US yields post sharp gains as Trump victory triggers caution about deficits

U.S.

November 06, 2024U.S.

November 06, 2024

By Michael S.

November 06, 2024

The Federal Reserve has plenty of reasons to deliver a widely expected interest rate cut on Thursday, including a decline in inflation and a cooling in labor markets that

November 06, 2024

Traders trimmed bets Tuesday on Federal Reserve interest rate cuts next year, as early tallies for the U.S. presidential election rolled in through the evening.

November 06, 2024

When Federal Reserve Chair Jerome Powell and his colleagues meet this week to discuss their next interest rate move, they'll face a much more complicated

November 05, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan Even with the uncertainty of what most pollsters see as a dead heat in the White House race, world markets are in a upbeat mood as

November 05, 2024

Bond investors are keeping a defensive but neutral stance in

November 04, 2024

U.S. stocks closed slightly lower after a choppy session on Monday, as investors prepared for a crucial week in which Americans will elect a new president and

November 04, 2024

Investors withdrew money from global equity funds in the week ended Oct. 30, amid caution ahead of Tuesday's U.S. presidential election and the Federal Reserve's policy decision later in

November 04, 2024

The dollar softened and stocks fell on Monday as investors treaded carefully hours before the U.S. presidential election, with a U.S.

November 04, 2024

The U.S. dollar slipped on Monday as investors pulled out of Trump trades, which have benefited in recent weeks from speculation that Republican

November 03, 2024

The world is about to get some much-needed clarity on the US economy’s future

November 03, 2024

A double dose of potentially market-moving events arrives in the coming week as Americans vote on their next president and the Federal Reserve offers more

November 01, 2024

Federal Reserve policymakers look all but certain to reduce short-term borrowing costs by a modest quarter of a percentage point at their policy meeting next week, their

November 01, 2024

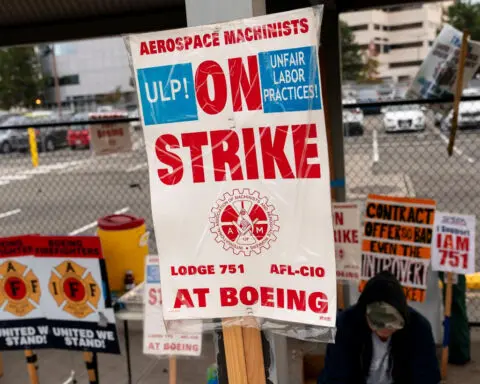

U.S. job growth slowed sharply in October amid disruptions from hurricanes and strikes by aerospace factory workers, but the unemployment rate held steady at 4.1%, offering assurance that

November 01, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan With next week's U.S. election now dominating thinking, the last two megacap earnings reports of the week appear to have calmed the

November 01, 2024

Wall Street's major indexes ended higher on Friday, rebounding from the previous day's sell-off as Amazon's strong earnings countered a significant drop in U.S. job

November 01, 2024

U.S. job growth almost stalled in October as strikes in the aerospace industry depressed manufacturing employment while hurricanes shortened the collection

November 01, 2024

The dollar rose against the euro and rebounded against most major currencies on Friday after traders digested data showing U.S. job growth

October 31, 2024

The U.S. dollar will hold on to its recent strength over coming months on robust domestic economic data and continued scaling back of bets for Federal Reserve

October 31, 2024

By Michael S.

October 31, 2024

The average rate on a 30-year mortgage in the U.S. rose for the fifth straight week, returning to its highest level since early August

October 31, 2024

U.S. labor costs recorded their smallest increase in more than three years in the third quarter amid cooling wage growth, indicating that inflation was firmly on a downward

October 31, 2024

As if financial markets needed another factor to complicate the near-term outlook for Federal Reserve policy, the U.S. economy and asset prices, investors

October 31, 2024

The Fed’s favorite inflation index just cooled again

October 31, 2024

The Commerce Department's personal consumption expenditures (PCE) price index, closely watched by the Federal Reserve, increased 0.2% in September after an unrevised 0.1% gain in August.

October 31, 2024

With inflation now only just above the Federal Reserve's 2% target and wage pressures easing, U.S. central bankers are widely expected to cut short-term borrowing costs next

October 31, 2024

U.S. consumer spending increased slightly more than expected in September, putting it and the economy on a higher growth trajectory heading into the final three months of the

October 31, 2024

As a presidential race profoundly shaped by Americans’ frustration with high prices nears its end, the government said Thursday that an inflation gauge closely watched by the Federal Reserve has dropped to near pre-pandemic levels

October 31, 2024

The number of Americans filing new applications for unemployment benefits fell to a five-month low last week and consumer spending increased more than expected

October 31, 2024

Trump’s former pick to join the Federal Reserve has proposed a radical solution to solve inflation

October 31, 2024

Most Asian central banks will cut interest rates slower than the U.S.

October 31, 2024

World stock indexes dropped on Thursday, with the Nasdaq ending more than 2% lower after Meta Platforms and Microsoft warned of rising costs for artificial

October 31, 2024

The interest rate for the most popular U.S. home loan jumped last week to 6.73%, its highest since July, adding to headwinds for the housing market even as the Federal Reserve looks set to

October 30, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan Markets struggling which way to look will be dizzy again in an event-strewn Wednesday but the spotlight first thing drops on

October 30, 2024

The Federal Reserve risks moving beyond its role as a lender of last resort to a prop markets need to function even in normal times, with pressures likely to increase as

October 30, 2024

The U.S. economy grew solidly in the third quarter, with consumer spending increasing at its fastest pace in 1-1/2 years and inflation slowing sharply,

October 30, 2024

Federal Reserve policymakers are nearly certain to deliver a quarter-point reduction in short-term borrowing costs next week, traders bet on Tuesday, as a U.S.

October 29, 2024

Job openings fall to pre-pandemic levels as US labor market continues to cool down

October 29, 2024

U.S. job openings fell to the lowest level in more than 3-1/2 years in September and data for the prior month was revised down, pointing to a considerable easing in labor market

October 29, 2024

This past summer, leads for Brian Brown's landscaping business near Lake Tahoe were drying up.

October 29, 2024

The Treasury Department may offer fresh guidance on expected increases in its 2025 debt auctions when it announces its updated refunding plans this week, though

October 28, 2024

Wall Street closed higher on Monday ahead of a packed week of earnings from megacap companies and the final stretch before the Nov. 5 presidential election, while

October 28, 2024

The nine days until Federal Reserve officials sit down to decide what to do next with interest rates features a veritable murderers' row of events to shape their move -

October 28, 2024

Boeing and other strikes will take at least a 44,000-job bite out of the October jobs report

October 25, 2024

Here’s why mortgage rates are rising after the Fed’s rate cut

October 24, 2024

U.S. mortgage rates increased for a fourth straight week this week, suggesting the housing market could remain on the back foot for some time even as the Federal Reserve cuts

October 24, 2024

Sales of new U.S. single-family homes increased to the highest level in nearly 1-1/2 years in September as buyers rushed in to take advantage of a decline in mortgage rates.

October 24, 2024

Last month Federal Reserve Chair Jerome Powell and his colleagues were lauded for starting their policy easing cycle with a half percentage-point rate cut

October 24, 2024

U.S. business activity increased in October amid strong demand, and firms raised prices for goods and services at the slowest pace in nearly 4-1/2 years, indicating that the

October 24, 2024

New applications for U.S. unemployment aid unexpectedly fell last week, but the number of people collecting benefits in mid-October was the highest in nearly

October 24, 2024

The euro and Japanese yen strengthened on Thursday as the U.S. dollar paused after rallying to a nearly three-month high, with the greenback only briefly

October 24, 2024

By Michael S.

October 23, 2024

U.S. economic activity was little changed from September through early October and firms saw a slight uptick in hiring, continuing recent trends that have reinforced

October 23, 2024

Hedge fund Bridgewater Associates said the Federal Reserve independence is probably a top issue in the U.S. presidential election, according to a commentary sent

October 23, 2024

The U.S.

October 23, 2024

U.S. stocks fell as more steam came out of Wall Street’s huge, record-breaking rally

October 23, 2024

The dollar climbed above 153 against the yen for the first time in nearly three months on Wednesday on U.S. economic strength and an expected divergence among

October 23, 2024

The U.S. dollar rose to a fresh 2-1/2-month high on Tuesday, continuing its recent ascent on expectations the Federal Reserve will temper its interest rate

October 22, 2024

San Francisco Federal Reserve Bank President Mary Daly on Monday said she has not seen anything to suggest the U.S. central bank would stop cutting interest rates, which are "absolutely"

October 21, 2024

Citi Research raised its three-month forecast for gold prices, citing possible further U.S. labor market deterioration, interest rate cuts by the Federal Reserve, and physical and ETF

October 21, 2024

Kansas City Federal Reserve Bank President Jeffrey Schmid said on Monday he supports a "cautious and deliberate" approach to interest rate cuts now that inflation is heading back to the

October 21, 2024

Four Federal Reserve policymakers on Monday expressed support for further interest-rate cuts, but appeared to differ on how fast or far they believe any cuts should go.

October 21, 2024

By Michael S.

October 21, 2024

Atlanta Federal Reserve Bank President Raphael Bostic on Friday made the case for patient reductions in the central bank's policy rate to somewhere between 3% and 3.5% by the

October 18, 2024

U.S. investors made large investments in equity funds in the week to Oct. 16, buoyed by strong third-quarter earnings from U.S. lenders and optimism over a potential Federal Reserve rate

October 18, 2024

Tech stocks powered Wall Street stocks to a higher close and crude prices posted their biggest weekly drop in a month on Friday as investors looked past mixed

October 18, 2024

Foreign holdings of U.S. Treasuries surged to a record high in August, data from the Treasury Department showed on Thursday, rising for four straight months. Holdings of U.S.

October 17, 2024

The average rate on a 30-year mortgage in the U.S. moved higher for the third week in a row and reached the highest level since late August

October 17, 2024

By Michael S.

October 17, 2024

The number of Americans filing new applications for unemployment unexpectedly fell last week, but could remain elevated in the near-term amid the effects of Hurricanes Helene

October 17, 2024

U.S. retail sales increased solidly in September likely as lower gasoline prices gave consumers more money to spend at restaurants and bars, supporting the view

October 17, 2024

Analysts turned bearish on most Asian currencies, with short bets on the Indian rupee at a one-year high, as expectations the Federal Reserve would cut rates less

October 17, 2024

Goldman Sachs said on Wednesday it expects the U.S.

October 16, 2024

By Michael S.

October 16, 2024

U.S. import prices fell by the most in nine months in September amid a sharp decrease in the cost of energy products, pointing to a benign inflation outlook

October 16, 2024

U.S.

October 15, 2024

By Michael S.

October 15, 2024

By Michael S.

October 15, 2024

UBS Global Research on Tuesday raised its year-end target for the benchmark S&P 500 index to 5,850 points from an earlier projection of 5,600, boosted by corporate profit growth,

October 15, 2024

Global investor optimism posted its biggest jump since June 2020 in October due to Federal Reserve rate cuts, stimulus pledges from China and expectations of a soft landing for the

October 15, 2024

The U.S. dollar edged higher against most major currencies on Tuesday, resuming the latest uptrend that took it to more than two-month highs fueled by

October 15, 2024

Donald Trump has vowed that if voters return him to the White House, “inflation will vanish completely.”

October 14, 2024

Donald Trump has vowed that if voters return him to the White House, “inflation will vanish completely.”

October 14, 2024

Citing a recent uptick in inflation and data showing the U.S. economy and labor market are stronger than previously thought, Federal Reserve Governor

October 14, 2024

Bank Indonesia (BI) will leave interest rates unchanged on Wednesday despite inflation falling to its lowest level since 2021, as receding expectations of

October 14, 2024

Wall Street ended higher on Monday, with both the S&P 500 and the Dow posting fresh record finishes, as investors bought into technology stocks ahead of a busy week packed

October 14, 2024

U.S. equity funds witnessed outflows in the week to Oct. 9 as investors booked profits due to a shift in market expectations about the Federal Reserve rate cut path and a surge in bond

October 11, 2024

The case for quarter-point U.S. interest rate cuts at upcoming Federal Reserve policy meetings appeared intact on Friday after a report showed producer prices were flat last month compared

October 11, 2024

Wells Fargo's profit beat analysts expectations in the third quarter as it set aside less money than expected to cover potential loan

October 11, 2024

The S&P 500 and the Dow scored record closing highs on Friday, with the big boosts from financial stocks after banks reported strong quarterly

October 11, 2024

A sharp steady rise in overnight repurchase agreements is overwhelming banks that serve as middlemen for such short-term borrowings in U.S. government

October 11, 2024

The Bank of Canada is likely to lower interest rates to a neutral setting that neither restricts nor stimulates its economy more quickly than the U.S.

October 11, 2024

Global stocks rose on Friday, lifted by U.S. bank earnings, and on track for a weekly gain while U.S.

October 11, 2024

The U.S. dollar was flat against major currencies on Friday as markets digested a slew of economic data that supported the Federal Reserve's

October 11, 2024

By Michael S.

October 10, 2024

Fed policymakers will be paying close attention to the latest data as their next policy meeting draws nearer.

October 10, 2024

Mortgage rates surged for the second-straight week after hitting two-year lows

October 10, 2024

The average rate on the popular U.S. 30-year mortgage rate increased to 6.32% this week, its largest one week increase since April, as a string of stronger-than-expected economic data

October 10, 2024

Federal Reserve Bank of New York President John Williams said Thursday he expects more rate cuts lie ahead as inflation pressures continue to moderate.

October 10, 2024

Chicago Federal Reserve Bank Austan Goolsbee on Thursday said he sees a series of interest-rate cuts over the next year to year and a half, noting that inflation is now near the Fed's 2%

October 10, 2024

U.S. consumer prices rose slightly more than expected in September, but the annual increase in inflation was the smallest in more than 3-1/2 years, potentially keeping the Federal Reserve

October 10, 2024

By Ann Saphir and Michael S.

October 10, 2024

U.S. consumer prices rose slightly more than expected in September amid higher food costs, but the annual increase in inflation was the smallest in more than 3-

October 10, 2024

Wall Street's main indexes closed lower on Thursday as investors looked to higher-than-expected inflation and unemployment claims for indications

October 10, 2024

The U.S. dollar slipped against the yen on Thursday as investors weighed data showing labor market weakness as well as a slight uptick in consumer prices,

October 09, 2024

San Francisco Federal Reserve Bank President Mary Daly on Wednesday said she "fully" supported the U.S. central bank's half-of-a-percentage-point interest-rate cut last month, and said one

October 09, 2024

The interest rate for the most popular U.S. home loan rose to 6.36% last week, marking the biggest weekly increase in more than a year after better-than-expected economic data caused

October 09, 2024

U.S. regional banks preparing for higher capital requirements will get some relief from the Federal Reserve's jumbo rate cut.

October 09, 2024

Dallas Federal Reserve Bank President Lorie Logan on Wednesday said she supported last month's outsized interest-rate cut but wants smaller reductions ahead, given "still real" upside

October 09, 2024

Wall Street stocks advanced on Wednesday with the S&P 500 and the Dow scoring record closing highs after the release of Federal Reserve meeting

October 09, 2024

Minutes of the U.S.

October 09, 2024

The dollar just had its best week in two years, showing once again how dangerous it can be to bet against the U.S. currency if the rest of the world just won't let it

October 09, 2024

The Federal Reserve's 50-basis-point interest-rate cut last month was "timely" and was neither reactive, nor proactive, Fed Vice Chair Philip Jefferson said on Tuesday.

October 08, 2024

Federal Reserve Vice Chair Philip Jefferson on Tuesday said the U.S. central bank's half-percentage-point interest-rate cut last month was aimed at keeping the labor market strong even as

October 08, 2024

A look at the day ahead in Asian markets.

October 08, 2024

By Michael S.

October 08, 2024

Last week's jobs numbers confirm the U.S. labor market remains strong even though it may be slowing, with a 4.1% unemployment rate around what is considered full employment and

October 08, 2024

The U.S. Federal Reserve is encouraging banks to count on its long-shunned cash backstops in a bid to support its monetary policy and financial stability goals.

October 08, 2024

The U.S. jobs market has started to cool but remains resilient and the Federal Reserve is keen to avoid a drastic weakening of the labor market, Fed Governor Adriana Kugler said

October 08, 2024

Federal Reserve Governor Adriana Kugler said on Tuesday she strongly supported the U.S. central bank's recent interest rate cut and will support further reductions if inflation continues to

October 08, 2024

A look at the day ahead in European and global markets from Rae Wee Investors hoping for a roaring restart to China's stock rally, after the mainland's week-long holiday, were disappointed on Tuesday

October 08, 2024

Federal Reserve Bank of New York President John Williams said that it will be appropriate again for the central bank to reduce rates 'over time,' after September's big half percentage point

October 08, 2024

The dollar held firm on Tuesday, treading water just under last week's seven-week highs as investors assessed the outlook for further U.S.

October 08, 2024

Federal Reserve Bank of St.

October 07, 2024

Why a key borrowing rate is above 4% again

October 07, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan With any thought of U.S. recession off the agenda after a monster September jobs report, doubts about the extent of further Federal

October 07, 2024

Wall Street's three major indexes closed down around 1% on Monday while Treasury yields rose, as traders tamped down bets for Federal Reserve

October 07, 2024

Goldman Sachs has lowered the odds of the United States slipping into a recession in the next 12 months by five percentage points to 15%, following the latest employment report that showed

October 07, 2024

The reverberations from a blowout U.S. employment number could threaten an assortment of trades predicated on falling interest rates, if

October 07, 2024

What a hot job market means for inflation

October 06, 2024

The jobs number surpassed everyone’s expectations. Cue the complaints about the Fed

October 05, 2024

U.S. exchange-traded funds (ETFs) that invest in dividend-paying stocks have enjoyed a rush of inflows since the Federal Reserve kicked off its rate cutting cycle last

October 04, 2024

A high-stakes corporate earnings season kicks into gear next week, with bullish investors hoping results will justify increasingly rich valuations in a U.S.

October 04, 2024

Chicago Federal Reserve President Austan Goolsbee on Friday called the latest U.S. jobs report "superb" and said more labor market data along those lines would boost his confidence the

October 04, 2024

A surge in U.S. job growth has financial markets betting the Federal Reserve will follow last month's half-point interest rate reduction with smaller moves, and ignited a

October 04, 2024

U.S. job growth accelerated in September and the unemploymentrate slipped to 4.1% from August's 4.2%, further reducing theneed for the Federal Reserve to maintain large interest ratecuts at

October 04, 2024

The Dow posted a record closing high on Friday and the Nasdaq ended with a more than 1% gain as a stronger-than-expected jobs report reassured investors

October 04, 2024

U.S.

October 04, 2024

U.S. job gains increased by the most in six months in September and the unemployment rate fell to 4.1%, pointing to a resilient economy that likely does not

October 04, 2024

U.S. Federal Reserve losses crossed the $200 billion point this week, according to data released on Thursday by the central bank.

October 03, 2024

U.S. services sector activity jumped to a 1-1/2-year high in September amid strong growth in new orders, more evidence that the economy remained on a solid footing in the third

October 03, 2024

Led by the U.S.

October 03, 2024

Most emerging market currencies are set to trade in tight ranges or pare some of the year-to-date gains in the next three months

October 03, 2024

The U.S. central bank's half-percentage-point interest rate cut last month was an acknowledgement that its policy rate was "out of sync" with

October 02, 2024

The U.S. dollar will hold steady in coming months despite an expected series of Federal Reserve interest rate cuts, according to median forecasts from FX

October 02, 2024

The market capitalization of many tech firms surged in September, buoyed by a Federal Reserve rate cut that typically enhances future profits and cash flows for high-growth companies, and

October 02, 2024

If you think Federal Reserve interest rate cuts could overly spur an already briskly growing U.S. economy, consider the other side of the equation: the income drag.

October 02, 2024

By Michael S.

October 01, 2024

The Federal Reserve announced on Tuesday that it had terminated a 2013 enforcement action it filed against Citigroup over shortcomings in its capacity to police

October 01, 2024

A sign of strength in the labor market: Job openings increased in August

October 01, 2024

A handful of mega-cap technology stocks has fueled Wall

October 01, 2024

U.S. job openings unexpectedly increased in August after two straight monthly decreases, but hiring was soft and consistent with a slowing labor market that

October 01, 2024

U.S. job openings rose unexpectedly in August as the American labor market continued to show resilience

October 01, 2024

U.S. manufacturing held steady at weaker levels in September, but new orders improved and prices paid for inputs declined to a nine-month low, which together with falling

October 01, 2024

U.S. stocks ended lower, with the Nasdaq losing more than 1%, on Tuesday as investors grew more cautious after Iran fired missiles at Israel.

October 01, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan Wall Street's S&P500 kicks off the final quarter of a stellar 2024 from yet another record close notched on Monday - with odd quarter

October 01, 2024

A look at the day ahead in European and global markets from Tom Westbrook European inflation figures are due on Tuesday and the risk is to the downside, which will reinforce bets that the European

October 01, 2024

MSCI's global equities index fell with Treasury yields on Tuesday as investors shied away from riskier assets while oil futures rallied on concerns about

October 01, 2024

Safe haven currencies strengthened on Tuesday as Iran launched missiles towards Israel, while the dollar also firmed on data showing a resilient U.S. labor market.

October 01, 2024

The U.S. economy seems poised for a continued slowdown in inflation that will allow the Federal Reserve to cut its benchmark interest rate and "over time" reach a level that is no longer

September 30, 2024

Federal Reserve Chair Jerome Powell has signaled that more rate cuts are in the pipeline, though their size and speed will depend on the evolution of the economy

September 30, 2024

Federal Reserve Chair Jerome Powell indicated on Monday the U.S. central bank would likely stick with quarter-percentage-point interest rate cuts

September 30, 2024

By Michael S.

September 30, 2024

By Michael S.

September 30, 2024

Atlanta Federal Reserve President Raphael Bostic said on Monday he would be open to another half-percentage-point interest rate cut at the U.S.

September 30, 2024

Investor hopes for a soft landing for the U.S. economy will be put to the test next week, as the government releases closely watched labor market data following

September 27, 2024

What fueled this week’s record-breaking stock rally

September 27, 2024

The first interest rate cut by the Federal Reserve signals a U.S. recession is imminent and a dramatic drop in financial markets could once

September 27, 2024

The personal consumption expenditures (PCE) price index rose 0.1% in August after an unrevised 0.2% gain in July the Commerce Department reported on Friday.

September 27, 2024

The Federal Reserve is likelier than not to deliver a second 50-basis-point interest rate cut in November, traders bet on Friday, after a government report showed U.S. inflation has cooled

September 27, 2024

U.S. consumer spending increased slightly less than expected in August, but that did little to change expectations that solid economic growth persisted in the

September 27, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan U.S. stocks surf new records as the last full week of the quarter comes to a close, with China's furious monetary easing accelerating

September 27, 2024

Slowing inflation in August buttressed arguments Federal Reserve officials used in defense of their decision to lower interest rates by half of a percentage

September 27, 2024

The blue-chip Dow Jones Industrial Average closed at a record high as a subdued inflation report stoked hopes for more Federal Reserve rate cuts, which also boosted small-cap

September 27, 2024

U.S. stocks closed another record-setting week with a muted performance

September 27, 2024

A Federal Reserve official says he supports reducing the central bank’s key interest rate somewhat from its current level

September 26, 2024

Federal Reserve Governor Lisa Cook on Thursday endorsed the U.S. central bank's 50-basis-point interest-rate cut last week as a way to address increased "downside risks" to employment.

September 26, 2024

By Michael S.

September 26, 2024

The average rate on a 30-year mortgage in the U.S. slipped this week to its lowest level in two years, boosting home shoppers’ purchasing power as they navigate a housing market with prices near all-time highs

September 26, 2024

U.S.

September 26, 2024

By Michael S.

September 26, 2024

By Michael S.

September 26, 2024

New orders for key U.S.-manufactured capital goods unexpectedly rose in August, though business spending on equipment appears to have lost momentum in the third quarter.

September 26, 2024

With key central banks now aligned in cutting interest rates a real-time experiment is underway in how much the global financial

September 26, 2024

U.S. stocks rose to another record as financial markets around the world rallied again

September 26, 2024

The dollar weakened in choppy trading on Thursday after a boost from healthy U.S. economic data faded, while the Swiss franc rose after the country's central

September 26, 2024

Federal Reserve Governor Adriana Kugler said on Wednesday that she "strongly supported" the U.S. central bank's decision to cut interest rates

September 25, 2024

As former Federal Reserve Chair Ben Bernanke used to quip, "monetary policy is 98% talk and only 2% action."

September 25, 2024

Gold’s hitting new records again. Here’s what it means for the economy

September 25, 2024

The Federal Reserve seems to be winning the inflation battle in the United States, Bank of America CFO Alastair Borthwick said, days after the central bank cut interest rates for the first

September 25, 2024

The Federal Reserve's aggressive start of the easing cycle has rekindled inflation worries in the U.S. bond market, as some investors fear looser financial

September 25, 2024

U.S. stocks edged back from their records as financial markets around the world took a pause following big recent moves

September 25, 2024

The dollar bounced off a 14-month low against the euro on Wednesday in choppy trading, but investors held onto bets that the Federal Reserve will make another

September 24, 2024

By Michael S.

September 24, 2024

Drew Greenblatt loves that the Federal Reserve has cut interest rates.

September 24, 2024

Launches of bond-focused exchange traded funds have surged from year-ago levels in 2024, boosted by expectations of interest rate cuts by the Federal Reserve, according to

September 24, 2024

U.S. stocks drifted to more records in a quiet day of trading

September 24, 2024

By Michael S.

September 23, 2024

Federal Reserve Bank of Chicago President Austan Goolsbee on Monday said he expects "many more rate cuts over the next year" as the U.S. central bank seeks a soft landing for the economy,

September 23, 2024

U.S.

September 23, 2024

By Ann Saphir and Michael S.

September 23, 2024

The Federal Reserve announced a jumbo-sized rate cut, its first rate reduction cut since Covid. Federal Reserve chair Jerome Powell held a press conference to share more about the supersized rate cut.

September 23, 2024

Hedge funds bought U.S. tech and media stocks at the fastest pace in four months last week, said a Goldman Sachs prime brokerage note to clients seen by Reuters on

September 23, 2024

U.S. stocks closed modestly higher on Monday as investors assessed whether a trend will develop in the week following the Federal Reserve’s rate cut.

September 23, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan With U.S. markets now mapping the extent of the Federal Reserve's easing cycle ahead, the prospect of inflation undershooting the

September 23, 2024

Even before the Federal Reserve approved its outsized half-percentage-point interest rate cut last week, financial markets had begun making

September 23, 2024

The euro dropped against the dollar on Monday as business activity reports for the euro zone economy disappointed, briefly extending declines after U.S. data

September 22, 2024

Global stock indexes rose on Monday as Federal Reserve policymakers said last week's large interest rate cut was warranted, while the euro fell against the

September 22, 2024

A look at the day ahead in Asian markets.

September 22, 2024

The Federal Reserve gave home shoppers what they hoped for this week: a big rate cut and a signal of more cuts to come

September 22, 2024

The Fed surprised many investors with a jumbo rate cut this week. It won’t get much easier to predict the next move

September 20, 2024

Federal Reserve Governor Michelle Bowman said on Friday she dissented over the U.S. central bank's half-percentage-point interest rate cut this week, favoring a quarter-

September 20, 2024

What lower rates mean for markets

September 20, 2024

Federal Reserve officials, in their first public comments since the U.S. central bank cut interest rates by half a percentage point, laid out on Friday the

September 20, 2024

U.S. bond funds attracted inflows for a 16th straight week in the week ended Sept. 18, on expectations that the Federal Reserve would deliver an outsized rate cut in its meeting during the

September 20, 2024

The Federal Reserve's blackout period on public comment around meetings of the U.S. central bank lifts on Friday after a key interest rate decision earlier in

September 20, 2024

Global investors scooped up equity funds in the week to Sept. 18, anticipating the Federal Reserve's interest rate cut to initiate its long-awaited reduction cycle.

September 20, 2024

The U.S.

September 20, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan After a roaring Thursday that saw Wall Street stocks lap up deep Federal Reserve easing into a still-healthy economy, there's a

September 20, 2024

Investment advisers are urging clients to dump hefty cash allocations now that the Federal Reserve has begun its much-anticipated interest-rate easing, a

September 20, 2024

If you own a home or hope to buy one soon, what does the Fed’s interest rate cut mean for you?

September 20, 2024

As the Federal Reserve kicks off a long-awaited rate cutting cycle, some investors are wary that richly valued U.S. stocks may have already priced in the

September 20, 2024

Gold soared above the $2,600 level on Friday for the first time, extending a rally boosted by bets for further U.S. interest rate cuts, and rising tensions in the

September 20, 2024

China unexpectedly left benchmark lending rates unchanged at the monthly fixing on Friday, confounding market expectations that were primed for a move after the Federal Reserve

September 20, 2024

Big global investors are on alert for wild market swings after a jumbo U.S. rate cut sparked confusion over whether the world's dominant economy is

September 19, 2024

The Federal Reserve's big bang start on Wednesday to what's expected to be more interest-rate cuts this year and next may have had the full support of only a slim majority of

September 19, 2024

President Joe Biden is celebrating the Federal Reserve’s decision to lower interest rates by saying it shows that inflation has eased

September 19, 2024

The U.S. central bank's decision to cut interest rates by half a percentage point leaves open the risk of a resurgence in inflation, a former Kansas City Federal Reserve

September 19, 2024

M&G Investments sees attractive valuations in some longer-duration government bonds and non-U.S. equities, a multi-asset fund manager at the London-based firm said on Thursday.

September 19, 2024

CNN’s Rahel Solomon talks to finance analyst Greg McBride, who puts the Fed’s first rate cut in years into perspective for homebuyers.

September 19, 2024

Dow, S&P 500 close at record highs after Federal Reserve’s supersized rate cut

September 19, 2024

U.S. existing home sales fell more than expected in August as house prices remained elevated despite a continued improvement in supply.

September 19, 2024

Traders on Thursday added to bets the U.S.

September 19, 2024

The number of Americans applying for unemployment benefits fell to their lowest level in four months last week

September 19, 2024

Shares of major U.S. homebuilders rose in early trading on Thursday as the Federal Reserve's rate-cut cycle is expected to ease pressure on mortgage rates, driving demand

September 19, 2024

U.S. bank stocks rose on Thursday after the Federal Reserve's 50 basis point cut in interest rates raised hopes of lower deposit costs and reduced pressure

September 19, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan After a typical skittish first-day reaction, world markets are on Thursday embracing the new Federal Reserve stance as insurance on

September 19, 2024

A big interest rate cut from the U.S.

September 19, 2024

The Bank of England is keeping its main interest rate unchanged at 5% despite a big cut from the U.S. Federal Reserve, its first since the onset of the coronavirus pandemic more than four years ago

September 19, 2024

Analysts remained bullish on most Asian currencies despite marginally dialling back some bets, a Reuters poll showed on Thursday, as a defensive U.S. dollar driven by a

September 19, 2024

BofA Global Research raised its forecast for the Federal Reserve's anticipated interest rate cuts for the remainder of this year to 75 basis points, after the U.S. central bank kicked off

September 19, 2024

European stocks jumped on Thursday after the U.S.

September 19, 2024

An initial muted market reaction following the Federal Reserve’s first rate cut in four years gave way to a surge in U.S.

September 19, 2024

One of the most consequential Federal Reserve meetings in recent history has put investors’ focus squarely on one question: whether the

September 19, 2024

A look at the day ahead in European and global markets from Rae Wee With the Federal Reserve's highly anticipated rate cut done and dusted, the Bank of England (BoE) is next up in the rate decision

September 19, 2024

Wall Street romped to records as a delayed jubilation swept markets worldwide following the Federal Reserve’s big cut to interest rates

September 19, 2024

Beyond the immediate headlines generated by the Fed's 50 basis point interest rate cut, it is policymakers' revised outlook for the fed funds rate's

September 19, 2024

Major Wall Street indexes broke record highs after global counterparts booked gains and Treasury yields rose on Thursday as the start of the Federal Reserve's first

September 19, 2024

The U.S. dollar slipped in choppy trading on Wednesday as markets grappled

September 18, 2024

The relatively large rate cut signals that the Fed is shifting its focus from fighting inflation to supporting the labor market, an economist explains.

September 18, 2024

A look at the day ahead in Asian markets.

September 18, 2024

By Michael S.

September 18, 2024

The U.S. central bank might have begun cutting interest rates in late July had it known that the labor market was cooling as fast as it has been,

September 18, 2024

Republican presidential candidate Donald Trump commented on the U.S. Federal Reserve's rate cut on Wednesday by saying "it was a big cut."

September 18, 2024

By Michael S.

September 18, 2024

U.S. consumers got an immediate reprieve on borrowing costs from banks after the Federal Reserve cut interest rates on Wednesday for the first time

September 18, 2024

Foreign holdings of U.S.

September 18, 2024

Federal Reserve Chairman Jerome Powell said Wednesday that central bank forecasts for the path of interest rate cuts don't imply an urgent process.

September 18, 2024

The Fed’s long-awaited rate cut is colliding with presidential politics

September 18, 2024

Futures on the federal funds rate, which measures the cost of unsecured overnight loans between banks, priced on Wednesday about 74 basis points of additional interest rate cuts by

September 18, 2024

The Federal Reserve's decision to cut interest rates by half a percentage point on Wednesday marked the closest the central bank has come in launching an easing cycle on the cusp of a U.S.

September 18, 2024

U.S. central bankers think they’ll need to lower interest rates to a range of 4.25%-4.50% by year-end, more than they anticipated in June, as inflation approaches their 2% goal

September 18, 2024

Federal Reserve Governor Michelle Bowman on Wednesday became the first Fed governor to vote against an interest-rate decision by the U.S. central bank since 2005, denying Fed

September 18, 2024

The interest rate for the most popular U.S. home loan fell last week to its lowest level in two years, on anticipation the Federal Reserve will start cutting interest rates on

September 18, 2024

The Federal Reserve cut U.S. short-term borrowing costs on Wednesday by a bigger-than-usual half percentage point, a watershed moment that should start to

September 18, 2024

As the U.S.

September 18, 2024

Key takeaways from the Fed’s decision to deliver a jumbo-sized interest rate cut

September 18, 2024

U.S. stocks closed with modest losses on Wednesday, well off their intraday highs, after the Federal Reserve cut interest rates by 50 basis points, the high

September 18, 2024

British stock indexes dropped on Wednesday as investors reined in bets on interest rate cuts by the Bank of England, while global risk sentiment

September 18, 2024

European shares closed lower on Wednesday, as investors refrained from risk-taking ahead of an all-important interest rate decision by the U.S.

September 18, 2024

The U.S. central bank on Wednesday kicked off an anticipated series of interest rate cuts with a larger-than-usual half-percentage-point

September 18, 2024

A look at the day ahead in European and global markets from Kevin Buckland With just hours until one of the most highly anticipated central bank decisions in recent memory, traders are still agonising

September 18, 2024

The Federal Reserve cut its benchmark interest rate by an unusually large half-point, a dramatic shift after more than two years of high rates that helped tame inflation but also made borrowing painfully expensive for consumers

September 18, 2024

Major stock indexes closed with modest losses and the dollar gained ground in choppy trading on Wednesday after the U.S.

September 18, 2024

Most of the U.S. stock market edged lower after the Federal Reserve kicked off its efforts to prevent a recession with a bigger-than-usual cut to interest rates

September 18, 2024

Oil prices slipped lower on Wednesday as a rate cut announcement from the Federal Reserve raised worries about the health of the U.S. economy, while investors

September 18, 2024

The dollar edged higher in choppy trading after the Federal Reserve on Wednesday cut interest rates by half a percentage point, citing greater

September 17, 2024

A look at the day ahead in Asian markets.

September 17, 2024

So we’re expecting a rate cut. When will we start to see a difference in the economy?

September 17, 2024

The U.S. economy is not in a recession but labor-market weakness might worry the Federal Reserve enough to cut interest rates by 50 basis points on Wednesday,

September 17, 2024

Traders on Tuesday kept bets the Federal Reserve will start an expected series of interest rate cuts with a half-percentage-point move downward on Wednesday, an expectation

September 17, 2024

America’s economic engine is still revving, despite fears of a slowdown

September 17, 2024

Americans spent a bit more at retailers last month, providing a small boost to the economy just as the Federal Reserve considers how much to cut its key interest rate

September 17, 2024

U.S. retail sales unexpectedly rose in August as a decline in receipts at auto dealerships was more than offset by strength in online purchases, suggesting

September 17, 2024

Market expectations of substantial U.S. rate cuts this year are making short-dated debt unattractive as the Federal Reserve is unlikely to be as aggressive in easing

September 17, 2024

Elizabeth Warren calls for emergency-like Fed rate cut ASAP

September 17, 2024

U.S. stocks closed nearly unchanged on Tuesday, giving up earlier gains that had vaulted the S&P 500 and Dow Industrial Average to record highs as investors

September 17, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan With Federal Reserve easing within touching distance, U.S. stocks are not hanging about, underlining an uncomfortable

September 17, 2024

By Michael S.

September 17, 2024

Bond investors are more cautious and divided over prospects for recession in the world's largest economy with the Federal Reserve poised to cut

September 17, 2024

Global investor sentiment improved in September for the first time since June on optimism over a soft landing and interest rate cuts by the U.S.

September 17, 2024

U.S. stock indexes remained stuck in place as Wall Street made few big moves ahead of what’s expected to be the first cut to interest rates in more than four years

September 17, 2024

U.S. stock markets ended nearly flat after hitting record highs on Tuesday and the dollar stood firm as strong economic data allayed slowdown fears and investors

September 17, 2024

The U.S. dollar strengthened against most major currencies on Tuesday following better-than-expected retail sales data that seemed to support a less aggressive

September 16, 2024

How stocks, bonds and the dollar perform after the Federal Reserve kicks off its rate-cutting cycle

September 16, 2024

The Federal Reserve will likely not cut U.S. interest rates as deeply as the bond market expects due to a resilient economy and inflation remaining sticky, the BlackRock

September 16, 2024

Top White House economic adviser Lael Brainard declared that the U.S. economy had turned the corner in bringing down inflation and it was now time to focus

September 16, 2024

As the Fed prepares to cut interest rates, U.S. households are sitting on their largest accumulation of net wealth in history.

September 16, 2024

Futures on the fed funds rate, which measures the cost of unsecured overnight loans between banks, have priced in a nearly 60% chance of a 50 basis-

September 16, 2024

The cracks in the labor market in Las Vegas and across Nevada have typically appeared early and widened fast when the U.S. economy

September 16, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan After an extraordinary 30-month monetary squeeze designed to zap a post-pandemic inflation spike, the Federal Reserve is finally set

September 16, 2024

Asian bonds attracted foreign inflows for a fourth successive month in August on optimism that the U.S. Federal Reserve will start easing interest rates in September.

September 16, 2024

When the Federal Reserve delivers a widely-anticipated interest rate cut on Wednesday, its first in four years, the move will resonate well beyond the United States.

September 16, 2024

Tech stocks dragged on U.S. indexes and the dollar touched a more than one-year low against the yen on Monday as all eyes looked to a Federal Reserve meeting later

September 15, 2024

The U.S. dollar fell to a more than one-year low versus the yen on Monday, as expectations increased that the Federal Reserve could

September 15, 2024

U.S. stock futures and the dollar were little changed on Sunday after Republican presidential candidate Donald Trump was safe following what the FBI said

September 15, 2024

A look at the day ahead in Asian markets.

September 15, 2024

American consumers and home buyers, business people and political leaders have been waiting for months for what the Federal Reserve is poised to announce this week: That it’s cutting its key interest rate from a two-decade peak

September 15, 2024

The Fed keeps brushing off concerns about another Trump presidency. Closed-door meetings from his first term show otherwise

September 15, 2024

The Federal Reserve is in focus next week, as uncertainty swirls over how much the U.S. central bank will cut interest rates at its monetary policy meeting and

September 13, 2024

Goldman Sachs on Friday said it continues to call for a quarter percentage point easing at next week's Federal Open Market Committee meeting, which contrasted with news stories about

September 13, 2024

The Federal Reserve is nearly as likely to deliver an outsized interest-rate cut next week as a more-usual-sized reduction, trading in rate-futures

September 13, 2024

Americans’ outlook on the economy improved for the second straight month in September, bolstered by lower prices for long-lasting goods such as cars and furniture

September 13, 2024

U.S. consumer sentiment rose to a four-month high in September amid expectations that inflation will continue moderating over the next year and household

September 13, 2024

Wall Street's main indexes closed higher on Friday as investors honed in on the chance of a bigger interest rate cut by the Federal Reserve next week,

September 13, 2024

Don't go anywhere: an event-packed week is coming up with central banks from the United States to Brazil and from Europe to Japan meeting.

September 13, 2024

U.S. stocks closed their best week of the year with more gains and climbed to the cusp of their records

September 13, 2024

Former New York Federal Reserve President Bill Dudley said there was a strong case for a 50 basis point interest rate cut in the United States.

September 13, 2024

The U.S. dollar fell on Friday to its

September 13, 2024

U.S. stocks advanced on Friday and gold continued to hit record highs as investors looked to whether the Federal Reserve might move more aggressively to cut rates at its

September 13, 2024

Mortgage rates fall to lowest level since February 2023

September 12, 2024

The International Monetary Fund said on Thursday it was appropriate for the U.S.

September 12, 2024

The U.S. Federal Reserve has joined a global easing cycle with a larger-than-anticipated half-point interest rate reduction.

September 12, 2024

Wholesale inflation slowed again last month

September 12, 2024

Slightly more Americans filed for unemployment benefits last week, but layoffs remain at historically low levels despite two years of elevated interest rates

September 12, 2024

Wall Street's main indexes closed higher on Thursday after the latest inflation data reinforced expectations for a 25-basis point rate cut by the

September 12, 2024

A look at the day ahead in U.S. and global markets by Amanda Cooper. The first cut might be the deepest in some cases, but in the case of the Federal Reserve, it would seem not.

September 12, 2024

U.S. stocks rose closer to their all-time highs following a couple reports on the economy that came in close to expectations

September 12, 2024

A look at the day ahead in European and global markets from Stella Qiu Asian stock markets were broadly higher as investors regained some of their love for tech stocks, and Nvidia in particular, while

September 12, 2024

Wall Street eked out gains and gold surged to a record high on Thursday as investors awaited a Federal Reserve interest rate cut next week.

September 12, 2024

A government investigation into Atlanta Federal Reserve President Raphael Bostic's securities trades and investments has found he violated several of the central bank's ethics policies

September 11, 2024

Federal Reserve Bank of Atlanta President Raphael Bostic's trading and investing broke central bank rules, the Fed's in-house watchdog said on Wednesday.

September 11, 2024

Wild comeback: Dow bounce erases 700-point one-day dip

September 11, 2024

The Federal Reserve's regulatory chief on Tuesday outlined major revisions to the Basel Endgame draft rule hiking bank capital, following intense industry pushback.

September 11, 2024

Debate over the Federal Reserve's independence is bubbling up again and could become a red-hot issue for market watchers if Donald Trump wins the Nov.

September 11, 2024

Inflation slowed to its lowest level since February 2021, even as housing costs and airline ticket prices continue to rise. Julia Chatterley explains how the new numbers may impact the Fed's looming decision on interest rates.

September 11, 2024

U.S. central bankers will likely start long-awaited interest rate cuts next week with a quarter-of-a-percentage-point reduction, as they seek to reduce the odds of a recession

September 11, 2024

U.S. consumer prices rose slightly in August, but underlying inflation showed some stickiness amid higher costs for housing and other services, further dashing

September 11, 2024

If steep interest rate hikes failed to slow the U.S. economy much in recent years, it is reasonable to ask whether their reversal will prove as toothless in a downturn.

September 11, 2024

U.S. stock indexes stormed back from big early drops to finish higher, led by a handful of influential Big Tech companies

September 11, 2024

The post-pandemic spike in U.S. inflation eased further last month as year-over-year price increases reached a three-year low, clearing the way for the Federal Reserve to cut interest rates and likely shaping the economic debate in the final weeks of the presidential race

September 10, 2024

A look at the day ahead in Asian markets.

September 10, 2024

The Federal Reserve's regulatory chief on Tuesday outlined a sweeping overhaul easing two major draft bank capital rules following intense industry opposition that delayed the

September 10, 2024

The Federal Reserve will lower

September 10, 2024

The Federal Reserve's regulatory chief on Tuesday outlined a plan to raise big banks' capital by 9%, significantly easing an earlier proposal after intense Wall

September 10, 2024

Growing risks to the U.S. stock rally are spurring demand for portfolio hedging, options markets showed, as investors grapple with U.S.

September 10, 2024

Citigroup's investment banking fees are expected to jump 20% in the third quarter from a year earlier, Chief Financial Officer Mark Mason told

September 09, 2024

By Michael S.

September 09, 2024

After grappling with the strongest U.S. price pressures in four decades, it's hard for investors to adjust to the notion that inflation could soon

September 09, 2024

Wall Street's three major indexes gained more than 1% on Monday as investors looked for bargains after the previous week's sell-off while they also waited

September 09, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan Wall Street futures have found their feet after Friday's exaggerated market reaction to an otherwise middling employment report -

September 09, 2024

U.S. stocks climbed Monday to claw back some of the losses from their worst week in nearly a year and a half

September 09, 2024

The dollar snapped back against the yen and other major currencies on Monday after losses last week, as investors looked ahead to key U.S. inflation

September 09, 2024

The U.S. Federal Reserve and other regulators are set to unveil sweeping changes to a raft of proposed banks capital rules as soon as Sept.

September 07, 2024

Uncertainty over the U.S. economy's health is rippling through markets, adding fuel to an already-volatile period that has investors grappling

September 06, 2024

Traders priced in a quarter-point Federal Reserve interest-rate cut this month, with a bigger move expected at its next meeting, after Fed Governor Christopher Waller said recent labor

September 06, 2024

Federal Reserve Governor Christopher Waller on Friday said "the time has come" for the U.S. central bank to begin a series of interest rate cuts this month, adding that he is open-minded

September 06, 2024

STORY: U.S. employment increased less than expected in August, but a drop in the jobless rate to 4.2% suggested an orderly labor market slowdown continued and probably did not

September 06, 2024

By Michael S.

September 06, 2024

By Ann Saphir, Lindsay Dunsmuir and Michael S.

September 06, 2024

U.S. stocks fell on Friday, weighed down by a jobs report that showed a continued labor market slowdown but left traders uncertain about how far the Federal

September 06, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan Friday looks set to play out like a concentrated version of what markets have been navigating all year - what's the fine

September 06, 2024

Investors poured $61 billion into cash-like money market funds in the week to Wednesday, as they braced for the Federal Reserve to cut interest rates for the

September 06, 2024

UK's main stock index ended lower on Friday, dragged down by personal goods and automobile shares, while investors assessed U.S. jobs report data to determine the extent of

September 06, 2024

European shares fell for a fifth straight session on Friday in their worst day since early August, after a widely anticipated U.S. jobs report

September 06, 2024

A look at the day ahead in European and global markets from Stella Qiu Whatever Friday's U.S. payrolls report says, it's going to move things.

September 06, 2024

The Federal Reserve is widely expected to cut borrowing costs at its upcoming meeting Sept. 17-18 and the strength of the job market is likely to be a deciding factor on whether it

September 06, 2024

Another rout hit Wall Street after an update on the U.S. job market came in weak enough to add to worries about the economy

September 06, 2024

MSCI's global equities gauge fell more than 1% on Friday and U.S.

September 06, 2024

The dollar rose in volatile trading on Friday after data showed U.S. employment grew less than expected in August, but indicated only a steady slowdown in the

September 05, 2024