Stocks racked up more losses on Wall Street Tuesday as a trade war between the U.S. and its key trading partners escalated, wiping out all the gains since Election Day for the S&P 500.

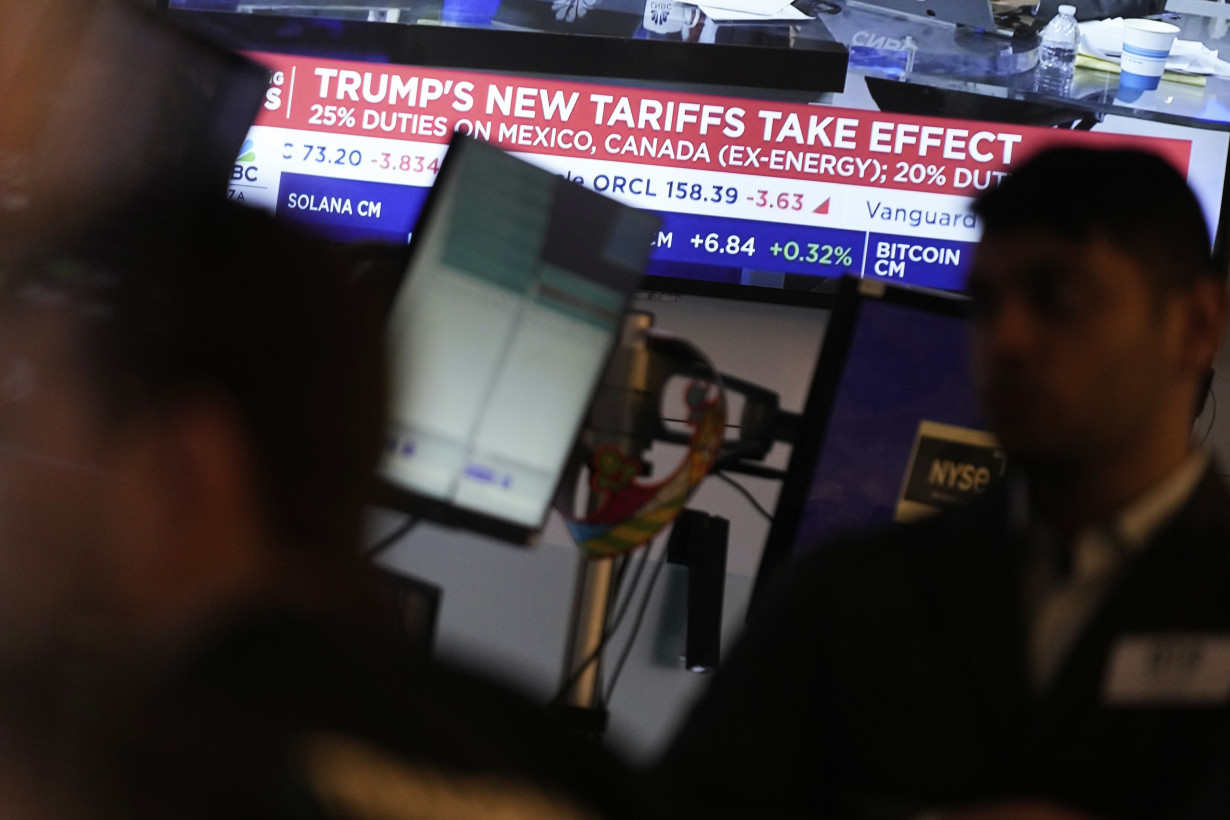

The Trump administration imposed tariffs on imports from Canada and Mexico starting Tuesday and doubled tariffs against imports from China. All three countries announced retaliatory actions, sparking worries about a slowdown in the global economy.

The S&P 500 fell 1.2%, with more than 80% of the stocks in the benchmark index closing lower. The Dow Jones Industrial Average slid 1.6%.

The Nasdaq composite slipped 0.4%. The tech-heavy index briefly reached a 10% decline from its most recent closing high, which is what the market considers a correction, but gains for Nvidia, Microsoft and other tech heavyweights helped pare those losses.

Financial stocks were among the heaviest weights on the S&P 500 index. JPMorgan Chase fell 4% and Bank of America lost 6.3%.

Markets in Europe fell sharply, with Germany's DAX falling 3.5% as automakers saw sharp losses. Stocks in Asia saw more modest declines.

“The markets are having a tough time even setting expectations for what this trade war could look like,” said Ross Mayfield, investment strategy analyst at Baird. “This is clearly a level step higher than anything we saw during (Trump's) first term.”

The market could soon face more twists in the tariff drama. President Donald Trump addresses a joint session of Congress Tuesday night. After the closing bell, Commerce Secretary Howard Lutnick told Fox Business News that the U.S. would likely meet Canada and Mexico “in the middle" on tariffs, with an announcement coming as soon as Wednesday.

The recent decline in U.S. stocks has wiped out all of the markets’ gains since Trump’s election in November. That rally had been built largely on hopes for policies that would strengthen the U.S. economy and businesses. Worries about tariffs raising consumer prices and reigniting inflation have been weighing on both the economy and Wall Street.

The tariffs are prompting warnings from retailers, including Target and Best Buy, as they report their latest financial results. Target fell 3% despite beating Wall Street’s earnings forecasts, saying there will be “meaningful pressure” on its profits to start the year because of tariffs and other costs.

Best Buy plunged 13.3% for the biggest drop among S&P 500 stocks after giving investors a weaker-than-expected earnings forecast and warning about tariff impacts.

“International trade is critically important to our business and industry,” said Best Buy CEO Corie Barry.

Barry said China and Mexico are the top two sources for products that Best Buy sells, and it also expects vendors to pass along tariff costs, which would make price increases for American consumers likely.

Imports from Canada and Mexico are now to be taxed at 25%, with Canadian energy products subject to 10% import duties. The 10% tariff that Trump placed on Chinese imports in February was doubled to 20%.

Retaliations were swift.

China responded to new U.S. tariffs by announcing it will impose additional tariffs of up to 15% on imports of key U.S. farm products, including chicken, pork, soy and beef, and expanded controls on doing business with key U.S. companies. Canada plans on slapping tariffs on more than $100 billion of American goods over the course of 21 days. Mexico also plans tariffs on goods imported from the U.S.

Companies in the S&P 500 are wrapping up the latest round of quarterly financial reports. They've posted broad earnings growth of 18% for the fourth quarter. But Wall Street has already trimmed expectations for the current quarter to about 7% growth from just over forecasts of 11% at the beginning of the year.

“The hit to growth is more of the commentary that we’ll be looking for from companies,” said Kevin Gordon, senior investment strategist at Charles Schwab.

Concerns about profits follow a series of economic reports with worrisome signals that include U.S. households becoming more pessimistic about inflation and pulling back on spending. Consumer spending has essentially driven U.S. economic growth in the face of high interest rates.

Wall Street has been hoping that the Federal Reserve would continue lowering interest rates in 2025. The central bank has signaled more caution, though, partly because of uncertainty surrounding the economic impact of tariffs. The Fed is expected to hold rates steady at its upcoming meeting later in March.

The Fed raised interest rates to their highest level in two decades in order to tame inflation. It started cutting its benchmark rate in 2024 as the rate of inflation moved closer to its target of 2%. But inflation remains stubbornly just above that target and tariffs threaten price increases that could fuel inflation.

In the bond market, Treasury yields were mixed. The yield on the 10-year Treasury rose to 4.20% from 4.16% late Monday. It’s still down sharply from last month, when it was approaching 4.80%, as worries have grown about the strength of the U.S. economy.

“Because tariffs are in effect, and there’s no guarantee that they’re likely to be temporary, that’s filtering its way to the bond market and we’re seeing the threat of higher inflation eroding the value of the 10-year note,” said Sam Stovall, chief investment strategist at CFRA.

The yield on the 2-year Treasury held steady at 3.94%.

All told, the S&P 500 fell 71.57 points to 5,778.15. The Dow dropped 670 points to 42,520.99, and the Nasdaq shed 65.03 points to 18,285.16.

___

AP Business Writers Matt Ott and Elaine Kurtenbach contributed.

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness