Los Angeles's housing market remains an uphill climb for people who have dreams of buying a home. A recent report identified Los Angeles as the least affordable major U.S. metro for home purchases. As home prices soar beyond what locals typically earn, the path to homeownership grows even steeper for residents of Southern California's urban heartland.

RealtyHop's monthly analysis examined 100 major cities nationwide. It weighs typical incomes against home prices and ownership costs like mortgages and property taxes. For years, L.A. has topped rankings as the least affordable city to become a homeowner. The city's expensive homes and modest paychecks make homeownership an impossible dream for most families.

RealtyHop's latest data shows L.A.'s median listed home price exceeded $1.1 million in May 2024. With the average family income of $78,671, affording a home at that price would devour a 99.33% of annual earnings. Financial advisors generally recommend keeping total housing costs below 30% of household income to maintain a balanced budget. Median home prices in L.A. put affordability metrics out of whack for regular families.

The imbalance between home values and local incomes in L.A. stands out even from other notoriously expensive housing markets. In most major U.S. cities, residents must allocate around 30% of earnings to cover ownership costs on a median-priced home. Even in the least affordable cities besides L.A., like New York and San Francisco, ownership typically demands no more than 49% of household income. L.A. is in a league of its own when it comes to home prices utterly detached from normal budgets.

California accounts for three of the five priciest housing markets in RealtyHop's latest affordability rankings. The study bluntly states that "California remains unaffordable for average Americans." The state's coastal hubs for jobs and economic activity, like L.A. and San Diego, have seen home values skyrocket in recent decades.

The RealtyHop Housing Affordability Index incorporates regional averages for household incomes, home listing prices, estimated mortgage costs, and local property taxes. This comprehensive data helps quantify the growing disconnect between home values and local salaries that effectively shuts out lower—and middle-income buyers from the L.A. housing market. Year after year, the index reinforces how difficult it has become for residents without extremely high earnings to afford a home.

South Korea's acting president faces impeachment vote as court meets on martial law case

South Korea's acting president faces impeachment vote as court meets on martial law case

Ex-Sen. Bob Menendez, citing 'emotional toll,' seeks sentencing delay in wake of wife's trial

Ex-Sen. Bob Menendez, citing 'emotional toll,' seeks sentencing delay in wake of wife's trial

Cats can get sick with bird flu. Here's how to protect them

Cats can get sick with bird flu. Here's how to protect them

WHO chief says he was at Yemen airport which Israeli strikes targeted

WHO chief says he was at Yemen airport which Israeli strikes targeted

An uneasy calm settles over Syrian city of Homs after outbreak of sectarian violence

An uneasy calm settles over Syrian city of Homs after outbreak of sectarian violence

Column-Why US Congress restored Social Security benefits for public-sector retirees: Mark Miller

Column-Why US Congress restored Social Security benefits for public-sector retirees: Mark Miller

NBA-Christmas Day viewership jumps as league contends with NFL-Netflix appeal

NBA-Christmas Day viewership jumps as league contends with NFL-Netflix appeal

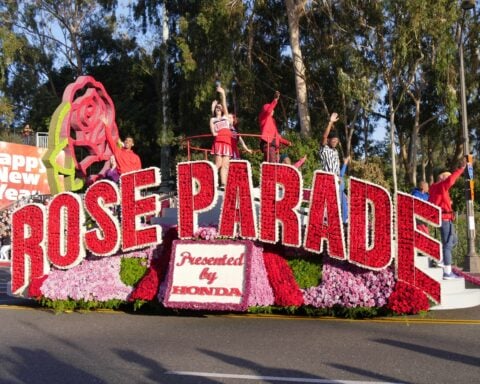

Rose Parade: Ways to get involved and float viewing tips

Rose Parade: Ways to get involved and float viewing tips

Organizers say two sailors have died in Sydney to Hobart yacht race amid wild weather conditions

Organizers say two sailors have died in Sydney to Hobart yacht race amid wild weather conditions

Getty Images

Getty Images