By Caroline Valetkevitch

NEW YORK (Reuters) - Analysts are turning more cautious on U.S. corporate earnings for the first quarter of this year, with the Trump administration's policies threatening to trigger a global trade war that could undermine economic growth.

Apple, Tesla and Ford Motor are among companies contributing the most to recently lowered estimates for the quarter, along with some insurers, whose projections have been hurt by fires in California early this year, according to Tajinder Dhillon, senior research analyst at LSEG.

S&P 500 forecasts for the first quarter of 2025 have fallen by 4.5 percentage points since January 1, the largest downward revision since the fourth quarter of 2023, he said.

Earnings growth for S&P 500 companies is now seen at 7.7% year-over-year, which would be the lowest since 2023's third quarter and a big decline from 17.1% in the fourth quarter of 2024, based on Friday's LSEG data.

While a handful of companies have already reported on the quarter, the unofficial start of the first-quarter season is still weeks away.

"You know there's this negative bias out there. You just don't know to what degree," said Michael O'Rourke, chief market strategist at JonesTrading in Stamford, Connecticut.

Earnings estimates typically decline in the weeks ahead of a new reporting period as companies guide more conservatively, but the majority of companies often go on to beat those lowered expectations.

Fears that import tariffs and retaliation by U.S. trade partners, along with government cutbacks under President Donald Trump in the first months of his second term, might push the economy into recession have increased in recent weeks.

On March 13, the S&P 500 confirmed it is in a correction by ending down more than 10% from its February 19 record high close.

"A lot of people are worried about things like tariffs ... Really, it's a broad economic slowdown that is the one thing that would be very difficult for companies to contend with," said Sameer Samana, senior global market strategist at Wells Fargo Investment Institute.

Some investors have hoped that first-quarter earnings could provide a catalyst for gains in the market after the sharp selloff. The S&P 500 is still trading at a multiple of 21 times forward earnings, compared with a 10-year average price-to-earnings ratio of about 18, based on LSEG data.

Apple on January 30 reported earnings for the quarter ended December 28 that beat analysts' expectations, but iPhone sales and China revenue for the holiday quarter were weak because of competition in China and a slow rollout of artificial intelligence features.

On Thursday, the Information reported, citing sources, that Apple is losing more than $1 billion a year on its streaming service Apple TV+.

Tesla sales fell in Scandinavia and France in February from a year ago, according to registration data, as the company faced a brand loyalty test amid CEO Elon Musk's role in the Trump administration's push to cut federal spending.

Even after a nearly 40% drop in Tesla shares since the start of the year, the stock is trading at more than 80 times forward earnings expectations.

Tesla's earnings per share estimate for the March quarter is down to 47 cents from 70 cents in late January, based on LSEG data.

Ford in February projected up to $5.5 billion in losses on its electric vehicle and software operations this year.

Automakers have been in focus, with the White House saying earlier this month that Trump will exempt them from his punishing 25% tariffs on Canada and Mexico for one month.

Some analysts see the California wildfires in January as among the costliest natural disasters for insurers. Travelers Companies said in February that it sees $1.7 billion of pre-tax catastrophe losses from the wildfires.

In the airline industry, shares tumbled recently as Delta Air Lines and others sharply cut earnings forecasts, citing uncertainty about consumer spending.

(Reporting by Caroline Valetkevitch; Editing by Alden Bentley and Nick Zieminski)

Trump has begun another trade war. Here's a timeline of how we got here

Trump has begun another trade war. Here's a timeline of how we got here

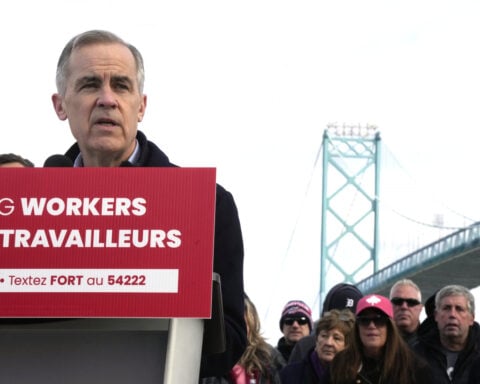

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Canada's leader laments lost friendship with US in town that sheltered stranded Americans after 9/11

Chinese EV giant BYD's fourth-quarter profit leaps 73%

Chinese EV giant BYD's fourth-quarter profit leaps 73%

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

You're an American in another land? Prepare to talk about the why and how of Trump 2.0

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Chalk talk: Star power, top teams and No. 5 seeds headline the women's March Madness Sweet 16

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness

Purdue returns to Sweet 16 with 76-62 win over McNeese in March Madness