Bank of England's Taylor says it's time to cut interest rates

The Bank of England should move quickly to bring down interest rates given signs of a slowdown in Britain's economy, Alan Taylor, the BoE's most recently

January 15, 2025The Bank of England should move quickly to bring down interest rates given signs of a slowdown in Britain's economy, Alan Taylor, the BoE's most recently

January 15, 2025

The Bank of England will cut interest rates four times this year to support a flat-lining economy, economists polled by Reuters said, but

January 15, 2025

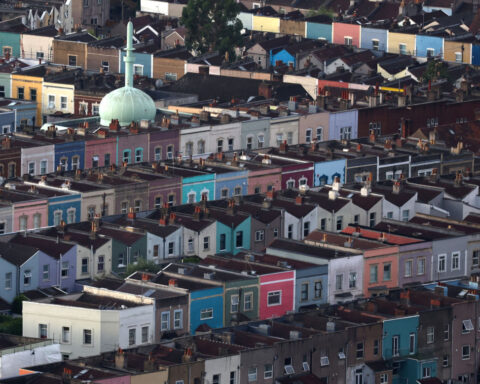

British house prices rose at their fastest annual pace in almost two years in November, adding to signs of resilience in the property market despite high borrowing costs, official

January 15, 2025

British inflation slowed unexpectedly last month and core measures of price growth - tracked by the Bank of England - fell more sharply, according

January 15, 2025

Inflation in the U.K. unexpectedly fell in December, a move that will likely fuel pressure on the Bank of England to cut interest rates again next month

January 15, 2025

British inflation figures will be closely watched on Wednesday as a sharp jump in government borrowing costs, concerns about domestic and global price pressures and

January 15, 2025

The British pound extended its recent drop against the dollar and the euro on Monday driven by investor concerns about Britain's fiscal sustainability as gilt yields

January 13, 2025

People's Bank of China Governor Pan Gongsheng met his Bank of England counterpart, Andrew Bailey, on Saturday in Beijing and discussed topics including financial stability and

January 12, 2025

British households' expectations for inflation rose in December, according to a survey published on Thursday that may add to concerns among investors about the slow pace of future

January 09, 2025

Bank of England Deputy Governor Sarah Breeden said on Thursday that recent evidence supported the case to cut interest rates gradually but that it was tricky to gauge the right speed of

January 09, 2025

British businesses expect to raise prices and reduce staff numbers in response to an increase in employers' social security contributions that will take effect in April, a Bank of

January 09, 2025

British government bond prices fell sharply for a second day on Wednesday, pushing 10-year yields to their highest since August 2008, while 30-

January 08, 2025

British consumer lending grew at the weakest pace since mid-2022 in November and lenders approved fewer mortgages than expected, according to Bank of England data released on Friday which

January 03, 2025

The Bank of England said on Thursday it had allotted 46.180 billion pounds ($57.49 billion) at its first short-term repo of 2025, the second-highest amount on record and up from

January 02, 2025

British factory activity shrank at the fastest pace in 11 months in December and manufacturers cut staffing levels due to higher taxes and weak foreign demand, a survey showed on

January 02, 2025

Britain's economy failed to grow during the first three months of Prime Minister Keir Starmer's new government, official figures showed on Monday, adding to

December 23, 2024

The Bank of England kept its main interest rate unchanged at 4.75% on Thursday but policymakers became more divided about whether rate cuts were needed to tackle a slowing economy.

December 19, 2024

The Bank of England wrapped up a big year of central bank rate cuts by keeping rates steady on Thursday, a day after the Federal Reserve

December 19, 2024

Bank of England policymakers voted 6-3 to keep interest rates on hold on Thursday, a bigger split than economists had predicted as officials

December 19, 2024

The U.K.’s central bank has warned about “heightened uncertainty” as it kept interest rates on hold after inflation moved further above target even at a time when the British economy is flatlining at best

December 19, 2024

British government bond prices fell sharply on Thursday after the U.S.

December 19, 2024

A look at the day ahead in European and global markets from Tom Westbrook The Bank of Japan left interest rates on hold, as expected, clearing the way for traders to sell the yen - which fell to a one

December 19, 2024

The Bank of England looks set to hold interest rates at 4.75% on Thursday, despite signs of a slowing economy, as persistent inflation pressures limit it to a "

December 19, 2024

British inflation hit an eight-month high in November, but the rise in services prices - watched closely by the Bank of England as an

December 18, 2024

Inflation in the U.K. has risen to its highest level since March

December 18, 2024

British pay rose by more than expected in the three months to October, official data showed on Tuesday, prompting investors to further rein in

December 17, 2024

The end of the year is almost in sight for traders, yet the last mile will be anything but slow.

December 13, 2024

Sterling's return close to pre-Brexit referendum levels against the euro owes much to Britain's delicate dance between resetting relations with Europe and the return of

December 13, 2024

The Bank of England looks set to keep interest rates on hold next week as it moves more slowly to cut borrowing costs than central banks in Europe and the

December 11, 2024

Inflation in Britain fell unexpectedly in August to its lowest level since the start of Russia’s invasion of Ukraine

September 20, 2023

The Bank of England has paused nearly two years of interest rate increases after a surprising fall in U.K. inflation eased concerns about the pace of price rises

September 21, 2023

Bank of England holds main interest rate steady after nearly two years of hikes in wake of surprise fall in inflation

September 21, 2023It is still not clear whether higher U.S. tariffs on goods imports proposed by U.S.

December 05, 2024

Inflation in the U.K. held steady at 6.7% in September as easing food and drink price rises were offset by higher fuel costs for motorists

October 18, 2023

The Bank of England kept its main interest rate unchanged at the 15-year high of 5.25% and indicated that borrowing costs will likely remain at these sort of elevated levels for a while yet especially if oil and gas prices increase sharply because of the Israel-Hamas war

November 02, 2023

The pound rose on Friday nearing its highest in almost three months, lifted in part by a broad-based retreat in the dollar, but also by a rise in UK bond yields

April 26, 2024

The Bank of England says it will make an assessment next year about the risks posed by artificial intelligence and machine learning

December 06, 2023

Inflation in the U.K. as measured by the consumer prices index has eased back to its lowest level in more than two years

December 20, 2023

Britain, which has had the strongest inflation among the world's big rich economies for much of the past two years, could see its pace of price growth slow to below 2% before the

April 26, 2024

The Federal Reserve and the Bank of England, grabbing the baton from the ECB and the Bank of Japan, hold their first meetings of the year while U.S. tech giants and Europe banks report

April 26, 2024

The Bank of England is expected to keep its main interest rate at near 16-year highs and indicate that lower borrowing costs aren't imminent because inflation is stuck too high for comfort

February 01, 2024

When the Bank of England's chief economist was asked to explain why its forecasting models had failed to anticipate runaway inflation, he sought to manage

May 07, 2024

Britain's dominant services sector lost steam in November, although not by as much as first feared, as a looming rise in employer taxes weighed on firms' hiring plans, a survey

December 04, 2024

Bank of England Governor Andrew Bailey reiterated in an interview published on Wednesday that gradual cuts in interest rates are likely over the next year, adding that the process of

December 04, 2024

Price rises in the U.K. eased by more than anticipated in February, raising expectations that the Bank of England may start cutting interest rates in the next few months

March 20, 2024

The Bank of England is expected to indicate that interest rates could be cut in the coming months following news that inflation across the U.K. is falling faster than expected

March 21, 2024

Bank of England Deputy Governor Dave Ramsden said on Friday that the risk of British inflation getting stuck too high had receded and it might prove weaker than the BoE's most

May 05, 2024

Cut in June or not at all? The Bank of England is left parsing policy between a European Central Bank nailed on for cutting rates by mid-year and a U.S.

May 08, 2024

The Bank of England will wait until next quarter to lower borrowing costs, according to median forecasts in a Reuters poll, although almost half of those

May 08, 2024

More slack in Britain's labour market is needed to be confident that inflation will stay at 2%, Bank of England policymaker Jonathan Haskel said on Tuesday.

May 08, 2024

If worries about sterling were a factor preventing the Bank of England cutting interest rates too far ahead of the U.S.

May 22, 2024

The Bank of England is likely to take another step towards its first interest rate cut in four years on Thursday as inflation falls, but will probably be

May 22, 2024

A look at the day ahead in European and global markets from Tom Westbrook The Bank of England is not expected to move interest rates today.

May 22, 2024

The Bank of England is keeping its main U.K. interest rate at a 16-year high of 5.25% though it gave a broad hint that a reduction could be on the cards as soon as June as inflation is forecast to fall below target

May 09, 2024

The Bank of England took another step towards lowering interest rates on Thursday, as a second official backed a cut and Governor Andrew Bailey said he was "optimistic that things

May 24, 2024

The Bank of England on Thursday took another step towards lowering interest rates, as a second official backed a cut and Governor Andrew Bailey said he was "optimistic that things

May 24, 2024

The Bank of England paved the way on Thursday for the start of interest rate cuts as soon as next month and Governor Andrew

May 24, 2024

Bank of England Chief Economist Huw Pill said on Thursday that members of the central bank's Monetary Policy Committee were more confident that they would soon be able to cut

May 24, 2024

The Bank of England has sent a new signal that borrowing costs will fall earlier and further across Europe than in the United States, setting

May 24, 2024

Britain's economy grew by the most in nearly three years in the first quarter of 2024, ending the shallow recession it entered in the second half

May 25, 2024

The Bank of England might be able to consider cutting interest rates over the summer although Britain's labour market remains tight by historical standards, the central bank's chief

May 29, 2024

Britain's statistics agency cautioned on Tuesday that the shift to its new, improved labour market survey may be pushed back to as late as

December 03, 2024

The Bank of England could cut interest rates in the next few months, depending on how rapidly the knock-on impact on wage growth and prices from

June 04, 2024

Britain's once towering inflation rate looks set to fall close to the Bank of England's 2% target on Wednesday, but it may be other figures in the data that influence the BoE's

June 05, 2024

Bank of England Governor Andrew Bailey set out an outline for how the central bank intends to keep money markets stable as it sells more of

June 05, 2024

Inflation in the U.K. fell sharply to its lowest level in nearly three years in April on the back of big declines in domestic bills

May 22, 2024

Inflation in Britain eased less than expected and a key core measure of prices barely dropped, prompting investors to pull bets on a Bank of England

July 02, 2024

Even as consensus builds inside and outside the Bank of England on UK interest rate cuts this summer, the thorny issue for banks and bond markets of when it stops its

June 05, 2024

Goldman Sachs, Barclays and Morgan Stanley said on Wednesday that a June rate cut from the Bank of England (BoE) now seems less likely, following a smaller-than-expected drop in British

June 06, 2024

The Bank of England allotted 16.245 billion pounds ($20.64 billion) of one-week funds in its short-term repo operation on Thursday, the largest usage of the facility since it

June 07, 2024

A look at the day ahead in European and global markets from Rae Wee Flash Purchasing Managers Index (PMI) figures in the euro zone, the UK and the United States take centre stage on Thursday, and

June 07, 2024

The British public's expectations for inflation over the next year fell to 3.1% in May, the lowest level since July 2021, a monthly Citi/YouGov survey said on Friday.

June 18, 2024

Growth among Britain's services businesses eased in May from April's 11-month high and inflation pressures dropped to their lowest in three years, a survey showed

June 21, 2024

The Bank of England will start cutting interest rates in August, according to all but two of 65 economists polled by Reuters, and most of them expect at

June 28, 2024

Britain's housing market lost momentum in May as the prospect of imminent rate cuts by the Bank of England faded, spurring a drop in buyer demand and house prices, a survey

June 28, 2024

Any lingering hopes Prime Minister Rishi Sunak might still have for a pre-election interest rate cut will probably be dashed next week, when the Bank of England

June 28, 2024

The value of pay deals handed out by British employers inched higher in the three months to May, according to a survey on Wednesday that underlined how pay growth - a major driver of

July 01, 2024

Sterling rose after UK data showed that underlying price pressures remained strong, meaning the Bank of England is likely to wait longer before cutting interest rates.

July 01, 2024

A look at the day ahead in European and global markets from Ankur Banerjee British inflation may have returned to its 2% target for the first time in nearly three years, setting the stage for the Bank

July 02, 2024

The Bank of England has kept its main interest rate at a 16-year high of 5.25%, even though inflation has fallen to its target of 2%

June 20, 2024

Britain's central bank looks on course to hold interest rates at a 16-year high of 5.25% on Thursday as underlying inflation pressures prove persistent, depriving

July 02, 2024

The Bank of England kept its main interest rate unchanged at a 16-year high of 5.25% at its last meeting before July 4's UK election, but the

July 02, 2024

Traders upped bets for a Bank of England rate cut in August, helping to underpin a pre-election rally for UK stocks and government bonds even

June 20, 2024

Risk management in the private equity sector needs improving, the Bank of England said on Thursday, particularly as the period of low interest rates

June 27, 2024

The Bank of England is likely to cut interest rates soon, "probably in August", as long as inflation and wage data align with the Monetary Policy Committee's (MPC

June 27, 2024

Fewer British firms plan to raise their prices in the coming months, according to a survey that will give reassurance to the Bank of England as it considers the possibility of

July 07, 2024

Bank of England policymaker Jonathan Haskel said on Monday that he does not want to cut interest rates from their current 16-year high as

July 08, 2024

Bank of England Chief Economist Huw Pill dampened expectations of an August interest rate cut on Wednesday as he focused on strong price pressures in

July 10, 2024

Bank of England interest rate-setter Catherine Mann on Wednesday emphasised the strength of price pressures in Britain's economy, giving a clear signal she is unlikely

July 10, 2024

Asking prices for British homes coming to the market fell this month, with signs that some buyers are waiting for the Bank of England to cut interest rates, a survey from

July 14, 2024

British inflation defied forecasts for a slight fall and held at 2% in June while strong underlying price pressures prompted investors to

July 17, 2024

Inflation in the U.K. held steady at the Bank of England’s target rate of 2% in June

July 17, 2024

Wages in Britain grew a bit more slowly but still increased at a pace that would normally be too strong for the Bank of England, leaving in doubt

July 18, 2024

First to hike, first to hit its inflation target - and the last to cut?

July 19, 2024

The Bank of England said on Monday that banks should get ready to make greater use of its repo facilities as it sells down its government bond holdings, and that it

July 22, 2024

Bank of England Chief Economist Huw Pill said earlier this month that it was an open question whether the BoE would cut interest rates on Aug. 1, despite inflation returning to its

July 24, 2024

The Bank of England will trim Bank Rate to 5% next week, a majority of economists said in a Reuters poll, and with inflation expected to hover around target, it

July 24, 2024