highest since 2016's Brexit referendum after a surprise UK election announcement is hard to ignore - and may suggest hope at margin

Any sustained bet against French government debt can only hinge on a belief in the improbable end of the euro - even if the European Central Bank needs to walk a fine

This week's milestone G7 interest rate cuts dispel any notion that hitting 2% inflation targets spot on is a precondition for central bank moves or indeed sensible -

Thanks in part to former UK Prime Minister Liz Truss' singular contribution to financial stability two years ago, Britain is proving something of an exception among

If greater political uncertainty necessarily begets higher financial volatility, world markets are still half asleep - but the alarm clock may be set nonetheless.

Some might wonder why it took so long, but the risk that this year's key elections exaggerate rather than rein in bloated public debt is finally seeing long-term

The remarkable thing about investor reaction to the UK's new Labour government is how much just a modicum of stability, consistency and competence is being richly

While investors are still scrambling to get on board the shiniest new mega-trends and what seems like a runaway stock market, a slower-moving juggernaut from the past

In all the hubbub about election uncertainty and the dash for the most lucrative financial trades to exploit it, creeping doubts about the resilience of the world

First to hike, first to hit its inflation target - and the last to cut?

Your subscription includes

Unlimited Access to All Content from

The Los Angeles Post

Your subscription has been successfully upgraded!