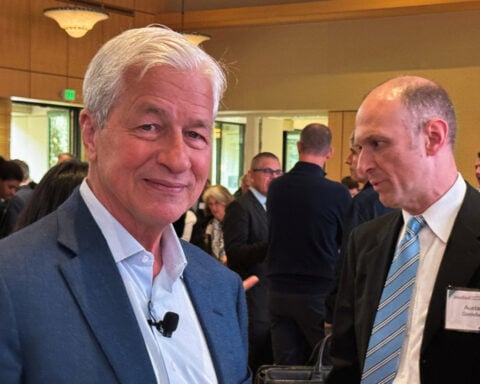

JPMorgan profit beats estimates on record stock trading, CEO sees economic turbulence

JPMorgan Chase topped first-quarter profit estimates on record equities trading and higher fees from debt underwriting and advising on mergers, but the bank

JPMorgan Chase topped first-quarter profit estimates on record equities trading and higher fees from debt underwriting and advising on mergers, but the bank

Executives at big U.S. banks warned on Friday of economic turbulence from tariffs that could weigh on economic growth, even as

JPMorgan Chase CEO Jamie Dimon said on Wednesday that sweeping tariffs imposed by U.S.

Individual investors have been working the phones for advice in the wake of U.S.

JPMorgan Chase CEO Jamie Dimon on Monday warned that trade wars could have lasting negative consequences, days after he and other U.S. bank CEOs

Shares of U.S. banks tumbled to multi-month lows on Thursday, after President Donald Trump's sweeping tariffs plan sparked fears of a recession and a

Global investors grappled on Thursday with rising chances of an economic downturn and a sprawling trade war, as they

U.S. consumers have been curbing their spending in response to high prices and a worsening economic outlook, according to consumer finance company Synchrony

JPMorgan Chase and Walmart are partnering to speed up payments for merchants that sell items through the retail giant's website.

JPMorgan Chase Chief Operating Officer Jenn Piepszak said the bank was making some changes to its Diversity, Equity and Inclusion programs and the language it uses

Investors and analysts are more hopeful the asset cap on Wells Fargo will be lifted this year after the bank managed to close five regulatory actions in 2025, making

Financial technology firms and crypto companies are seeking to become state or national banks in a bid to expand their business under the Trump administration that

A new category of employees at the U.S.

At a JPMorgan townhall meeting on Wednesday, CEO Jamie Dimon was asked whether the Trump administration's decision to

JPMorgan Chase's investment banking fees have grown by a mid-teens percentage so far in the first quarter as clients' economic optimism grows,

The Trump administration's rapid dismantling of the U.S. consumer protection watchdog will have broad implications for consumers with credit

JPMorgan Chase appointed Matt Sable and Melissa Smith as co-heads of commercial banking, the largest U.S. lender said on Friday, as it continues to reorganize the

Tesla CEO Elon Musk, who has been tasked by President Donald Trump to oversee a drastic downsizing and reshaping of the federal government, spoke at a JPMorgan Chase

The top U.S. consumer watchdog has terminated a 2022 order punishing Wells Fargo for allegedly mishandling auto loans and mortgages, the bank

Your subscription includes

Unlimited Access to All Content from

The Los Angeles Post

Your subscription has been successfully upgraded!