By Fergal Smith

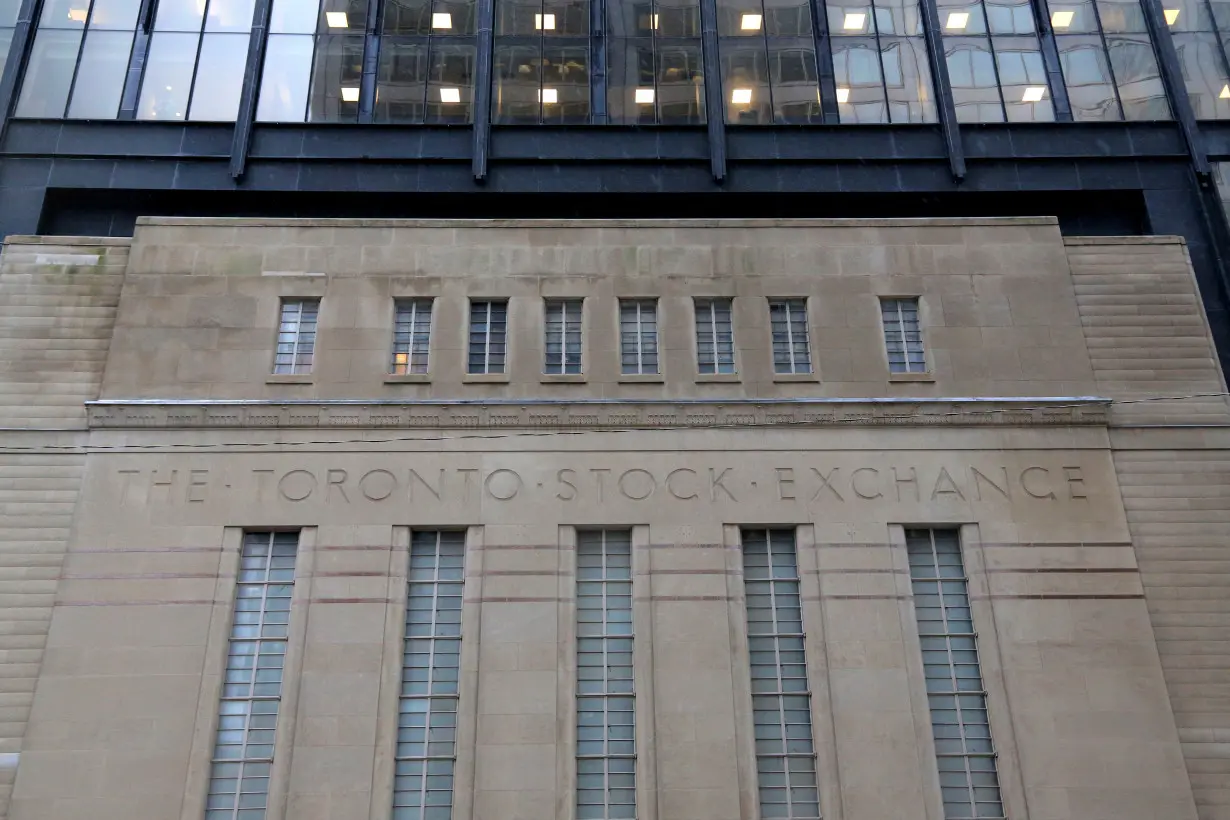

TORONTO (Reuters) -Canadian stocks and bonds rallied on Wednesday, while the loonie touched a near two-week low against its U.S. counterpart, after the Bank of Canada became the first central bank among G7 countries to cut interest rates, raising prospects for Canada's economy.

The Toronto Stock Exchange's S&P/TSX composite index ended up 166.84 points, or 0.8%, at 22,145.02, clawing back much of its losses since the start of the week.

The Canadian central bank lowered its benchmark interest rate by 25 basis points to 4.75%, its first cut in four years, in a move that will ease pressure on highly indebted consumers.

"It was clearly a positive development for equity markets and bonds," said Angelo Kourkafas, senior investment strategist at Edward Jones in St. Louis, Missouri. "It is consistent with a soft landing scenario that the Bank of Canada is willing to start (to) normalize policy while economic growth still is holding up."

The Canadian services economy grew in May for the first time in a year as firms saw an increase in new business and hired workers at a faster pace, data from S&P Global showed.

All 10 major sectors on the Toronto market moved higher, including the interest rate-sensitive real estate sector and resource stocks, as commodity prices climbed.

Wall Street also rallied, led by technology shares.

The Canadian 2-year yield fell as much as 12.7 basis points to 3.929%, its lowest level since Feb. 1, as investors bet that the BoC would ease rates further in the coming months.

Swap market data shows that the central bank is expected to cut 77 basis points in total this year, compared with 49 basis points of easing that is priced in for the Federal Reserve.

That prospect of interest rate divergence weighed on the Canadian dollar. The currency was trading 0.1% lower at 1.3690 to the U.S. dollar, or 73.05 U.S. cents, after touching its weakest intraday level since May 23 at 1.3741

"We think the BoC will cut rates at least once more before the Fed meets on Sept. 18, leaving CAD vulnerable to a further widening in rate differentials," said Simon Harvey, head of FX analysis for Monex Europe and Monex Canada.

The Federal Reserve's next policy meeting is June 11-12, when it is widely expected to leave rates unchanged. The Fed will also hold a policy meeting in late July, followed by its meeting on Sept. 17-18.

A majority of forecasters in a Reuters poll expect the Fed to cut its key interest rate in September, followed by one more cut this year.

The loonie is set to strengthen less than previously expected over the coming year as the BoC leads the Fed on rate cuts and if the U.S. election in November raises global trade uncertainty, a Reuters poll found.

(Reporting by Fergal Smith; Editing by Sriraj Kalluvila, Leslie Adler and Josie Kao)

Man back home after losing 200 pounds

Man back home after losing 200 pounds

CNN's Matt Egan asks Fed Chair if he's worried about the stock market

CNN's Matt Egan asks Fed Chair if he's worried about the stock market

Georgia man sentenced to to 1 year in theft of Arnold Palmer green jacket, other Masters memorabilia

Georgia man sentenced to to 1 year in theft of Arnold Palmer green jacket, other Masters memorabilia

Pentagon reviews plans to cut troops handling migrants at Guantánamo by as much as half

Pentagon reviews plans to cut troops handling migrants at Guantánamo by as much as half

Italian postal service sees surge in mail for Pope Francis, much sent from children

Italian postal service sees surge in mail for Pope Francis, much sent from children

Justice Department moves to drop lawsuit that would allow Texas police to arrest migrants

Justice Department moves to drop lawsuit that would allow Texas police to arrest migrants

Controversial insider account by former Meta official has strong first-week sales

Controversial insider account by former Meta official has strong first-week sales

Fed leaves rates unchanged. But here are changes you can make to earn more on savings or pay less on debt

Fed leaves rates unchanged. But here are changes you can make to earn more on savings or pay less on debt

A look at injuries that could shape the NCAA Tournament and the brackets of millions of Americans

A look at injuries that could shape the NCAA Tournament and the brackets of millions of Americans

Carlos Alcaraz doesn't support the lawsuit from the tennis players' group Novak Djokovic founded

Carlos Alcaraz doesn't support the lawsuit from the tennis players' group Novak Djokovic founded