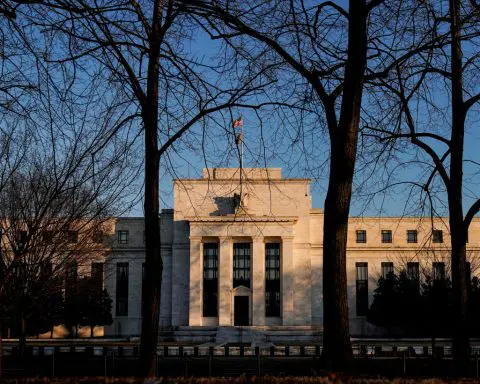

Elon Musk says Fed foolish not to have cut interest rates

Billionaire Elon Musk said on Sunday the Federal Reserve needs to cut interest rates and that it was foolish for the U.S. central bank not to have done so already.

August 04, 2024Billionaire Elon Musk said on Sunday the Federal Reserve needs to cut interest rates and that it was foolish for the U.S. central bank not to have done so already.

August 04, 2024

3 reasons to worry about July’s weak jobs report — and 1 reason not to panic

August 03, 2024

By Michael S.

August 02, 2024

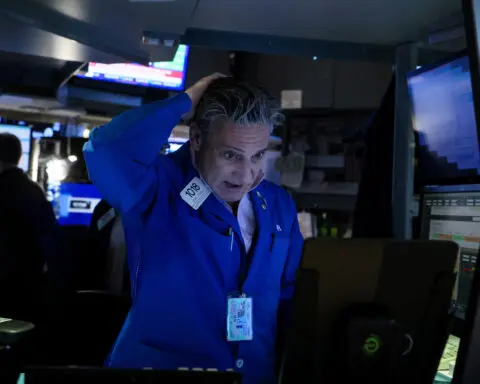

A surprisingly weak U.S. employment report for June has turned Wall Street confidence on a soft landing into near panic that a recession is looming, prompting major firms to change

August 02, 2024

A sharp repricing in U.S. interest rate cut expectations could give more fuel to a searing bond rally triggered by weakening economic data, as investors

August 02, 2024

The disappointing U.S. employment report for July unleashed a "Freakout Friday" moment in financial markets and triggered a wholesale resetting of expectations for how much

August 02, 2024

The turmoil shaking global financial markets reflects a sudden fear that the Federal Reserve may have held its key interest rate too high for too long, heightening the risk of a U.S. recession

August 02, 2024

Chicago Federal Reserve Bank President Austan Goolsbee said on Friday the U.S. central bank should move in a "steady" way, a mild pushback against the rush of market bets that the Fed will

August 02, 2024

Worries over tech earnings and a slowing U.S. economy slammed the Nasdaq Composite index on Friday as it extended recent declines to fall 10% below

August 02, 2024

Investors put money into U.S. equity funds in the week through July 31 as they anticipated the Federal Reserve would signal interest rate cuts following its policy meeting, though an

August 02, 2024

U.S. job growth slowed more than expected in July, while the unemployment rate increased to 4.3%, which could heighten fears that the labor market is deteriorating and potentially making

August 02, 2024

Traders bet on Friday that the Federal Reserve will start easing policy in September with a big half-percentage-point interest rate cut, after government data showed employers added far

August 02, 2024

U.S. central bankers may be having second thoughts about their decision earlier this week to hold borrowing costs steady, after a government report on Friday showed the job

August 02, 2024

Economic fears are roiling Wall Street, as worries grow that the Federal Reserve may have left interest rates elevated for too long, allowing them to hurt U.S.

August 02, 2024

The U.S. dollar dropped to a four-month low on Friday after a weaker-than-expected employment report for July raised expectations that the Federal Reserve will

August 01, 2024

The S&P 500 fell more than 2% and the Nasdaq more than 3% at one point late on Thursday, reversing early gains and closing the first session of August sharply lower after data spurred

August 01, 2024

The average rate on the popular U.S. 30-year mortgage rate fell to 6.73% this week, its lowest level since February as the bond market reacted to signs of

August 01, 2024

Dow closes nearly 500 points lower as investors fear the US economy is faltering

August 01, 2024

As the first U.S. interest rate cut in this cycle draws closer, long and short positions in the Treasury futures market, and overnight repo lending

August 01, 2024

U.S. construction spending unexpectedly fell in June and the prior month's data was revised lower as higher mortgage rates weighed on single-family homebuilding.

August 01, 2024

The Fed is about to do something it hasn’t done since the pandemic

August 01, 2024

U.S. stocks kicked off August sharply lower after a round of economic data on Thursday spurred concerns the economy may be slowing faster than anticipated

August 01, 2024

U.S. stocks tumbled after weak data raised worries the Federal Reserve may have missed its window to cut interest rates before undercutting the economy’s growth

August 01, 2024

As U.S. rate cuts come into view, investors are confronting a new challenge: figuring out whether the Federal Reserve will be able to ease

August 01, 2024

The dollar gained on Thursday as rising geopolitical tensions drove a safe-haven boost, while the British pound fell after the Bank of England cut interest rates

August 01, 2024

A look at the day ahead in Asian markets.

July 31, 2024

Federal Reserve Chair Jerome Powell said recent inflation data is increasing the central bank's confidence that inflation pressures are moving back to the 2% target.

July 31, 2024

The Federal Reserve held interest rates steady on Wednesday but opened the door to reducing borrowing costs as soon as its next meeting in September as inflation continues coming into line

July 31, 2024

Traders on Wednesday added to bets the Federal Reserve will start easing in September and go big when it does, even after Fed Chair Jerome Powell said policymakers are not thinking about a

July 31, 2024

Fitch Ratings said on Wednesday it expects the U.S. Federal Reserve to cut interest rates twice this year - in September and December.

July 31, 2024

Pay and benefits for America’s workers grew more slowly in the April-June quarter than in the first three months of the year, a trend that could keep price pressures in check and encourage the inflation-fighters at the Federal Reserve

July 31, 2024

Gold prices extended gains on Wednesday after Federal Reserve Chair Jerome Powell hinted that an interest rate cut could be on the table as

July 31, 2024

The S&P 500 and Nasdaq scored their biggest daily percentage gains since Feb. 22 and the Dow rose on Wednesday as chip stocks rallied and the Federal Reserve kept

July 31, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan By any standards of an already busy year, markets are digesting an awful lot of information in a very short space of time - with a

July 31, 2024

Benign inflation data and a cooling job market aside, U.S. credit conditions featuring tepid loan demand and stiff terms may also be bolstering confidence among Federal

July 31, 2024

Federal Reserve Chair Jerome Powell said on Wednesday interest rates could be cut as soon as September if the U.S. economy follows its expected

July 31, 2024

A look at the day ahead in European and global markets from Ankur Banerjee Investors in Europe will wake up to a volatile yen after the BOJ raised interest rates in a long-awaited move and a growing

July 31, 2024

MSCI'S global equities index registered its biggest daily gain in over five months on Wednesday and the dollar slightly pared losses after the U.S.

July 31, 2024

The dollar added to losses on Wednesday after the Federal Reserve held interest rates steady but opened the door to reducing borrowing costs as soon as its next

July 30, 2024

Federal Reserve Chair Jerome Powell has set the stage for the central bank’s first rate cut in four years

July 30, 2024

For more than a year, the U.S. stock market went in mostly one direction, up, and in mostly one manner, quietly

July 30, 2024

U.S. job openings fell modestly in June and data for the prior month was revised higher, suggesting the labor market continued to gradually slow and was not in

July 30, 2024

U.S. job openings fell slightly last month, a sign that the American labor market continues to cool in the face of high interest rates

July 30, 2024

Bond investors, expecting the Federal Reserve to hold interest rates steady this week but signal that rate cuts are imminent, are betting that the U.S.

July 30, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan To the extent that worries about pricey tech stocks and rising AI capex spending were partly behind last week's market shakeout,

July 30, 2024

European shares closed higher on Tuesday, boosted by earnings-driven gains across several pockets of the market, with focus squarely on the Federal

July 30, 2024

Asian stocks are mostly higher following a decision by the Bank of Japan to raise its benchmark interest rate

July 30, 2024

Federal Reserve efforts to overhaul a key emergency lending facility historically viewed with anxiety by banks are now being joined by potential congressional action.

July 29, 2024

The S&P 500 closed barely higher after Monday's choppy trading session as investors held their breath ahead of a raft of big technology company earnings, a

July 29, 2024

The Federal Reserve is expected to hold interest rates steady at a two-day policy meeting this week but open the door to interest rate cuts as soon as

July 29, 2024

Inflation is nearing the Federal Reserve's 2% target, and the central bank is expected to begin cutting interest rates as soon as September.

July 29, 2024

The longest and deepest U.S. Treasury yield curve inversion in history, a key bond market signal of an upcoming recession, could be nearing its end.

July 29, 2024

European shares ended a touch lower on Monday as investors remained risk averse at the start of an earnings-packed week, while global risk events such

July 29, 2024

Global stocks advanced and longer-dated U.S. yields slipped on Monday, at the start of a week jammed with earnings and a trio of central

July 28, 2024

A look at the day ahead in Asian markets.

July 28, 2024

Smart moves to make when the Fed starts cutting rates

July 27, 2024

Two years after launching an aggressive fight against inflation and one year after leaving its benchmark interest rate at a near-quarter-century high, the Federal Reserve is expected to signal this week that it will likely reduce borrowing costs as soon as September

July 26, 2024

Dow closes more than 600 points higher as investors gear up for rate cuts

July 26, 2024

Federal Reserve policymakers on Friday got fresh evidence of progress on inflation, fueling expectations they will use the U.S. central bank's meeting next week to signal they

July 26, 2024

The Federal Reserve’s favored inflation measure remained low last month, bolstering evidence that price pressures are steadily cooling and setting the stage for the Fed to begin cutting interest rates in September

July 26, 2024

U.S. prices increased moderately in June as the declining cost of goods tempered a rise in the cost of services, underscoring an improving inflation

July 26, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan The end of a hair-raising week for the stock market has left more questions than answers, with Thursday's bumper U.S. growth data

July 26, 2024

Rattled investors are bracing for earnings from the market’s biggest tech companies, a Federal Reserve policy meeting and closely watched employment data in a

July 26, 2024

Often the scariest thing in markets is a rout without a trigger. People are still unsure about the precise cause of the October 1987 crash, for example.

July 26, 2024

A gauge of global stocks climbed for the first time in four sessions on Friday as equities steadied after a sharp selloff and U.S. economic data showed an

July 26, 2024

Federal Reserve policymakers are seen leaving their short-term interest-rate target in the 5.25%-5.50% range next week and waiting until September to start a string of quarter-point

July 25, 2024

Fewer Americans filed for unemployment benefits last week, but applications remained at recently elevated, though not troubling levels

July 25, 2024

By Michael S.

July 25, 2024

The nation’s economy accelerated last quarter at a strong 2.8% annual pace, with consumers and businesses helping drive growth despite the pressure of continually high interest rates

July 24, 2024

U.S. existing home sales fell more than expected in June as the median house price set another record high, but improving supply and declining mortgage rates

July 23, 2024

The Federal Reserve will cut interest rates just twice this year, in September and December, as resilient U.S. consumer demand warrants a cautious approach

July 23, 2024

The worst may be over for homebuyers

July 23, 2024

In September 2021, after absorbing three months of price hikes that were more than double the Federal Reserve's 2% target, U.S. central bank staff and

July 22, 2024

The U.S.

July 19, 2024

Top U.S. asset manager Vanguard favors high-rated corporate debt over riskier high-yield companies' bonds as it seeks protection against the possibility a

July 19, 2024

Global equity funds attracted inflows for a fourth successive week in the seven days to July 17, spurred by expectations of a Federal Reserve rate cut after recent data showed cooling

July 19, 2024

Investors have locked onto the U.S. central bank's Sept. 17-18 meeting for the start of interest rate cuts that Federal Reserve Chair Jerome Powell has said

July 19, 2024

The dollar climbed on Friday and was set to snap a two-week streak of declines as a worldwide cyber outage that affected banks, airlines and broadcasters

July 19, 2024

The average interest rate on the popular U.S. 30-year fixed-rate mortgage fell to its lowest level since mid-March this week, a welcome development for a housing

July 18, 2024

The International Monetary Fund on Thursday said the U.S.

July 18, 2024

The number of Americans filing new applications for unemployment benefits increased more than expected last week, but that did not signal a material shift in

July 18, 2024

U.S. filings for unemployment benefits rose again last week and appear to be settling consistently at a slightly higher though still healthy level

July 18, 2024

The European Central Bank left its key interest rate benchmark unchanged Thursday as its rate-setting council and President Christine Lagarde take their time to make sure stubborn inflation is firmly under control before lowering rates again

July 18, 2024

Gold prices edged higher on Thursday, as expectations of a September interest rate cut from the U.S. Federal Reserve continue to gather momentum.

July 18, 2024

Oil prices steadied on Thursday as investors wrestled with mixed signals about crude demand, with concerns about an economic slowdown in the U.S. contending with

July 18, 2024

Trump says he wouldn’t fire Fed Chair Jerome Powell. Don’t hold your breath

July 17, 2024

Consumer credit ratings firm Equifax forecast third-quarter revenue below Wall Street estimates on Wednesday as higher-for-longer interest rates continue to derail recovery in mortgage

July 17, 2024

U.S. economic activity expanded at a slight to modest pace from late May through early July with firms expecting slower growth ahead as they also reported

July 17, 2024

Loretta Mester, having worked in the Federal Reserve system her entire career, rose to become president of the Cleveland Fed for a decade until her retirement on June 30

July 17, 2024

By Michael S.

July 17, 2024

By Howard Schneider and Michael S.

July 17, 2024

Donald Trump will not try ousting Federal Reserve Chair Jerome Powell before the central banker's term ends and would consider JPMorgan CEO Jamie Dimon for

July 16, 2024

Dow and S&P 500 close at record highs as investors bet on September rate cut

July 16, 2024

Federal Reserve Governor Adriana Kugler on Tuesday expressed cautious optimism that inflation is returning to the U.S. central bank's 2% target, with goods,

July 16, 2024

Cooling inflation data is allowing the Federal Reserve to begin a "very reasonable" shift toward easing rates, but a still-strong U.S. labor market means that

July 16, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan After a jarring Monday that spurred a wave of U.S. election trades, world markets zeroed in Federal Reserve easing hopes, China's

July 16, 2024

Asian stocks are mostly lower even as investors wager that the Federal Reserve will come ahead with a cut to interest rates, while Australia's benchmark hit a new record

July 16, 2024

World stock indexes mostly rose and the U.S. dollar gained against the yen on Tuesday after solid U.S. retail sales data was taken as

July 16, 2024

The dollar rose on Tuesday, on track for a second straight daily gain, after a reading of retail sales proved to be firmer than expected, but was still soft

July 16, 2024

Oil prices settled more than 1% lower on Tuesday, the third straight day of losses, on worries of a slowing Chinese economy crimping demand, though declines

July 15, 2024

San Francisco Federal Reserve Bank President Mary Daly on Monday said "confidence is growing" that inflation is heading toward the U.S. central bank's 2% goal, the bar that policymakers

July 15, 2024

Federal Reserve Chair Jerome Powell said on Monday the three U.S. inflation readings over the second quarter of this year do "add somewhat to confidence" that the pace of price increases

July 15, 2024

Chair Jerome Powell said the Federal Reserve is becoming more convinced that inflation is headed back to its 2% target and said the Fed would cut rates before the pace of price increases actually reached that point

July 15, 2024

Federal Reserve Chair Jerome Powell on Monday said he has no plans to leave his post as head of the U.S. central bank before his term expires, pouring cold

July 15, 2024

Federal Reserve Chair Jerome Powell said on Monday the three U.S. inflation readings over the second quarter of this year "add somewhat to confidence" that

July 15, 2024

Credit rejection rates were higher in June than earlier in 2024 but slightly lower than a year ago, new data from the Federal Reserve Bank of New York said on Monday.

July 15, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan The shock shooting on Saturday of former President Donald Trump, who is seeking a return to the White House, is

July 15, 2024

Wall Street closed higher on Monday, building on Friday's rally as increasing expectations of a second Donald Trump presidency in the wake of a failed assassination

July 15, 2024

Federal Reserve Chair Jerome Powell on Monday kicks off what is shaping up as a key week of commentary from U.S. central bank officials taking stock of

July 15, 2024

The Federal Reserve has proposed new rules that would allow it to gather granular details about banks' exposure to shadow banks, a move that shows how regulators are

July 15, 2024

A look at the day ahead in European and global markets from Stella Qiu. Shock at the attempt to assassinate former President Donald Trump is driving markets this Monday.

July 15, 2024

The dollar fell slightly on Monday after comments from Federal Reserve Chair Jerome Powell, while cryptocurrencies rose on bets that an assassination attempt

July 14, 2024

Goldman Sachs has lodged an appeal with the U.S.

July 14, 2024

Looming U.S. interest rate cuts are presenting investors with a tough choice: stick with the Big Tech stocks that have driven returns for more than a year or

July 12, 2024

Executives from top U.S. banks remained divided over the U.S.

July 12, 2024

Unexpected bad news for inflation: Wholesale prices rose in June

July 12, 2024

U.S. producer prices increased slightly more than expected in June amid a rise in the cost of services, but that did not change expectations that the Federal

July 12, 2024

Wholesale prices in the United States rose by a larger-than-expected 2.6% last month from a year earlier, a sign that some inflation pressures remain elevated

July 12, 2024

India's No.3 IT services provider HCLTech reported a 6.7% rise in first-quarter revenue on Friday, and projected growth in most

July 12, 2024

Global debt funds attracted inflows for a 29th straight week in the seven days to July 10 on expectations of a Federal Reserve rate cut amid weakening labour market conditions and easing

July 12, 2024

U.S. stocks rose after some mixed signals on big banks’ profits and inflation did little to dent Wall Street’s belief that easier interest rates are on the way

July 12, 2024

Chicago Federal Reserve Bank President Austan Goolsbee said on Thursday the U.S. economy looks like it is back on track to 2% inflation after a bump up earlier this

July 11, 2024

Federal Reserve Bank of St.

July 11, 2024

The International Monetary Fund said on Friday it continues to believe that the Federal Reserve could start cutting interest rates later this year and should

July 11, 2024

San Francisco Federal Reserve Bank President Mary Daly on Thursday said that recent cooler inflation readings are a "relief" and she expects further easing in both price

July 11, 2024

The average rate on a 30-year mortgage fell slightly this week, providing modest relief for home shoppers facing record-high home prices

July 11, 2024

The Consumer Price Index, a measurement of the average change in prices for a commonly purchased basket of goods and services, dropped 0.1% from May, which helped to slow the annual rate of inflation to 3% from 3.3% in May, according to the Bureau of Labor Statistics’ latest report.

July 11, 2024

U.S. consumer prices unexpectedly fell in June and the annual increase was the smallest in a year, reinforcing views that the disinflation trend was back on track and drawing the Federal

July 11, 2024

The number of Americans filing new applications for unemployment benefits dropped more than expected last week, but volatility around this time of the year as automobile

July 11, 2024

The "last mile" of the Federal Reserve's battle against inflation may have shortened to a last lap after U.S. consumer prices unexpectedly fell in

July 11, 2024

U.S. consumer prices fell for the first time in four years in June amid cheaper gasoline and moderating rents, firmly putting disinflation back on track and

July 11, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan If Federal Reserve boss Jerome Powell had any inkling of the June U.S. inflation readout when speaking to Congress this week, then

July 11, 2024

Oil prices rose for the second consecutive session on Thursday with the Brent benchmark settling above $85 a barrel as hopes rose for U.S. interest rate cuts after

July 10, 2024

The Federal Reserve is closely watching changes in the unemployment rate and would respond if it starts a quick climb, Fed Governor Lisa Cook said on Wednesday.

July 10, 2024

U.S. inflation should continue to fall without a significant further rise in the unemployment rate, Federal Reserve Governor Lisa Cook said on Wednesday.

July 10, 2024

Optimism is rising among economists, investors and Federal Reserve officials that U.S. inflation is nearly under control, with the latest report on consumer prices expected to show another month of mild increases

July 10, 2024

Federal Reserve Chair Jerome Powell reinforced a message that the Fed is paying growing attention to a slowing job market and not only to taming inflation, a shift that signals it’s likely to begin cutting interest rates soon

July 10, 2024

Federal Reserve Chair Jerome Powell said on Wednesday the U.S. central bank will make interest rate decisions "when and as" they are needed, pushing back on a

July 10, 2024

Shares are mixed in Asia, while Tokyo's Nikkei 225 index has closed at another record high as investors awaited further comments by Federal Reserve Chair Jerome Powell before Congress

July 10, 2024

The prospect of near-term interest rate cuts is bolstering the case for investors to remain bullish after a run in U.S. stocks that may soon be tested by

July 10, 2024

The dollar dipped on Wednesday after Federal Reserve Chair Jerome Powell indicated that the U.S. central bank is getting closer to cutting interest rates but wants to see

July 10, 2024

A look at the day ahead in Asian markets. Is a U.S. interest rate cut coming? If so, when?

July 09, 2024

Rent and housing costs are keeping U.S. inflation higher than preferred but consumer price pressures will continue to come down over time,

July 09, 2024

By Michael S.

July 09, 2024

Key takeaways from Fed Chair Powell’s testimony on Capitol Hill

July 09, 2024

Inflation "remains above" the U.S.

July 09, 2024

The Federal Reserve faces a cooling job market as well as persistently high prices, Chair Jerome Powell said in testimony to Congress, a shift in emphasis away from the Fed’s single-minded fight against inflation that suggests it's moving closer to cutting interest rates

July 09, 2024

The S&P 500 and Nasdaq notched record-high closes on Tuesday, fueled by gains in Nvidia after U.S.

July 09, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan After an intense month focused on election risk around the world, markets quickly switched back to the more prosaic matter of the

July 09, 2024

The U.S.

July 09, 2024

Stocks closed mixed on Wall Street after testimony from Federal Reserve Chair Jerome Powell in front of Congress provided little new guidance on the Fed's plans on when it might lower interest rates

July 09, 2024

MSCI's global equities index bumped around in a narrow range while edging lower on Tuesday while U.S. Treasury yields rose after U.S.

July 09, 2024

The dollar gained on Tuesday after Federal Reserve Chair Jerome Powell acknowledged progress in inflation and a cooling job market, but did not give a clear signal that

July 09, 2024

A look at the day ahead in Asian markets.

July 08, 2024

A surge in the U.S. labor force in recent years may have driven up the number of new jobs needed to avoid a rise in the unemployment rate to around 230,000 a month, according

July 08, 2024

By Michael S.

July 08, 2024

The S&P 500 and Nasdaq notched record-high closes on Monday as investors awaited fresh inflation data, commentary from Federal Reserve Chair Jerome

July 08, 2024

The Federal Reserve is highlighting the importance of its political independence at a time when Donald Trump, who frequently attacked the Fed’s policymaking in the past, edges closer to formally becoming the Republican nominee for president again

July 05, 2024

Inflation is easing and the job market has returned to the "tight but not overheated" situation seen before the COVID-19 pandemic threw the U.S. economy into disarray,

July 05, 2024

Federal Reserve policymakers got more evidence of U.S. labor-market cooling on Friday that could boost their confidence they are winning their fight on inflation, and open the

July 05, 2024

STORY: U.S. job growth slowed to a still-healthy pace in June, with the unemployment rate rising to 4.1%, increasing the chances that the Federal Reserve will be able to tame

July 05, 2024

Investors hoovered up U.S. equity funds in the week to July 3 as data indicating a softening economy and U.S.

July 05, 2024

Global investors piled into equity funds in the week to July 3 on expectations of U.S. rate cuts following weaker economic indicators and dovish remarks from Federal Reserve Chair Jerome

July 05, 2024

The Federal Reserve has taken great strides in lowering inflation back down toward its 2% target rate but is still "a way" from achieving the goal, New York Fed Bank President John

July 05, 2024

U.S. employment increased solidly in June, but government and healthcare services hiring made up about three-quarters of the payrolls gain and the unemployment

July 05, 2024

The U.S. dollar index stayed slightly lower on Friday after data showed U.S. job growth slowed marginally in June while the unemployment rate rose,

July 05, 2024

The American job market likely cooled last month while still remaining fundamentally healthy, which would be welcome news for the Federal Reserve in its drive to fully tame inflation

July 04, 2024

Foreign investors channelled massive money into Asian equities in June, after two months of selling, as easing U.S. price pressures raised hopes that the Federal Reserve

July 04, 2024

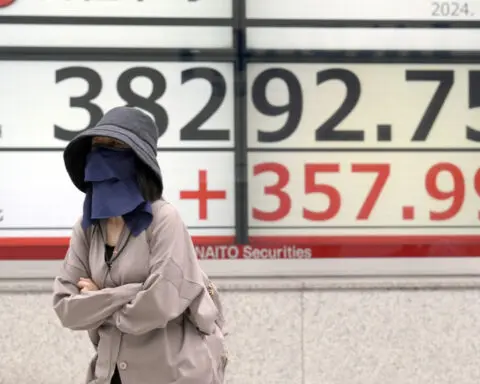

Japan's benchmark Nikkei 225 has surged to a record close of 40,913.65, leading markets in most of Asia higher

July 04, 2024

Federal Reserve officials at their most recent meeting welcomed recent signs that inflation is slowing and highlighted data suggesting that the job market and the broader economy could be cooling

July 03, 2024

Federal Reserve officials at their last meeting acknowledged the U.S. economy appeared to be slowing and that "price pressures were diminishing," but still

July 03, 2024

First-time applications for U.S. unemployment benefits increased last week, while the number of people on jobless rolls rose further to a 2-1/2 year high

July 03, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan Federal Reserve chair Jerome Powell managed to smooth some election-ruffled feathers in bond markets on Tuesday, helping

July 03, 2024

The S&P 500 index and technology-laden Nasdaq rose on Wednesday to post record high closes, as data pointing to a softening economy

July 03, 2024

Asian shares are trading mostly higher after Tesla zoomed upward, helping drive the U.S. stock market to more records

July 03, 2024

A look at the day ahead in European and global markets from Ankur Banerjee It was a risk-on session in Asia, with European bourses poised for a similar start in the wake of comments by Fed Chair

July 03, 2024

By Michael S.

July 03, 2024

The U.S. Federal Reserve is due to release the results of its annual bank health checks on Wednesday at 4:30 p.m. ET (2030 GMT).

July 03, 2024

By Michael S.

July 03, 2024

The Federal Reserve must "exhibit care" as it aims to finish the job of bringing inflation under control, San Francisco Fed President Mary Daly said on Monday, noting that

July 03, 2024

Big U.S. lenders are expected to show they have ample capital to weather any renewed turmoil during this week's Federal Reserve health checks,

July 03, 2024

World equities rose while the U.S. dollar fell on Wednesday following soft labor market data that buoyed investor expectations of Federal Reserve interest rate

July 03, 2024

The U.S.

July 02, 2024

By Michael S.

July 02, 2024

By Howard Schneider YORK, Pa.

July 02, 2024

U.S. consumer prices increased in September amid a surprise surge in rental costs, but a steady moderation in underlying inflation pressures supported

July 02, 2024

Federal Reserve officials throughout this year had pinned their hopes for falling inflation in part on an expected easing of U.S. housing price increases

July 02, 2024

The dollar dropped on Thursday after Federal Reserve Chair Jerome Powell was interpreted as being generally dovish in comments made at an economic forum, even as

July 02, 2024

Stocks tumbled on Thursday, under pressure from investor caution over the Middle East conflict and from the largest one-week rise in 10-year Treasury yields in 18

July 02, 2024

U.S. stocks ended solidly lower on Thursday, with shares of Tesla falling after its results and Treasury yields surging as Federal Reserve Chair Jerome

July 02, 2024

The U.S. economy's strength and continued tight labor markets could warrant further Federal Reserve interest rate increases, Fed Chair Jerome Powell said on Thursday in

July 02, 2024

The dollar touched the closely watched 150 level against the yen on Friday, before falling back again, as investors positioned for the

July 02, 2024

Early next month, the Federal Reserve Bank of New York will take on what has become something of a fraught subject for the central bank: climate change.

July 02, 2024

U.S. stocks tumbled on Thursday, dragged by tech and tech-adjacent megacap shares as investors digested mixed quarterly earnings and signs of economic resiliency

July 02, 2024

The U.S. dollar fell against most currencies on Wednesday as investors perceived that Federal Reserve Chairman Jerome Powell's statements after its two

July 02, 2024

The Federal Reserve held interest rates steady on Wednesday but left the door open to a further increase in borrowing costs in a policy statement that

July 02, 2024

Barclays said it now expects the U.S. Federal Reserve to deliver a 25 basis point interest rate increase in January instead of an earlier expectation for a December hike.

July 02, 2024

U.S.

July 02, 2024

By Ann Saphir and Michael S.

July 02, 2024

MSCI's global stock index turned higher on Tuesday while the dollar fell as a Federal Reserve official suggested that the U.S. central bank

July 02, 2024

MSCI'S global stock index edged lower on Thursday, the last day of its strongest month since November 2020, while bond yields and the dollar

July 02, 2024

U.S.

July 02, 2024

U.S. manufacturing remained subdued in November, with factory employment declining further as hiring slowed and layoffs increased, more evidence that the

July 02, 2024

A gauge of global stocks declined for a second straight session and U.S.

July 02, 2024

A gauge of global equities rose on Wednesday following consecutive declines to start the week, while longer-dated U.S.

July 02, 2024

U.S. unit labor costs were much weaker than initially thought in the third quarter amid robust worker productivity, providing a boost to the Federal Reserve's

July 02, 2024

World stocks teetered close to their first weekly loss since October, government bond prices dropped and the dollar firmed as strong U.S

July 02, 2024

The S&P 500 ended little changed on Friday but registered a seventh straight week of gains in its longest weekly winning streak since 2017 after this

July 02, 2024

The Federal Reserve can begin reducing interest rates "sometime in the third quarter" of 2024 if inflation falls as expected, Atlanta Fed President Raphael

July 02, 2024

As a strong year in U.S. stocks winds down, fund managers face a potentially consequential choice in 2024: stick with the few massive growth and technology

July 02, 2024

Asian stocks took a breather on the last trading day of the year and are set to snap their two-year losing streak with investors buoyed by the expectations that

July 02, 2024

Federal Reserve officials project the U.S. central bank will cut its benchmark overnight interest rate during 2024, but the timing and pace of the reductions in borrowing costs will depend

July 02, 2024

Chicago Federal Reserve President Austan Goolsbee on Thursday called 2023 a "hall-of-fame" year for falling inflation, which has paved the way for a few U.S. interest rate

July 02, 2024

Banks on Tuesday will urge the U.S.

July 02, 2024

The Federal Reserve will conclude a two-day policy meeting on Wednesday, with officials parsing evidence of slowing inflation alongside continued labor

July 02, 2024

U.S. labor costs rose less than expected in the fourth quarter, leading to the smallest annual increase in two years, signs of moderating wage inflation that could give the

July 02, 2024

The Federal Reserve left interest rates unchanged on Wednesday but took a major step towards lowering them in coming months in a policy statement that tempered inflation concerns

July 02, 2024

U.S. worker productivity grew faster than expected in the fourth quarter, keeping unit labor costs contained and giving the Federal Reserve another boost in the fight against

July 02, 2024

The Federal Reserve should likely reduce its policy rate two or three times this year based on the information on the economy currently in hand, Minneapolis Fed President Neel Kashkari

July 02, 2024

(Adds dropped words in headline) By Michael S.

July 02, 2024

Dallas Federal Reserve Bank President Lorie Logan on Friday said she is in no rush to cut interest rates, and while there has been "tremendous progress" on

July 02, 2024

U.S. consumer prices increased more than expected in January amid rises in the costs of shelter and healthcare, but the pick-up in inflation likely does not change expectations

July 02, 2024

The Federal Reserve's path back to its 2% inflation target rate would still be on track even if price increases run a bit hotter-than-expected over the next few months,

July 02, 2024

U.S. producer prices increased more than expected in January amid strong gains in the costs of services, which could amplify worries that inflation was picking up.

July 02, 2024

The dollar was steady on Friday, on track for its fifth straight weekly gain, as investors take stock of economic data and firm expectations of the Federal

July 02, 2024

U.S. stock index futures slipped on Tuesday as hopes for early interest rate cuts from the Federal Reserve waned, while investors geared up for quarterly earnings from U.S. retail giants

July 02, 2024

Asian stocks were tentative on Wednesday ahead of a U.S. inflation reading this week that could influence the timing of the Federal Reserve's easing cycle,

July 02, 2024

The U.S. economy grew at a solid clip in the fourth quarter amid strong consumer spending, the government confirmed on Wednesday, but it appears to have lost some speed early in

July 02, 2024

Wall Street futures edged higher on Thursday ahead of more economic data and commentary from Jerome Powell after the Federal Reserve chair stuck

July 02, 2024

JPMorgan Chase CEO Jamie Dimon on Tuesday urged the Federal Reserve to wait past June before cutting interest rates, arguing the central bank needs to shore up its inflation-

July 02, 2024

The U.S.

July 02, 2024

Asian stocks nudged higher on Tuesday ahead of the influential U.S. inflation report, while Japanese shares fell and the yen firmed on rising expectations that

July 02, 2024

U.S. stock index futures were subdued on Wednesday as investors awaited a slew of economic data this week, including producer prices and retail sales numbers, for clues on the Federal

July 02, 2024

U.S. equity funds witnessed robust demand in the seven days to March 20, buoyed by Wall Street's continued rally and expectations of Federal Reserve rate cuts later this year.

July 02, 2024

Atlanta Federal Reserve bank President Raphael Bostic said on Friday he now expects just a single quarter-point interest rate cut this year versus two cuts that he had projected

July 02, 2024

Orders for long-lasting U.S. manufactured goods increased more than expected in February, while business investment on equipment appeared to improve in the first quarter.

July 02, 2024

U.S. stocks vacillated on Thursday, swinging from red to green and back as investors contended with the push-pull of a strong economy and restrictive Federal

July 02, 2024

The dollar surged to a fresh 34-year high against the yen on Friday, bolstered in part by U.S. inflation data that showed no signs of easing, coming in

July 02, 2024

The allies of Republican presidential candidate Donald Trump are drafting proposals that would attempt to erode the Federal Reserve's independence if he wins, the Wall Street Journal

July 02, 2024

U.S. equity markets closed sharply lower on Tuesday, joining their global counterparts in the monthly loss column as investors await crucial economic data and the

July 02, 2024

Wall Street pared earlier gains on Tuesday after equity markets elsewhere rallied as investors parsed when and by how much the Federal Reserve cuts

July 02, 2024

Morgan Stanley said it now expects the U.S.

July 02, 2024

Global stock indexes were little changed on Monday while the U.S. dollar index eased as investors awaited this week's U.S. inflation data that is expected

July 02, 2024

MSCI's gauge of stocks across the globe was set for a record high close on Tuesday, while the U.S. dollar edged lower as investors digested U.S. producer

July 02, 2024

A world stock index rose for a seventh straight session and U.S.

July 02, 2024

The Nasdaq closed at a record high on Monday and gold jumped to an all-time high as investors weighed hawkish statements from the Federal Reserve against evidence

July 02, 2024

Wall Street ended modestly higher and U.S.

July 02, 2024

Federal Reserve policymakers said on Tuesday the U.S. central bank should wait several more months to ensure that

July 02, 2024

Wall Street ended lower and oil prices fell on Wednesday as investors parsed minutes from the U.S. Federal Reserve's most recent policy meeting.

July 02, 2024

The S&P 500 and Nasdaq posted record closing highs for a third straight day on Wednesday after inflation data came in softer than expected but the indexes

July 02, 2024

The Federal Reserve held interest rates steady on Wednesday and pushed out the start of rate cuts to perhaps as late as December as

July 02, 2024

The dollar gained on Thursday despite a soft U.S. producer price inflation report for May, after the Federal Reserve adopted a hawkish tone at the conclusion of

July 02, 2024

A gauge of global stocks advanced for a second straight session on Tuesday and U.S.

July 02, 2024

U.S. bank regulators are arguing over the path forward for rules easing bank capital hikes, with some wanting to allow additional feedback from Wall Street

July 02, 2024

By Michael S.

July 02, 2024

A measure of the borrowing costs on loans between banks and other participants in the U.S. repurchase agreement (repo) market hit its highest level since

July 02, 2024

Chicago Federal Reserve Bank President Austan Goolsbee on Tuesday said he sees some "warning signs" of weakening in the economy, adding that the U.S. central bank's goal is to get

July 02, 2024

U.S. job openings rose in May after posting outsized declines in the prior two months, but the trend remained consistent with an easing in labor market

July 02, 2024

U.S. job openings rose slightly to 8.1 million in May despite the impact of higher interest rates

July 02, 2024

The U.S. is back on a "disinflationary path," Federal Reserve Chair Jerome Powell said on Tuesday, but policymakers need more data

July 02, 2024

Inflation in the United States is slowing again after higher readings earlier this year, Federal Reserve Chair Jerome Powell said, while adding that more such evidence would be needed before the Fed would cut interest rates

July 02, 2024

Global stocks edged higher while U.S.

July 02, 2024

The dollar slipped on Tuesday in thin, choppy trading after Federal Reserve Chair Jerome Powell struck a moderately dovish tone in his comments,

July 02, 2024

Supreme Court lets a truck stop sue the Federal Reserve in latest threat to agency regulations

July 01, 2024

By Michael S.

July 01, 2024

Federal Reserve officials, heartened by recent data, are looking for further confirmation that inflation is cooling and for any warning signs from a still

July 01, 2024

Inflation is exhibiting encouraging signs of cooling, U.S.

July 01, 2024

Dallas Federal Reserve Bank President Lorie Logan on Tuesday said recent data showing inflation is cooling is "welcome news" but that the U.S. central bank can

July 01, 2024

The dollar eased against the euro on Tuesday after retail sales data indicated signs of exhaustion among U.S. consumers, boosting the case for Federal Reserve

July 01, 2024

U.S. retail sales barely rose in May and data for the prior month was revised considerably lower, suggesting that economic activity remained lackluster in the

July 01, 2024

The U.S.

July 01, 2024

By Michael S.

July 01, 2024

The S&P 500 and Nasdaq scored record closing highs on Monday as technology shares rallied on enthusiasm over artificial intelligence ahead of this week's economic data and

June 29, 2024

A gauge of global stocks rose for the first time in three sessions on Monday, powered by a rally in U.S. equities, while U.S.

June 28, 2024

The U.S. Federal Reserve would be able to cut its benchmark interest rate once this year, Philadelphia Fed President Patrick Harker said on Monday, if his economic forecast plays out.

June 28, 2024

UBS Global Research said it now expects the Federal Reserve to start cutting interest rates in December instead of September, while Goldman Sachs and Morgan Stanley continue to expect the

June 28, 2024

A look at the day ahead in markets from Dhara Ranasinghe. It's back to the markets versus the U.S. Federal Reserve.

June 28, 2024

The U.S. Federal Reserve may have just ducked out of the presidential campaign spotlight with a fresh set of forecasts showing no interest rate cuts are likely until after Election Day.

June 28, 2024

U.S. producer prices unexpectedly fell in May amid lower energy costs, another indication that inflation was subsiding after surging in the first quarter.

June 28, 2024

The number of Americans filing new claims for unemployment benefits increased to a 10-month high last week, suggesting the labor market was losing momentum and

June 28, 2024

The Nasdaq and the S&P 500 recorded their fourth consecutive record closing highs on Thursday and U.S.

June 28, 2024

U.S. equity funds observed heavy outflows in the seven days through June 12 as some investors booked profits and exercised caution ahead of the Federal Reserve's policy decision.

June 28, 2024

Federal Reserve Bank of Chicago President Austan Goolsbee on Friday said he was relieved after data this week showed inflation in May had cooled, but he would still like to

June 28, 2024

By Michael S.

June 28, 2024

Minneapolis Federal Reserve President Neel Kashkari on Sunday said it's a "reasonable prediction" that the U.S. central bank will cut interest rates once this year, waiting

June 28, 2024

The Federal Reserve announced Friday it had ordered Evolve Bancorp Inc to bolster its risk management programs around fintech partnerships as

June 28, 2024

A series of upcoming economic reports and Congressional testimony from Federal Reserve Chairman Jerome Powell could jolt U.S. government bonds out of a narrow

June 28, 2024

The quarter end saw substantial inflows into the Federal Reserve Bank of New York's reverse repo facility on Friday.

June 28, 2024

Federal Reserve Governor Michelle Bowman on Friday said she believes the U.S. has strayed from the style of international leadership it had under Republican President Ronald Reagan during

June 28, 2024

Soft landing hopes that have powered U.S. stocks this year received a boost following encouraging inflation data and a nod from the Federal

June 28, 2024

U.S. prices were unchanged in May while consumer spending rose moderately, a trend that could draw the Federal Reserve closer to start cutting interest rates this year.

June 28, 2024

Market bets rose on Friday that the Federal Reserve will cut interest rates by September and do so again in December after a government report showed a key measure of U.S. inflation

June 28, 2024

A measure of prices that's closely tracked by the Federal Reserve suggests that inflation pressures in the U.S. economy are continuing to ease

June 28, 2024

U.S. monthly inflation was unchanged in May as a modest increase in the cost of services was offset by the largest drop in goods prices in six months, drawing

June 28, 2024

U.S. consumer demand is still solid although households are beginning to get more sensitive to prices, Richmond Fed President Thomas Barkin said on Friday.

June 28, 2024

U.S. consumer prices were unexpectedly unchanged in May as cheaper gasoline and other goods offset higher costs for rental housing, but inflation remains too

June 28, 2024

The Federal Reserve held interest rates steady on Wednesday and pushed out the start of rate cuts to perhaps as late as December, with officials projecting only a single quarter-percentage-

June 28, 2024

Signs of falling U.S. inflation on Wednesday and growing hopes for interest rate cuts from the Federal Reserve could be a positive signal

June 28, 2024

U.S. stocks ended weaker on Friday after an early rally fizzled as investors digested in-line inflation data and weighed

June 28, 2024

Richmond Federal Reserve Bank President Thomas Barkin on Friday said that while he believes the U.S. central bank's interest-rate hikes to date will be enough to bring inflation down

June 28, 2024

Oil settled higher on Wednesday as ongoing tensions in the Middle East lent support to prices, but news that interest rate cuts could start as late as December

June 28, 2024

U.S. central bankers believe they’ll cut interest rates just once this year, two fewer than they thought in March as inflation approaches their 2% goal more slowly than they

June 28, 2024

Federal Reserve policymakers have reason to feel more confident that inflation is cooling after a U.S. government report on Wednesday showed consumer prices did not rise at

June 28, 2024

European shares advanced on Wednesday, with rate-sensitive sectors like real-estate jumping after a cool U.S. inflation reading propped up hopes that

June 28, 2024

As U.S. stocks lock in a solid first half, investors are speculating whether political uncertainty, potential Federal Reserve policy shifts and big tech's

June 28, 2024

The U.S.

June 28, 2024

A look at the day ahead in U.S. and global markets by markets correspondent Naomi Rovnick What a difference half a year makes. Traders started 2024 convinced that the U.S.

June 27, 2024

The S&P 500 and Nasdaq registered record closing highs for a second straight day on Tuesday, helped by a gain of more than 7% in Apple shares, while

June 27, 2024

Inflation in the U.S. "appears to be narrowing" and that should allow the Federal Reserve to cut interest rates later this year, Atlanta Fed President

June 27, 2024

U.S. stocks ended Thursday around the unchanged mark as investors awaited fresh inflation data, with the Nasdaq able to eke out a

June 27, 2024

U.S.

June 27, 2024

Bond investors, worried about persistently sticky inflation, have reduced their exposure to longer-dated U.S.

June 27, 2024

Big U.S. banks survived a hypothetical 40% drop in commercial real estate values as a part of the U.S.

June 26, 2024

The S&P 500 and Nasdaq eked out record closing highs on Monday, although investors were cautious ahead of this week's consumer prices report and a Federal

June 26, 2024

The euro fell on Monday after gains by the far right in European Parliament elections on Sunday prompted French President Emmanuel Macron to

June 26, 2024

Oil prices climbed about 3% to a one-week high on Monday, buoyed by hopes of rising fuel demand this summer despite a stronger U.S. dollar and expectations the

June 26, 2024

Updated economic projections from Federal Reserve officials this week are expected to show fewer interest rate cuts than policymakers anticipated three

June 26, 2024

The U.S. public’s outlook on the future path of inflation was mixed in May, according to a report on Monday from the Federal Reserve Bank of New York.

June 26, 2024

By Michael S.

June 25, 2024

Investors will closely watch next week’s inflation numbers and Federal Reserve meeting for clues on whether the soft landing hopes that drove stocks to record

June 25, 2024

U.S. household wealth rose to a record of more than $160 trillion in the first three months of 2024 thanks to the stock market's record run and gains in real estate, Federal Reserve data

June 25, 2024

Oil prices edged down on Friday and posted a third straight weekly loss as investors weighed OPEC+ reassurances against the latest U.S. jobs data that lowered

June 25, 2024

Wall Street stocks ended slightly lower on Friday in choppy trading after stronger-than-expected U.S. jobs data pointed to a robust economy but prompted worries

June 25, 2024

U.S. Federal Reserve and Bank of Japan meetings, a G7 gathering, plus key U.S. inflation and UK jobs data are all coming up in the week ahead - and that's not all.

June 25, 2024

Traders scaled back bets that the

June 25, 2024

U.S. job growth accelerated far more than expected in May, keeping the Federal Reserve on track to hold off starting to cut interest rates.

June 25, 2024

U.S. bond funds secured the largest weekly inflow in four weeks in the seven days to June 5, driven by a rally in treasury bond prices after softer economic data bolstered expectations of

June 25, 2024

A U.S. job market scorecard that exceeded all forecasts has undercut confidence over when, or even if, the Federal Reserve will begin easing policy this year, putting the

June 25, 2024

The U.S. economy created far more jobs than expected in May and annual wage growth reaccelerated, underscoring the resilience of the labor market and reducing the

June 25, 2024

The U.S. dollar rose on Tuesday, bolstered by hawkish comments from Federal Reserve officials as well as data showing a stable housing market in the

June 24, 2024

Crude oil prices fell 1% on Tuesday as weak U.S. consumer confidence data fed worries about the economic outlook and fuel demand after a slow start to the U.S.

June 24, 2024

The Biden administration announced new steps to increase access to affordable housing

June 24, 2024

U.S. worker productivity grew slightly less than previously estimated in the first quarter but exceeded market expectations, and unit labor costs rose by less than first thought, data from

June 24, 2024

The dollar traded sideways on Thursday ahead of Friday's U.S. employment data that could help the Federal Reserve set a

June 24, 2024

The S&P 500 and Nasdaq indexes hit record closing highs on Wednesday, powered mainly by technology stocks as markets digested economic data that could support a

June 23, 2024

By Michael S.

June 22, 2024

Oil prices climbed 1% on Wednesday, rebounding from four-month lows, as hopes of an interest rate cut by the U.S.

June 21, 2024

U.S. investors shed equity funds for a second successive week in the seven days to June 19, exercising caution as they evaluated the Federal Reserve's hawkish signals and ongoing political

June 21, 2024

Global equity funds faced outflows for the second straight week in the week ending June 19, with investors cashing in on a share rally amid concerns that the Fed might cut rates only once

June 21, 2024

U.S. stocks coasted to the close of their latest winning week, as Nvidia’s stock continued to cool from its startling, supernova run

June 21, 2024

A look at the day ahead in European and global markets from Ankur Banerjee: A softening labour market and a cooling economy have traders perking up with expectations of a September rate cut from the

June 21, 2024

The U.S.

June 21, 2024

U.S. banking regulators rejected Citigroup's so-called "living will", which is a detailed plan to wind itself down in the event of catastrophic failure, The Financial Times reported on

June 20, 2024

U.S. stocks ended a shade higher on Tuesday following softer-than-expected labor market data that reaffirmed expectations of an interest rate cut by the Federal

June 20, 2024

Home loan borrowing costs eased again this week as the average rate on a 30-year mortgage declined to its lowest level since early April

June 20, 2024

U.S. job openings fell more than expected in April, pushing the number of available jobs per job-seeker to its lowest in nearly three years as labor market conditions soften

June 20, 2024

First-time applications for U.S. unemployment benefits fell moderately last week, while new housing construction dropped to the lowest

June 20, 2024

The dollar fell to a three-week low on Monday after data showed the U.S. economy is gradually slowing down with weaker-than-expected readings on

June 20, 2024

The U.S. central bank should only start to cut interest rates after "months, and more likely quarters" of falling inflation, moderating demand and expanding supply, St.

June 18, 2024

U.S. inflation tracked sideways in April and consumer spending weakened, mixed signals for the Federal Reserve that provided little clarity on whether the U.S. central

June 18, 2024

The dollar was lower on Friday and on track for its first monthly decline in 2024 after data showed U.S. inflation rose in line with expectations in April, offering

June 18, 2024

Price cuts by major U.S. retailers and new data showing a slowdown in consumer spending may boost the Federal Reserve's confidence in falling inflation and

June 18, 2024

The Federal Reserve is more likely to deliver a long-awaited rate cut in September after a U.S.

June 18, 2024

European shares rose on Friday after softer U.S. inflation data spurred hopes of interest rates cuts by the Federal Reserve, while June rate cut bets

June 17, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan Wall Street looks set to end the shortened week slightly punch drunk, with Friday's May inflation update set to be a decider after a

June 17, 2024

U.S. equity funds saw outflows for the first time four weeks in the seven days ended May 29, hit by rising bond yields and uncertainty over the timing and extent of Federal Reserve

June 17, 2024

By Ann Saphir and Michael S.

June 17, 2024

Dallas Federal Reserve Bank President Lorie Logan said on Thursday she believes inflation is still heading to the Fed's 2% target, although she can imagine "other paths" that

June 17, 2024

U.S.

June 15, 2024

The U.S. economy grew more slowly in the first quarter than previously estimated after downward revisions to consumer spending and a key measure of inflation ticked down

June 15, 2024

U.S. economic activity continued to expand from early April through mid-May but firms grew more downbeat about the future amid weakening consumer demand while inflation

June 14, 2024

The number of Americans filing new claims for unemployment benefits ticked higher last week, but underlying strength in the labor market still shows signs of persisting and should continue

June 14, 2024

Mortgage rates eased again this week, though the latest pullback leaves the average rate on a 30-year home loan at close to 7%, where it’s been much of this year

June 13, 2024

The number of Americans filing for jobless benefits jumped to the highest level in 10 months last week, a sign that the labor market is likely cooling under the weight of high interest rates

June 13, 2024

Wholesale price increases fell in May, the latest sign that inflation pressures in the United States may be easing as the Federal Reserve considers a timetable for cutting interest rates

June 13, 2024

Gold prices gained on Tuesday, helped by a weaker dollar as investors look forward to U.S. inflation data due later this week for more clarity on interest rate cut timings

June 13, 2024

The dollar gained on Tuesday, giving back earlier losses, as benchmark U.S. Treasury yields hit a four-week high following some weak auctions.

June 13, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan World markets wobbled on Tuesday, with benchmark bond yields and volatility gauges jumping to their highest in almost four weeks, as

June 12, 2024

Wall Street opened lower on Wednesday, with investors turning risk averse as concerns around the timing and scale of the Federal Reserve's interest rate cuts pushed Treasury yields higher

June 12, 2024

The Federal Reserve is being characteristically cautious.

June 12, 2024

Federal Reserve Governor Michelle Bowman on Tuesday said she would have supported either waiting to start slowing the run-off in the U.S. central bank's balance sheet or a more moderate

June 12, 2024

Federal Reserve policy statements would benefit from somewhat lengthier passages than currently employed to describe assessments of economic developments, how that influences the central

June 12, 2024

Minneapolis Federal Reserve Bank President Neel Kashkari said in an interview with CNBC broadcast on Tuesday that the U.S. central bank should wait for significant progress on inflation

June 12, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan Wall Street looks set for a sleepy but positive start to a shortened week after Monday's Memorial Day break, with the consumer back

June 12, 2024

Asian shares are mostly higher as investors turned their attention to what the Bank of Japan might decide on monetary policy later this week

June 12, 2024

Inflation in the United States eased in May for a second straight month, a hopeful sign that an acceleration of prices that occurred early this year may have passed

June 11, 2024

Federal Reserve officials said inflation has fallen further toward their target level in recent months but signaled that they expect to cut their benchmark interest rate just once this year

June 11, 2024

U.S. stocks rebounded on Friday from sharp losses the day before on news of an improving consumer outlook on inflation, sending the Nasdaq to a fifth straight

June 11, 2024

Shares are mostly lower in Asia ahead of a decision by the Federal Reserve on interest rates

June 11, 2024

The typical summer slowdown in U.S. stock markets may be more pronounced this year with inflation jitters and an early presidential debate that have the potential

June 10, 2024

In nearly 40 years working for and helping lead the Federal Reserve, Cleveland Fed President Loretta Mester was part of a revolution that saw the

June 10, 2024

By Michael S.

June 10, 2024

Asian stocks are mixed ahead of a busy week with several top-tier reports on U.S. inflation due along with a policy meeting of the Federal Reserve

June 10, 2024

The Federal Reserve may need to wait longer to cut interest rates because even with April's slightly cooler inflation reading there is continued upward pressure on prices, Atlanta Fed

June 09, 2024

U.S. stocks ended lower on Thursday, even as a strong revenue forecast for Nvidia fueled a surge in its shares, but that was overshadowed by economic data

June 09, 2024

The number of Americans filing new claims for unemployment benefits fell last week, pointing to underlying strength in the labor market that should continue to

June 07, 2024

Stocks slipped and Treasury yields rose sharply after the government released a jobs report whose headline numbers came in hotter than expected

June 07, 2024

Federal Reserve officials at their last policy meeting said they still had faith that price pressures would ease at least slowly in coming months, but doubts emerged

June 07, 2024

U.S. stocks fell on Wednesday as investors digested minutes of the Federal Reserve's most recent meeting but Nvidia's shares rose about 6% after the close on

June 07, 2024

The Biden administration asserted its support for an independent Federal Reserve on Wednesday, after a report surfaced last month that Republican presidential candidate

June 07, 2024

Goldman Sachs CEO David Solomon said on Wednesday he does not expect the Federal Reserve to cut interest rates this year.

June 06, 2024

By Michael S.

June 06, 2024

Federal Reserve Chair Jerome Powell said in a May 1 press conference he didn't want to talk about economic "hypotheticals," but that's what he and other U.S.

June 06, 2024

The Standard & Poor's 500 will end the year near current levels, but strong stock market gains so far in 2024 have some strategists saying the index is at

June 06, 2024

The European Central Bank cut its key interest rate by a quarter-point, moving ahead of the U.S. Federal Reserve as central banks around the world lean toward lowering borrowing costs — a shift with far-reaching consequences for home buyers, savers and investors

June 06, 2024

U.S. stocks closed with slight gains on Tuesday, sending the S&P 500 and Nasdaq to record levels, as investors assessed the latest comments from Federal

June 05, 2024

A look at the day ahead in European and global markets from Kevin Buckland Two of the biggest events of this week are almost upon us, as Wednesday brings an end to the drawn-out two-day news vacuum

June 05, 2024

U.S. households continued to feel pinched by inflation in late 2023 even as price pressures ebbed, the Federal Reserve reported on Tuesday, with most Americans saying their financial

June 05, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan Partly due to the absence of top-tier economic news this week, world markets have found a relatively calm plateau with stocks near

June 05, 2024

A look at the day ahead in European and global markets from Kevin Buckland Stock market momentum is waning as a dearth of fresh economic clues sees the feverish punting over the pace of Federal

June 05, 2024

The Nasdaq closed at a record high on Monday while the S&P 500 gained slightly as technology stocks advanced ahead of Nvidia's highly anticipated earnings and

June 04, 2024

U.S. bank regulators are reconsidering how much liquidity banks should be required to have on hand following a series of abrupt bank failures in 2023, the

June 04, 2024

A new set of supply availability indexes show that improvement in firms' access to inputs hit a wall over the past couple of months, the Federal Reserve Bank of New York said on Monday.

June 04, 2024

The Federal Reserve and two other U.S. regulators are moving toward a new plan that would significantly reduce a nearly 20% mandated increase in capital for the country's biggest banks

June 04, 2024

The dollar retreated against major currencies on Friday as market speculation continues to swirl about the timing of Federal Reserve

June 03, 2024

The Federal Reserve Bank of New York is bolstering its data offerings tracking the state of supply chains.

June 03, 2024

The Bank of Canada would be willing to cut interest rates three times ahead of the Federal Reserve's first move before a declining currency threatens to endanger

June 03, 2024

Federal Reserve Chair Jerome Powell tested positive for COVID-19 on Thursday and is currently working from home, a Fed spokesperson said in an emailed statement.

June 03, 2024

A look at the day ahead in European and global markets from Ankur Banerjee The cold harsh reality of the Federal Reserve likely keeping interest rates higher for longer to combat inflation has put a

June 02, 2024

Foreign investors were net sellers of Asian bonds for a second straight month in April as a strong U.S. dollar and uncertainties around the Federal Reserve's interest rate cuts dampened

June 02, 2024

Data this week offered the U.S.

June 01, 2024

The dollar rose on Thursday after data showed U.S. import prices increased 0.9% last month, a jump that raised concerns the Federal

June 01, 2024

The International Monetary Fund on Thursday views recent U.S. inflation data as "overall higher than we would like to see" and is urging the Federal Reserve to stay cautious and

May 31, 2024

Top global brokerages have retained their expectations for when the U.S.

May 31, 2024

A price gauge closely tracked by the Federal Reserve cooled slightly last month, a sign that inflation may be easing after running high in the first three months of this year

May 31, 2024

By Michael S.

May 31, 2024

Federal Reserve Bank of New York President John Williams was interviewed by Reuters on Wednesday.

May 31, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan World stocks notched new records and the dollar nursed its worst day of the year as fears of an overheating U.S. economy dissipate -

May 31, 2024

The Federal Reserve Bank of Kansas City on Wednesday said its annual central banking conference in Jackson Hole, Wyoming, will take place from Aug. 22-24.

May 30, 2024

Federal Reserve policymakers waiting to see renewed progress on inflation before reducing borrowing costs got some encouraging data on Wednesday with a government report

May 30, 2024

The dollar slumped against major currencies on Wednesday after U.S. consumer prices in April showed inflation had resumed trending lower in the second quarter,

May 30, 2024

U.S. consumer prices increased less than expected in April, suggesting that inflation resumed its downward trend at the start of the second quarter in a boost

May 30, 2024

The U.S. economy grew at a sluggish 1.3% annual pace from January through March, the weakest quarterly rate since the spring of 2022, the government said in a downgrade from its previous estimate

May 30, 2024

Inflation is still too high, and the U.S. central bank has more work to do to bring it down, Kansas City Federal Reserve Bank President Jeffrey Schmid said on Tuesday, a signal that he

May 30, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan Markets seem to have got bored waiting for today's big U.S. inflation print and stocks zoomed to new records in advance, taking

May 30, 2024

The Nasdaq scored a record closing high on Tuesday and the S&P 500 and the Dow also advanced as Federal Reserve Chair Jerome Powell reassured

May 29, 2024

Federal Reserve Chair Jerome Powell said on Tuesday support for U.S. central bank independence remains "very strong" in Congress, pushing back on concerns surfaced in recent news

May 29, 2024

The Federal Reserve needs to rethink how it provides swift liquidity to banks, a report from the Federal Reserve Bank of New York said on Monday.

May 29, 2024

The Cleveland branch of the Federal Reserve says that Beth Hammack, an executive at investment bank Goldman Sachs, would be its next president effective Aug. 21

May 29, 2024

Investors’ newfound optimism on the U.S. economy faces an important test on Wednesday, with consumer price data set to show whether the soft landing hopes that

May 29, 2024

Hopes for interest rate cuts this year by the Federal Reserve are steadily fading, with a stream of recent remarks by Fed officials underscoring their intention to keep borrowing costs high as long as needed to curb persistently elevated inflation

May 29, 2024

Bond strategists upgraded their U.S.

May 29, 2024

Traders on Tuesday pared bets the Federal Reserve will deliver a first interest-rate cut in September after a government report showed wholesale prices rose more than expected in April.

May 29, 2024

Federal Reserve Chair Jerome Powell on Tuesday said the latest report on U.S. producer prices was more "mixed" than "hot" given that prior data was revised lower even as the

May 29, 2024

Corporate price gouging has not been a primary driver of U.S. inflation, according to research published on Monday by economists at the Federal Reserve Bank of San Francisco.

May 28, 2024

Gold prices fell 1% on Monday on profit-taking, as investors looked forward to key inflation figures this week for clues on the U.S. interest rate cuts this year.

May 28, 2024

The S&P 500 closed very slightly lower on Monday as investors took a breather after three weekly gains while they awaited key inflation readings and

May 28, 2024

The U.S.

May 28, 2024

By Michael S.

May 28, 2024

U.S. stocks eked out modest gains on Friday and all three indexes posted another weekly advance as investors parsed comments from Federal Reserve officials and

May 27, 2024

Oil prices fell by nearly $1 a barrel on Friday as comments from U.S. central bank officials indicated higher-for-longer interest rates, which could hinder demand

May 27, 2024

Debate over whether U.S. interest rates are high enough deepened among Federal Reserve officials this week, and may be stoked further after a

May 26, 2024

Chicago Federal Reserve President Austan Goolsbee on Friday said he believes U.S. monetary policy is "relatively restrictive," meaning that borrowing costs are putting downward pressure on

May 26, 2024

The dollar inched higher on Friday following a reading on U.S. consumer sentiment as investors sorted through a batch of comments from Federal Reserve

May 26, 2024

Dallas Federal Reserve President Lorie Logan on Friday said it's not clear if monetary policy is tight enough to bring inflation down to the U.S.

May 26, 2024

The U.S. central bank likely remains on track to cut interest rates this year even if the timing and extent of the policy easing is uncertain and further

May 25, 2024

There is "considerable" uncertainty about where U.S. inflation will head in coming months, San Francisco Federal Reserve President Mary Daly said on

May 24, 2024

The Bank of England has sent a new signal that borrowing costs will fall earlier and further across Europe than in the United States, setting

May 24, 2024

U.S. stocks rose in a bounce back from Wall Street’s worst day since April

May 24, 2024

The number of Americans filing new claims for unemployment benefits rose last week to the highest level in more than eight months, offering more evidence that

May 24, 2024

Through a tumultuous period of high inflation, aggressive interest rate hikes, and global instability, the U.S.

May 23, 2024

By Michael S.

May 23, 2024

The average rate on a 30-year mortgage dipped this week to just below 7% for the first time since mid April, a modest boost for home shoppers navigating a housing market dampened by rising prices and relatively few available properties

May 23, 2024

The number of Americans applying for unemployment benefits fell last week as layoffs remained historically low levels

May 23, 2024

A look at the day ahead in U.S. and global markets from Mike Dolan Wall Street looks to have brushed off the latest hawkish Federal Reserve noises and Disney's outsize swoon, with European bourses

May 22, 2024

By Michael S.

May 22, 2024

U.S. households, banks and firms are largely in solid financial shape, with the means at hand to cover debt payments and with strong enough buffers to absorb

May 22, 2024

U.S. bond giant PIMCO said on Wednesday it is increasing its bond exposure in developed markets outside the United States as inflation could complicate the

May 22, 2024

A look at the day ahead in European and global markets from Kevin Buckland The Federal Reserve and the enigmatic path of U.S. interest rates continue to dominate the market's attention.

May 22, 2024

After several unexpectedly high inflation readings, Federal Reserve officials concluded at a meeting earlier this month that it would take longer than they previously thought for inflation to cool enough to justify reducing their key interest rate, now at a 23-year high

May 22, 2024

The U.S. dollar rose against most currencies on Tuesday, steadily gaining ground throughout the day as investors digested the latest comments from Federal

May 22, 2024

U.S. banks reported renewed weakening in demand for industrial loans and a decline in household demand for credit in the first quarter of the year, according to a Federal Reserve survey of

May 22, 2024

Stalled inflation buoyed in part by housing market strength means the Federal Reserve will need to hold borrowing costs steady for an "extended period," and possibly all year, Minneapolis

May 22, 2024

Inflation lodged above the U.S.

May 22, 2024

The Reserve Bank of Australia on Tuesday left its cash rate unchanged at 4.35% following a policy meeting.

May 21, 2024

By Michael S.

May 21, 2024

Federal Reserve Bank of New York President John Williams said Monday that at some undefined point the U.S. central bank will lower its interest rate target.

May 21, 2024

The dollar fell against most currencies on Monday for a fourth straight session as recent labor market data and comments from Federal Reserve officials buoyed

May 21, 2024

Finishing the battle against inflation will likely require a hit to demand, after a year in which U.S. price pressures cooled largely through

May 21, 2024

Ken Griffin, Citadel's founder and chief executive, said on Monday that he is unsure when the Federal Reserve may be able to cut interest rates this year,

May 21, 2024

U.S. stock indexes closed higher on Monday, their third straight session of advances, as investors continued to gain hope that there was a greater chance of the Federal